Last Update04 Aug 25Fair value Increased 19%

The upward revision in Teradyne's consensus price target is primarily driven by stronger revenue growth projections and an increased forward P/E multiple, resulting in a new fair value estimate of $113.06.

What's in the News

- Teradyne expects Q3 2025 revenue between $710 million and $770 million, with GAAP net income of $0.62 to $0.80 per diluted share.

- The company was dropped from several Russell indexes, including the Russell Midcap Growth, Russell 1000 Growth, and Russell 3000 Growth.

- The Board amended and restated By-Laws, adjusting director nomination and shareholder proposal notice periods, updating shareholder nomination procedures, clarifying voting standards, and making various administrative updates.

Valuation Changes

Summary of Valuation Changes for Teradyne

- The Consensus Analyst Price Target has significantly risen from $97.81 to $113.06.

- The Consensus Revenue Growth forecasts for Teradyne has significantly risen from 11.3% per annum to 13.2% per annum.

- The Future P/E for Teradyne has risen from 20.73x to 22.45x.

Key Takeaways

- Strategic focus on AI, robotics, and semiconductor automation aims to drive significant future revenue and net margin improvement.

- Quantifi Photonics acquisition and share buyback plan reflect confidence in earnings growth and market position strengthening.

- Geopolitical and economic factors including tariffs are causing uncertainty, potentially impacting Teradyne's revenue, margins, and financial performance across multiple segments.

Catalysts

About Teradyne- Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

- Teradyne expects significant future growth potential from AI accelerators, robotics, and semiconductor automation, which are being driven by long-term industry themes such as AI, verticalization, and electrification. These areas are likely to boost future revenue.

- The acquisition of Quantifi Photonics is anticipated to strengthen Teradyne’s position in silicon photonics testing, potentially enhancing revenue growth in semiconductor testing markets.

- Teradyne’s strategic initiatives in robotics and its recent structural reorganization aim to lower the operating breakeven, thus potentially improving net margins in the future as market conditions improve.

- The significant share buyback plan, up to $1 billion through the end of 2026, indicates confidence in future earnings and free cash flow generation, which could drive EPS growth.

- New opportunities in production board test for AI compute and new mobile testing enhancements demonstrate potential for diversification and revenue growth, particularly as demand recovers for more advanced and complex technologies.

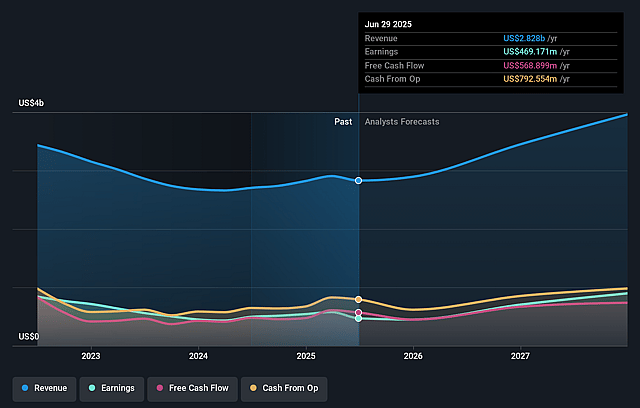

Teradyne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Teradyne's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.6% today to 23.7% in 3 years time.

- Analysts expect earnings to reach $972.1 million (and earnings per share of $6.39) by about August 2028, up from $469.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $684.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, down from 38.7x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 2.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.11%, as per the Simply Wall St company report.

Teradyne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariffs and trade policies are creating uncertainty among Teradyne's customers in the mobile, automotive, and industrial segments, potentially reducing demand and impacting future revenue projections.

- Limited visibility beyond the second quarter due to geopolitical factors might lead to unpredictability in earnings and revenue forecasts.

- Robotics revenue has declined both sequentially and year-over-year, with challenging macro conditions being a persistent headwind, potentially affecting net margins and operational outcomes.

- Fluctuating product mix and volume could lead to variations in gross margins, especially concerning future semiconductor test needs and possible shifts in demand for HBM test capacity.

- The continuity of economic factors such as tariffs and trade policy might impact not only end market demand but also cost structures, thereby affecting net profit margins and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.062 for Teradyne based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $133.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $972.1 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 10.1%.

- Given the current share price of $114.01, the analyst price target of $116.06 is 1.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.