Catalysts

About Allot

Allot provides cybersecurity and network intelligence solutions, with a growing focus on Cybersecurity as a Service for telecom operators and communication service providers.

What are the underlying business or industry changes driving this perspective?

- The shift by telecom operators to offer cybersecurity as a consumer and business service is aligning directly with Allot’s SECaaS platform. In this segment, 60% year-over-year ARR growth to US$27.6 million and SECaaS reaching 28% of quarterly revenue can support higher recurring revenue and earnings quality over time.

- Rising demand for always-on protection across mobile, fixed and Wi-Fi connections is reflected in the launch of OffNetSecure, which extends protection beyond operator networks and can increase subscription uptake, expand addressable subscribers per carrier and support faster revenue growth.

- Telecom operators are leaning into subscription models and value-added services. Allot’s growing base of Tier 1 and large carrier SECaaS contracts, coupled with a growing pipeline, can support broader adoption, higher attach rates and more stable revenue visibility.

- Data traffic growth and the need for better visibility and control are supporting interest in Allot’s smart network intelligence products. New Tera III deployments and upgrades, plus a robust backlog, can contribute to revenue and support gross margins around the current non-GAAP level of 72.2%.

- Greater focus by carriers on operational efficiency and outsourced security solutions is aligning with Allot’s unified cybersecurity first platform. Rising recurring revenue at 63% of Q3 2025 revenue and positive operating cash flow for three straight quarters can support margin expansion and earnings sustainability.

Assumptions

This narrative explores a more optimistic perspective on Allot compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

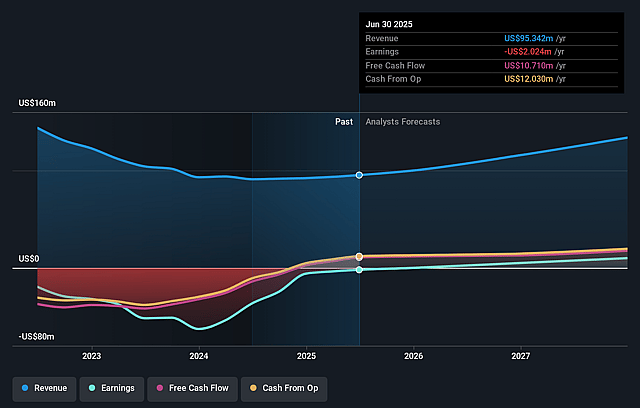

- The bullish analysts are assuming Allot's revenue will grow by 15.6% annually over the next 3 years.

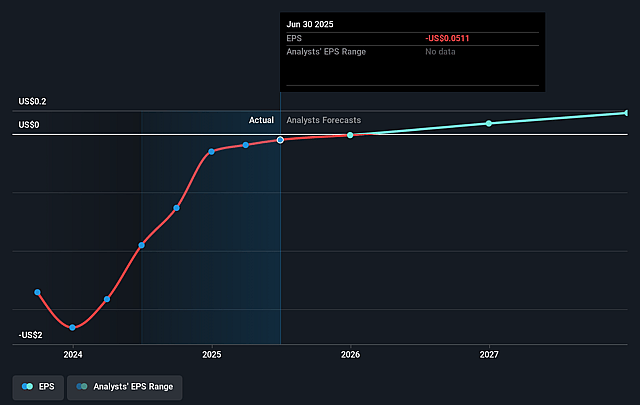

- The bullish analysts assume that profit margins will increase from 1.1% today to 13.2% in 3 years time.

- The bullish analysts expect earnings to reach $20.0 million (and earnings per share of $0.37) by about January 2029, up from $1.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 57.8x on those 2029 earnings, down from 504.9x today. This future PE is greater than the current PE for the US Software industry at 32.9x.

- The bullish analysts expect the number of shares outstanding to grow by 4.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.68%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The shift of telecom operators toward tighter capital spending, as management points out for the telecom industry, can limit budgets for both network intelligence and SECaaS projects. This could slow new deployments and expansions and affect revenue growth and earnings.

- Allot’s SECaaS engine relies heavily on a growing base of large Tier 1 and other telecom contracts. Any delay in service launches, weaker attach rates, lower marketing push by carriers or churn in existing agreements could reduce subscription uptake and affect ARR, recurring revenue mix and future net margins.

- The company is investing to add new capabilities and functionality for both SECaaS and smart network products to maintain technology leadership. If these investments fail to keep pace with competing security and traffic management offerings, pricing power and win rates could weaken, which would pressure gross margin and operating income.

- Customer concentration in large, multimillion dollar smart and SECaaS deals, including a relatively large smart order in the Americas, leaves Allot exposed to timing swings or cancellations of a small number of telco projects. This could create volatility in quarterly revenue and operating profit despite a growing backlog.

- Management highlights a strong backlog and increased guidance. If long-term telecom demand for cybersecurity and network intelligence services normalizes at a lower level than implied by current pipelines and expectations, the company could miss growth targets, which would weigh on earnings, cash generation and the perceived justification for a high P/E multiple tied to bullish forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Allot is $18.0, which represents up to two standard deviations above the consensus price target of $14.3. This valuation is based on what can be assumed as the expectations of Allot's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $12.5.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $152.0 million, earnings will come to $20.0 million, and it would be trading on a PE ratio of 57.8x, assuming you use a discount rate of 10.7%.

- Given the current share price of $10.88, the analyst price target of $18.0 is 39.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Allot?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.