Key Takeaways

- Rapid expansion in automotive, IoT, and PC segments, combined with leadership in on-device AI, positions Qualcomm for above-industry-average earnings growth and margin improvement.

- Dominant patent portfolio and supply chain resilience provide robust downside protection, supporting stability and premium valuation amid industry and economic shifts.

- Growing competition, shifting customer strategies, and regulatory pressures threaten Qualcomm's core revenue streams, margins, and long-term profitability across handset and licensing businesses.

Catalysts

About QUALCOMM- Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

- While analyst consensus expects non-handset segment revenues (automotive, IoT, PC, XR) to hit $22 billion by fiscal 2029, recent quarterly growth rates in automotive (up 59% year over year) and industrial IoT (up 27% year over year) indicate that a substantially faster ramp is possible, potentially accelerating total company revenue and mix shift toward structurally higher-margin businesses.

- Analysts broadly agree that Snapdragon-powered PCs could reach just 12% market share by fiscal 2029, but current momentum-over 85 designs in development, major partnerships with Microsoft, and rapid expansion beyond the $600 price tier-suggests Qualcomm could far exceed share expectations in the premium and mass-market PC segments, driving upside to both PC revenues and blended operating margins.

- Qualcomm's leadership in on-device AI-enabled by its x85 5G platform, proprietary NPUs, and tight integration with leading foundation models-positions it to capitalize on an inflection point for AI at the edge, unlocking a multi-year upgrade cycle in smartphones, IoT, and XR devices that could boost average selling prices and long-term gross profit per unit.

- The global rollout of Wi-Fi 7 and early-stage 6G wireless standards leverages Qualcomm's dominant patent portfolio, enhancing recurring high-margin licensing revenues and providing robust downside protection to earnings, particularly as new device categories proliferate.

- Structural supply chain resilience due to geographic diversification and a growing share of automotive and industrial semiconductor content should allow Qualcomm to deliver more stable, above-industry-average earnings growth despite sector cyclicality or macro disruptions, supporting a premium valuation multiple.

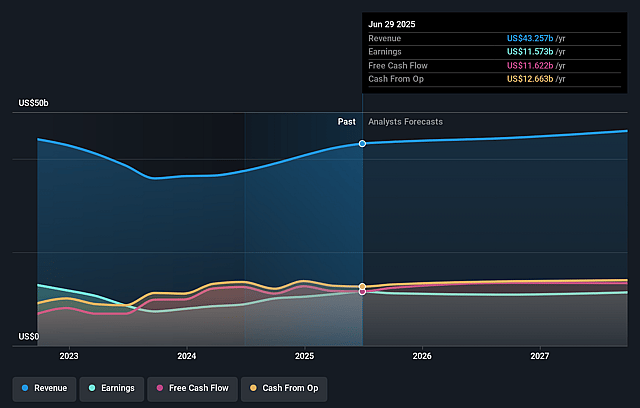

QUALCOMM Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on QUALCOMM compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming QUALCOMM's revenue will grow by 5.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 26.0% today to 26.8% in 3 years time.

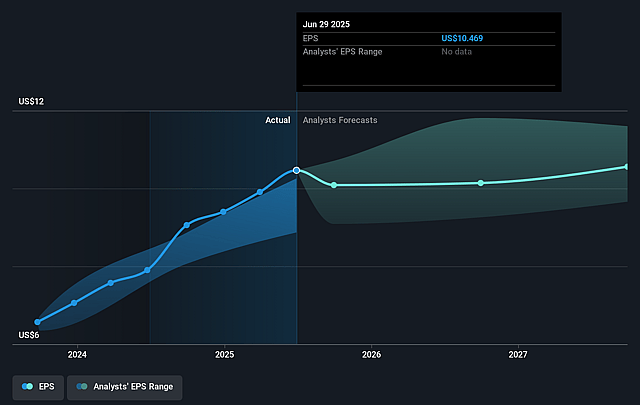

- The bullish analysts expect earnings to reach $13.4 billion (and earnings per share of $11.61) by about July 2028, up from $11.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from 15.5x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to decline by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.8%, as per the Simply Wall St company report.

QUALCOMM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing insourcing of chip design by major customers-especially Apple, which is expected to further reduce its use of Qualcomm modems in upcoming product cycles-could erode Qualcomm's handset chipset revenues and compress gross margins as high-value customer contributions dwindle.

- Commoditization of mobile chipsets and intensifying competition from low-cost Asian competitors like MediaTek may increase price pressure in both premium and mid-tier segments, threatening Qualcomm's ability to maintain premium pricing and leading to declines in both revenue and net profit margins over time.

- Ongoing regulatory scrutiny, geopolitical tensions, and evolving tariffs-especially in China, where Qualcomm relies on a strong customer base-could restrict market access and increase compliance costs or operating risks, producing revenue volatility and added expense burden that pressure net income.

- The growing shift toward open-source and RISC-V architectures threatens Qualcomm's core intellectual property and licensing business, introducing the risk of reduced recurring royalties and licensing revenue which could lower overall operating margins and impact future profitability.

- Continued reliance on a small number of key smartphone OEMs-particularly in the premium Android and China market segments-creates revenue concentration risk and exposes Qualcomm to shifts in customer bargaining power, deteriorating the stability of its gross margins and increasing vulnerability to abrupt declines in earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for QUALCOMM is $216.48, which represents two standard deviations above the consensus price target of $175.6. This valuation is based on what can be assumed as the expectations of QUALCOMM's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $50.1 billion, earnings will come to $13.4 billion, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 9.8%.

- Given the current share price of $157.99, the bullish analyst price target of $216.48 is 27.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.