Key Takeaways

- Worsening US-China tensions and increased localization threaten Qualcomm's revenue, market share, and licensing profitability due to shrinking international demand and intensified competition.

- Rising client vertical integration and adoption of open-source architectures undermine chip sales, royalty streams, and net margins, increasing risks of margin compression and obsolescence.

- Diversification into automotive, IoT, and AI markets, combined with ongoing product innovation, is enhancing QUALCOMM's growth prospects and resilience beyond the traditional smartphone segment.

Catalysts

About QUALCOMM- Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

- The company faces a significant threat from rising geopolitical fragmentation and escalating trade tensions, particularly between the U.S. and China. Ongoing and potential future tariffs, combined with increased efforts by China to reduce dependence on U.S. suppliers, could lead to a substantial decline in Qualcomm's addressable revenue and loss of market share in its largest international market over the next several years, severely constraining long-term revenue growth.

- The global push for technological sovereignty is accelerating, as governments and major customers invest heavily in developing domestic semiconductor industries and alternative architectures. This will likely erode Qualcomm's dominance in key overseas markets and threaten the reliability of its high-margin licensing revenue, putting sustained downward pressure on net margins by reducing royalty streams from its traditional IP business.

- Major clients such as Apple and Samsung are further advancing their in-house chip development and vertical integration strategies, which will result in Qualcomm losing chip sales and related royalties in both high-end and mid-tier smartphones, leading to declining revenues and ongoing net margin compression as its customer concentration risk materializes.

- The growing industry adoption of open-source solutions and RISC-V architectures undermines Qualcomm's licensing model, potentially leading to lower royalty rates, diminished pricing power, and unpredictable earnings from its historically dependable and lucrative intellectual property portfolio.

- As supply chains shift toward localization and onshoring, Qualcomm is likely to face increased component costs and capital expenditures, while rapid innovation cycles in AI and automotive necessitate rising R&D investment. These factors together will strain its cost structure, squeeze gross margins, and increase the risk of technological obsolescence, putting sustained downward pressure on profitability.

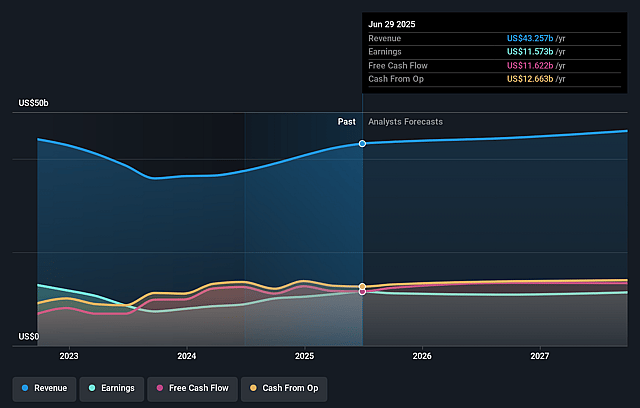

QUALCOMM Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on QUALCOMM compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming QUALCOMM's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 26.0% today to 23.9% in 3 years time.

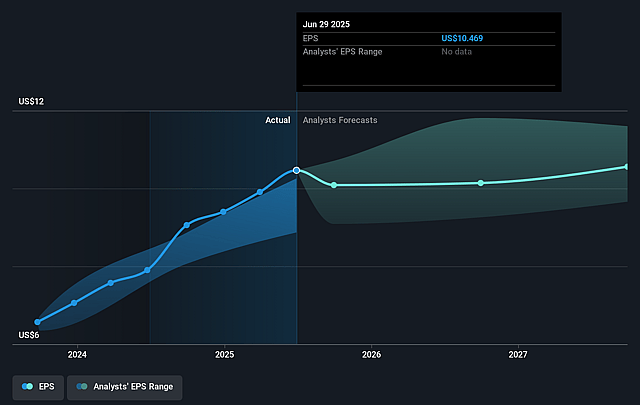

- The bearish analysts expect earnings to reach $10.2 billion (and earnings per share of $9.32) by about July 2028, down from $11.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 15.7x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to decline by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.79%, as per the Simply Wall St company report.

QUALCOMM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued strength and rapid expansion in IoT, automotive, and premium handset markets are diversifying QUALCOMM's revenue streams beyond smartphones, supporting long-term revenue growth and improving resilience for earnings.

- Significant growth in automotive and industrial IoT segments, including strong design traction and major new partnerships, positions QUALCOMM to capitalize on secular trends such as digital car transformation and intelligent edge, supporting increasing margins and revenue.

- Heavy investment in on-device and edge AI, supported by successful recent acquisitions and new product launches, strengthens QUALCOMM's role in next-generation computing and connectivity, supporting pricing power and average selling prices for long-term earnings growth.

- Expansion of its Snapdragon platforms into PCs, XR, smart glasses, and automotive ADAS, backed by strong OEM adoption and ecosystem momentum, is broadening QUALCOMM's total addressable market and could drive higher revenues and margin stability.

- Strong free cash flow generation and disciplined capital allocation strategy, including significant shareholder returns and ongoing investment in R&D, improve QUALCOMM's ability to weather cyclical downturns and support future net income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for QUALCOMM is $140.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of QUALCOMM's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $42.5 billion, earnings will come to $10.2 billion, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 9.8%.

- Given the current share price of $159.88, the bearish analyst price target of $140.0 is 14.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.