Catalysts

About AudioEye

AudioEye provides digital accessibility software and services that help organizations make their websites and applications more accessible and compliant.

What are the underlying business or industry changes driving this perspective?

- Growing enforcement and awareness of digital accessibility rules in the U.S., including the DOJ Title II rule beginning to take effect in May 2026, is encouraging more government and government adjacent entities to adopt accessibility solutions. This can support AudioEye's partner ARR and overall revenue.

- The EU accessibility framework, including the EAA and country level documentation requirements, is supporting a higher mix of larger enterprise and upper mid market deals in Europe, where AudioEye is already seeing pipelines build and average deal sizes around 50% above U.S. levels. This can lift ARR and enterprise revenue contribution.

- Ongoing customer migration to the AudioEye Core platform and consolidation of acquired businesses onto a single system is expected to simplify operations. Management links this to gross margin improvement, adjusted EBITDA expansion and higher free cash flow.

- Deployment of AI tools such as Playwright MCP and broader AI efficiencies in product development is aimed at better detection accuracy and more scalable service delivery. Management connects this to margin expansion, more efficient R&D spend and higher adjusted EBITDA.

- Continued traction across both Enterprise and Partner and Marketplace channels, supported by high customer counts of about 123,000 and strong retention in SMB focused offerings, is providing a broad ARR base that management is using to drive operating leverage. This can influence adjusted EBITDA margins and adjusted EPS.

Assumptions

This narrative explores a more optimistic perspective on AudioEye compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

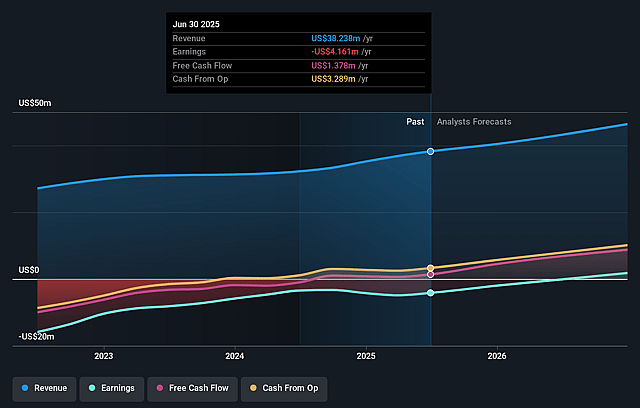

- The bullish analysts are assuming AudioEye's revenue will grow by 12.6% annually over the next 3 years.

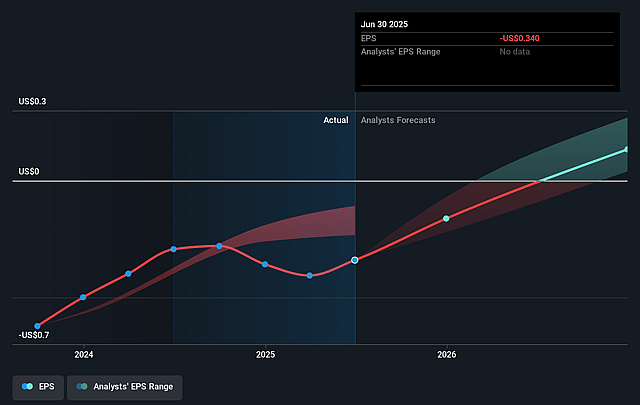

- The bullish analysts assume that profit margins will increase from -8.9% today to 18.7% in 3 years time.

- The bullish analysts expect earnings to reach $10.6 million (and earnings per share of $0.81) by about January 2029, up from $-3.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 37.8x on those 2029 earnings, up from -33.5x today. This future PE is greater than the current PE for the US Software industry at 30.4x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- AudioEye is leaning heavily on future enforcement of regulations like the DOJ Title II rule and the EU accessibility framework to support demand. If enforcement timelines slip or regulators are slower or softer than expected, new deal flow and expansion with government and government adjacent partners could be weaker than hoped, which would pressure ARR growth and revenue.

- The company is relying on AI tools such as Playwright MCP and other efficiency gains to support high gross margins and operating leverage. If these technologies are slower to integrate, less effective at scale or matched by competitors, the expected efficiency gains may not fully materialize, which would limit gross margin improvement and adjusted EBITDA growth.

- Management is consolidating acquired customers onto the AudioEye Core platform and has already seen customer counts affected by a partner renegotiation. If further attrition from migrations or partner contract changes is larger or more prolonged than expected, ARR growth and customer count could be weaker, which would weigh on revenue and earnings.

- AudioEye is increasing its exposure to larger enterprise and upper mid market deals, especially in Europe where average deal sizes are around 50% higher than in the U.S. If close rates, sales cycles or renewal patterns for these larger contracts do not develop as hoped, overall growth in ARR and revenue could slow and adjusted EBITDA margins could come under pressure.

- The business is using cash for share repurchases while carrying net debt of US$8.9 million and relying on adjusted profitability metrics. If free cash flow does not grow as expected or litigation, R&D or sales costs rise, the balance sheet could become more constrained, which would affect net margins and the company’s ability to support earnings growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for AudioEye is $25.0, which represents up to two standard deviations above the consensus price target of $21.4. This valuation is based on what can be assumed as the expectations of AudioEye's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $56.5 million, earnings will come to $10.6 million, and it would be trading on a PE ratio of 37.8x, assuming you use a discount rate of 8.7%.

- Given the current share price of $9.48, the analyst price target of $25.0 is 62.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AudioEye?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.