Key Takeaways

- International expansion, AI-driven automation, and self-serve tools position AppLovin for significant market share and revenue growth beyond current analyst expectations.

- Advanced machine learning and end-to-end onboarding will enhance ad targeting, user monetization, and make AppLovin a top choice for performance marketing among global businesses.

- Heavy dependence on mobile advertising and platform partners, limited diversification, and strong competitors threaten AppLovin's growth, margins, and long-term business resilience.

Catalysts

About AppLovin- Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

- Analyst consensus emphasizes AppLovin capturing a larger share of global digital ad spend outside gaming, but the pace and scale of market share gains could be vastly underestimated given the imminent opening of self-serve AXON and international expansion-these steps could drive not only explosive new client onboarding but also rapid revenue compounding as category penetration remains under 1 percent.

- While analysts broadly agree that automation and self-service drive margin expansion, they may be missing the sheer scale at which AppLovin's end-to-end AI-powered onboarding and ad creation can operate, allowing the company to onboard tens of thousands of customers with virtually no incremental labor cost, which could unlock sustainable adjusted EBITDA margins approaching levels seen in the most profitable digital platforms.

- The upcoming international rollout and removal of onboarding constraints are poised to unlock a latent wave of advertiser demand across both gaming and e-commerce, tapping into billions of new mobile users and dramatically accelerating top-line growth well above consensus expectations, fueled by continued global smartphone adoption and 5G connectivity.

- As AXON's machine learning models ingest cross-category behavioral data from vastly expanded verticals and geographies, the resulting feedback loop will turbocharge ad targeting effectiveness for all advertisers, further lifting conversion rates and ARPU, and enabling structurally higher revenue yields per user.

- The coming surge in AI-driven automation for advertisers-including autonomous campaign agents and generative creative tools-will solidify AppLovin as the performance marketing standard for small and medium businesses globally, cementing high retention, share gains, and recurring revenue growth sustained by the industry-wide shift from traditional to digital, automated advertising.

AppLovin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AppLovin compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AppLovin's revenue will grow by 28.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 43.8% today to 67.7% in 3 years time.

- The bullish analysts expect earnings to reach $8.2 billion (and earnings per share of $23.68) by about September 2028, up from $2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, down from 75.1x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

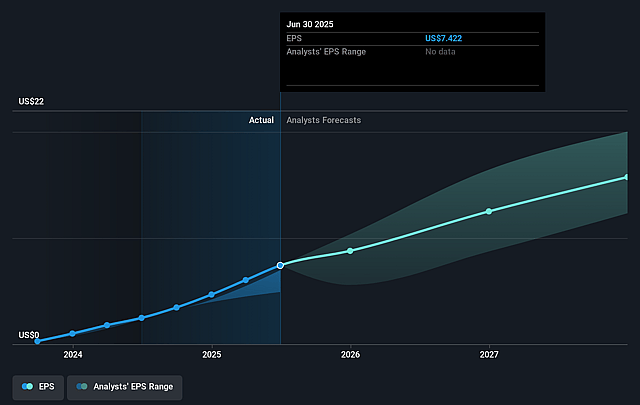

AppLovin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AppLovin remains heavily dependent on in-app advertising, especially within mobile gaming, leaving its revenue growth and margins highly vulnerable to regulatory crackdowns on digital advertising, privacy changes, and any shifts in mobile ad spend.

- Platform risk from Apple and Google persists, as any further tightening of anti-tracking or privacy policies may significantly undermine AppLovin's ability to target users, reducing advertiser demand and compressing core advertising revenue and margins.

- The company faces intense long-term competition from larger, more diversified competitors like Meta, Google, and Unity, which could erode AppLovin's market share, weaken pricing power, and place sustained pressure on its net earnings growth.

- AppLovin's limited track record of successfully diversifying outside its core ad network business means that future revenue growth and sustained valuation could be jeopardized if its e-commerce or web expansion initiatives fail to gain strong traction.

- Long-term changes in consumer behavior, such as greater adoption of ad blockers, privacy-centric tools, or shifting time toward subscription-based and non-advertising content, could reduce ad impressions and overall demand for AppLovin's core offerings, negatively impacting both revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AppLovin is $650.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AppLovin's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $12.2 billion, earnings will come to $8.2 billion, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $558.17, the bullish analyst price target of $650.0 is 14.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.