Key Takeaways

- Increasing data privacy regulations and consumer ad resistance threaten AppLovin's ad targeting effectiveness, limiting revenue and margin growth.

- Heavy dependence on mobile gaming and rising competition from tech giants could lead to market share loss, lower profitability, and stunted platform expansion.

- Strategic expansion into self-serve ads, e-commerce, and high-margin software, fueled by AI and data advantages, strengthens AppLovin's long-term growth, profitability, and competitive edge.

Catalysts

About AppLovin- Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

- As global regulators continue tightening data privacy rules and restricting the use of third-party data, AppLovin's ability to deliver targeted ads could face severe limitations, directly eroding pricing power, reducing eCPMs, and diminishing revenue growth well below current expectations in the coming years.

- Accelerating consumer resistance to digital ads-including widespread adoption of ad-blockers and growing aversion to mobile advertising-threatens to undermine the core value proposition of AppLovin's platforms, leading to lower ad inventory demand, falling fill rates, and sustained pressure on both revenues and margins.

- The increasing fragmentation across mobile devices and operating systems will significantly complicate cross-platform advertising integration, raising operational complexity and technology expenses, which could stunt expansion into new supply channels and compress net margins over the long term.

- A continued over-reliance on mobile gaming as the primary engine of growth leaves AppLovin especially exposed to market saturation and decelerating category growth, jeopardizing both top-line revenue and the ability to grow its software platform fee base as quickly as investors anticipate.

- Intensifying competition from vertically integrated giants such as Google, Meta, and Apple, as well as persistent tracking restrictions and potential consolidation in the sector, may erode AppLovin's market share and trigger a margin-destroying price war, resulting in structurally lower long-term earnings and return on invested capital.

AppLovin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AppLovin compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AppLovin's revenue will grow by 13.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 43.8% today to 58.6% in 3 years time.

- The bearish analysts expect earnings to reach $4.9 billion (and earnings per share of $14.29) by about September 2028, up from $2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.8x on those 2028 earnings, down from 76.3x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

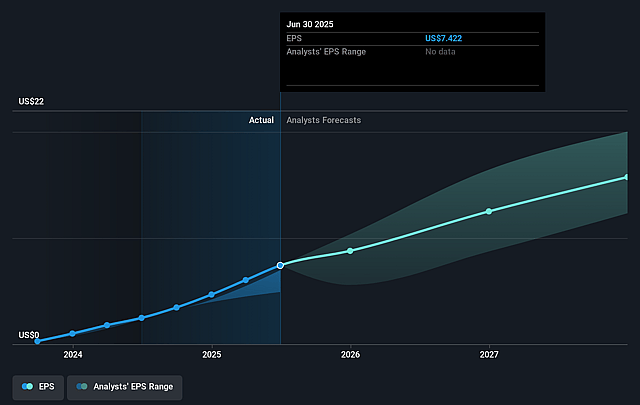

AppLovin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expansion into self-serve advertising and broader e-commerce, accompanied by the upcoming global rollout of AXON, positions AppLovin to significantly increase its addressable market, which could drive sustained high revenue growth beyond the maturing gaming segment.

- AppLovin's continued investment in advanced AI-driven ad optimization, automation, and dynamic product tools is creating a durable technology edge that can enhance advertiser performance and platform stickiness, which supports both revenue growth and high EBITDA margins over time.

- The company's ability to rapidly onboard international and non-gaming advertisers, now possible after investments in attribution partners and Shopify integrations, allows AppLovin to capture a much larger share of global ad spend, providing upside to revenue and earnings as new verticals ramp.

- The ongoing transition toward high-margin, recurring software revenue-evidenced by strong incremental margins and the divestiture of lower-margin app businesses-points to improvement in free cash flow and net margins, bolstering the company's long-term profitability profile.

- AppLovin's data flywheel, stemming from its significant market penetration in gaming and emerging e-commerce verticals, may enable superior ad targeting, cross-vertical insights, and further model improvements, supporting durable competitive advantages and long-term earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AppLovin is $318.43, which represents two standard deviations below the consensus price target of $501.76. This valuation is based on what can be assumed as the expectations of AppLovin's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $4.9 billion, and it would be trading on a PE ratio of 28.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $567.12, the bearish analyst price target of $318.43 is 78.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.