Catalysts

About AudioEye

AudioEye provides digital accessibility solutions that help websites meet legal and usability requirements for people with disabilities.

What are the underlying business or industry changes driving this perspective?

- Although laws such as the DOJ Title II rule and the European Accessibility Act are set to increase demand for compliance tools, any delay in enforcement timelines or slower than expected customer adoption could limit the ramp in new contracts and keep revenue growth below management's aspirations.

- While the company is working AI capabilities like Playwright MCP into its platform to improve detection and accuracy, heavier reliance on AI tools may require sustained R&D spending and higher infrastructure costs, which could prevent the recent adjusted EBITDA margin of 24% from improving meaningfully.

- Although enterprise demand in the EU and U.S. is contributing to ARR of US$38.7m and higher average deal sizes in Europe, longer sales cycles or tighter IT budgets at larger customers could restrain ARR growth and slow progress toward higher earnings.

- While customer migration to the upgraded platform is expected to support gross margin improvement from the current 77%, any integration issues, unexpected churn or additional support costs could offset these gains and keep net margins under pressure.

- Although the Partner and Marketplace channel has a large SMB base and is tied to accessibility requirements that touch many smaller websites, partner renegotiations such as the one that reduced customer counts by about 3,000 and potential future repricing could weigh on reseller revenue and constrain free cash flow growth.

Assumptions

This narrative explores a more pessimistic perspective on AudioEye compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

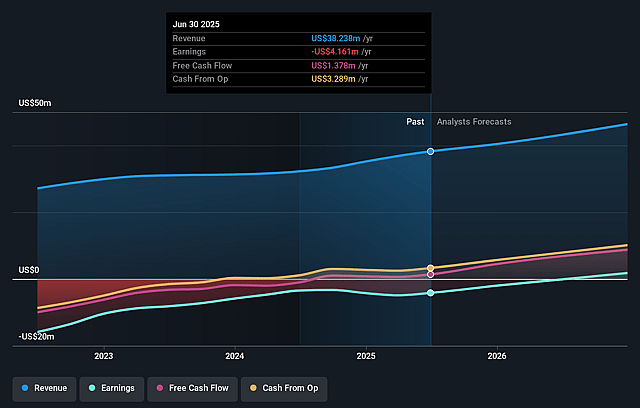

- The bearish analysts are assuming AudioEye's revenue will grow by 12.8% annually over the next 3 years.

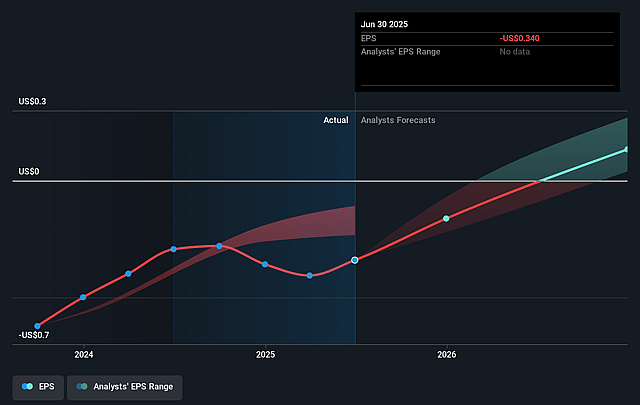

- The bearish analysts assume that profit margins will increase from -8.9% today to 19.2% in 3 years time.

- The bearish analysts expect earnings to reach $10.9 million (and earnings per share of $0.83) by about February 2029, up from $-3.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.4x on those 2029 earnings, up from -23.5x today. This future PE is lower than the current PE for the US Software industry at 26.7x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- AudioEye is leaning heavily on regulatory catalysts such as the DOJ Title II rule in 2026 and the European Accessibility Act. If enforcement is slower, penalties are lighter than expected, or public sector budgets tighten, demand for accessibility tools could be weaker than management hopes, which would directly pressure ARR growth and revenue.

- The company is investing in AI approaches like Playwright MCP to improve detection and accuracy. If this technology does not translate into clear customer wins or cost efficiencies, AudioEye could see AI infrastructure and R&D costs stay high without matching pricing power, which would keep gross margin and adjusted EBITDA margins under strain.

- Enterprise deals in the EU and U.S. are described as larger, with some late stage opportunities above US$100,000 in ARR. If these long sales cycles slip, close at lower values, or face tougher competition as accessibility tools become more common, the mix shift toward enterprise could stall, limiting the long term uplift to revenue and earnings.

- The business is in the middle of migrating acquired customers to the Core platform to remove duplicate systems. If attrition from that integration is higher than expected or support needs increase, the company could see weaker ARR trends, more volatile customer counts, and less improvement in gross margin and free cash flow than it is aiming for.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for AudioEye is $18.0, which represents up to two standard deviations below the consensus price target of $21.4. This valuation is based on what can be assumed as the expectations of AudioEye's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $56.8 million, earnings will come to $10.9 million, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $6.64, the analyst price target of $18.0 is 63.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AudioEye?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.