Key Takeaways

- Expansion in energy management and advanced security technology could drive revenue as the company grows in commercial and international markets.

- Recent acquisitions and new product releases aim to boost margins and earnings through enhanced service efficiency and diversified revenue streams.

- Competitive pressures, key growth initiative reliance, and economic conditions may affect revenue, while international expansion and CFO retirement could impact financial stability.

Catalysts

About Alarm.com Holdings- Provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally.

- Expansion in the commercial security and EnergyHub segments, which saw significant growth in 2024, could drive future revenue as these sectors continue to scale and integrate more advanced AI and IoT technologies.

- The recent acquisition of CHeKT, a company with momentum in Remote Video Monitoring (RVM), expands Alarm.com's capabilities, potentially enhancing net margins by reducing false alarms and increasing service efficiency.

- The release of the Pro Thermostat HQ for residential and rental markets, which operates without needing WiFi, could lead to increased hardware sales and recurring SaaS revenues as property managers seek convenient management solutions.

- International growth remains a strategic focus, with expanded service provider partnerships expected to enhance revenue streams, particularly in regions with increasing demand for advanced security solutions.

- Continued development in venture businesses like EnergyHub, which is introducing cutting-edge capabilities such as dynamic load shaping, could boost earnings by diversifying revenue sources and capitalizing on the growing demand for energy management solutions.

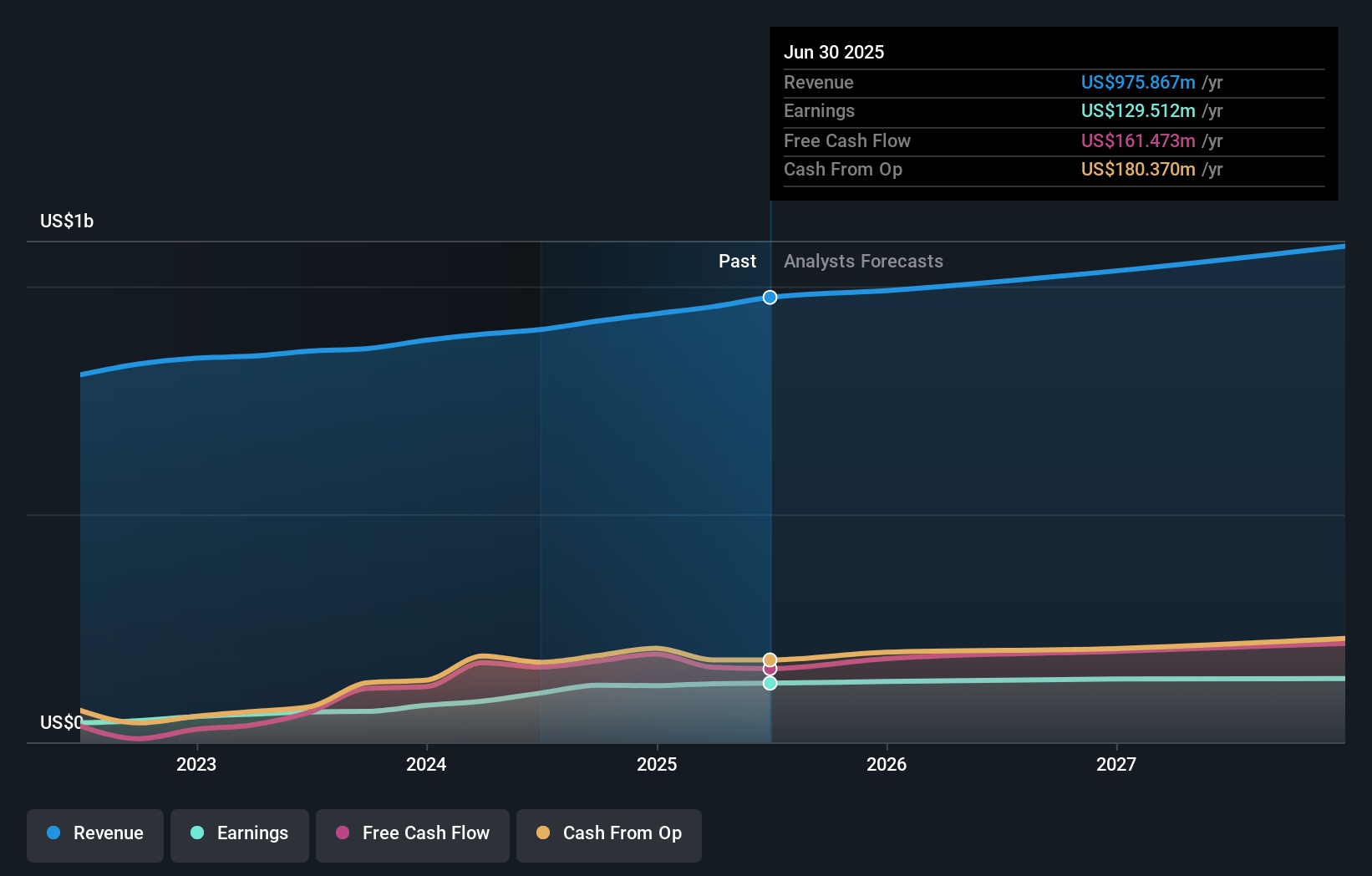

Alarm.com Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alarm.com Holdings's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.2% today to 12.3% in 3 years time.

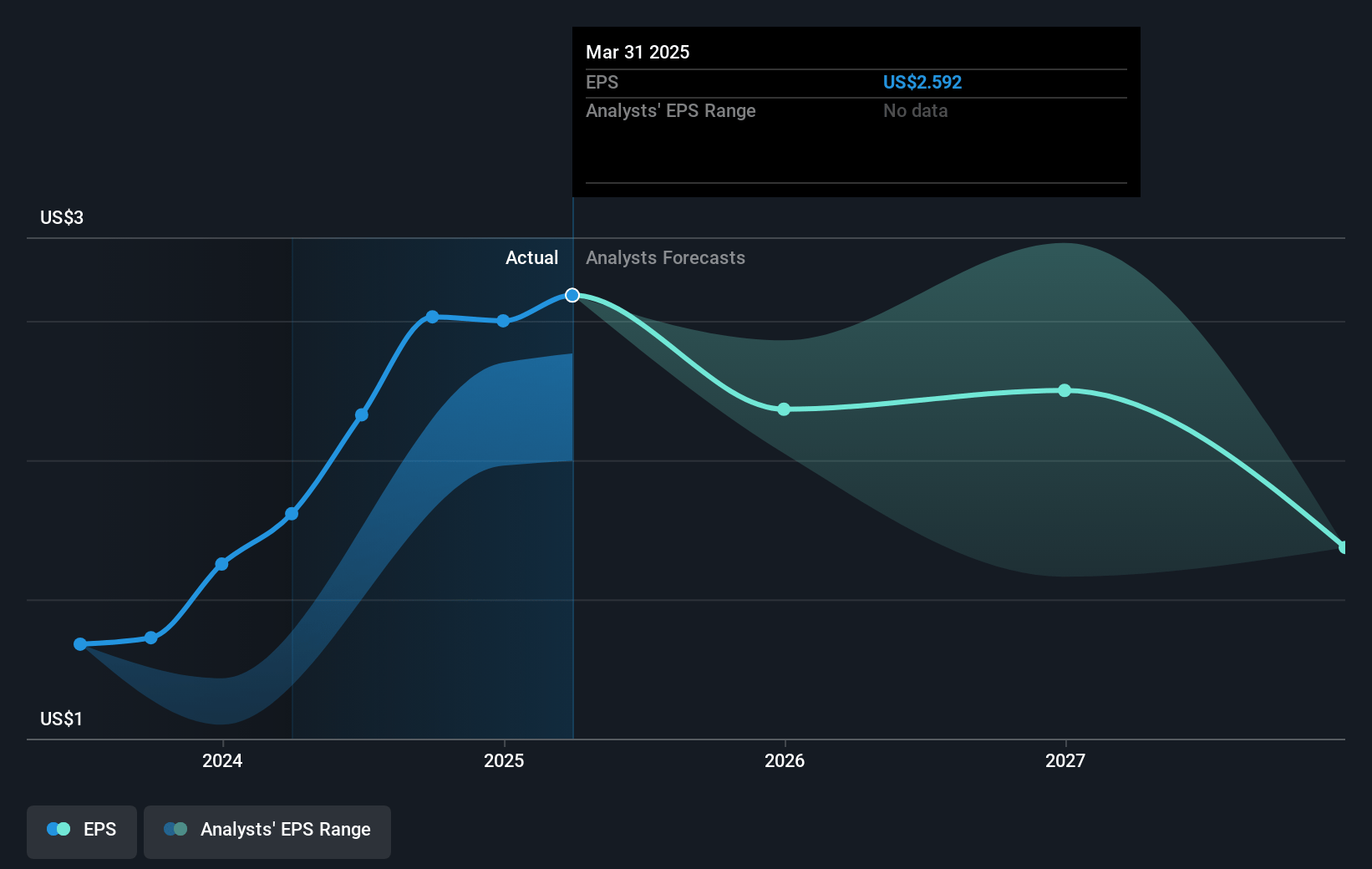

- Analysts expect earnings to reach $131.4 million (and earnings per share of $1.62) by about March 2028, up from $124.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.3x on those 2028 earnings, up from 23.4x today. This future PE is greater than the current PE for the US Software industry at 28.2x.

- Analysts expect the number of shares outstanding to decline by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

Alarm.com Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces competitive pressure in the North American residential market, which could impact its future revenue if it cannot maintain or grow its market share.

- Alarm.com's reliance on a few key growth initiatives, such as EnergyHub, which overperformed, may result in an uneven revenue contribution if these segments underdeliver in the future.

- Economic conditions, such as subdued residential home sales, could potentially impact revenue retention rates and customer acquisition in its core markets.

- Dependence on international expansion carries risks associated with currency fluctuations, which could create a downward pressure on earnings, especially given the noted impact of a strengthening U.S. dollar.

- The pending retirement of the CFO could introduce transitional challenges or uncertainties in financial management, potentially impacting the company's profitability and earnings oversight.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $73.875 for Alarm.com Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $131.4 million, and it would be trading on a PE ratio of 34.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $58.39, the analyst price target of $73.88 is 21.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.