Narratives are currently in beta

Key Takeaways

- Strategic expansion in Data Centers and AI partnerships likely boosts revenue growth and strengthens net margins.

- Growing adoption of NVIDIA Omniverse could enhance operational efficiencies and open new revenue streams in industrial AI.

- Intense competition, supply constraints, and geopolitical risks may pressure NVIDIA's revenue growth and margins, particularly in the AI, gaming, and data center markets.

Catalysts

About NVIDIA- Provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally.

- NVIDIA's continued expansion of its Data Center offerings, such as the exceptional demand for NVIDIA Hopper and Blackwell GPUs, is likely to significantly boost revenue growth due to the strong sequential and year-over-year performance.

- The upcoming release of NVIDIA NIM, which will boost Hopper inference performance by 2.4x, along with ongoing performance optimizations, could drive increased revenue and improved net margins by enhancing the value proposition of NVIDIA's existing product base.

- NVIDIA's strategic positioning in sovereign AI and partnerships with global consulting firms like Accenture indicates a robust pipeline that may more than double AI enterprise revenue, contributing to revenue growth and potentially higher net margins.

- The increasing adoption of NVIDIA Omniverse by major industrial manufacturers suggests potential operational efficiencies and new revenue streams from industrial AI and robotics, positively impacting long-term earnings.

- NVIDIA's ability to address supply constraints and its accelerated production of Blackwell, despite high demand, points to potential revenue growth and stabilization of gross margins as their supply chain scales to meet evolving infrastructure demands.

NVIDIA Future Earnings and Revenue Growth

Assumptions

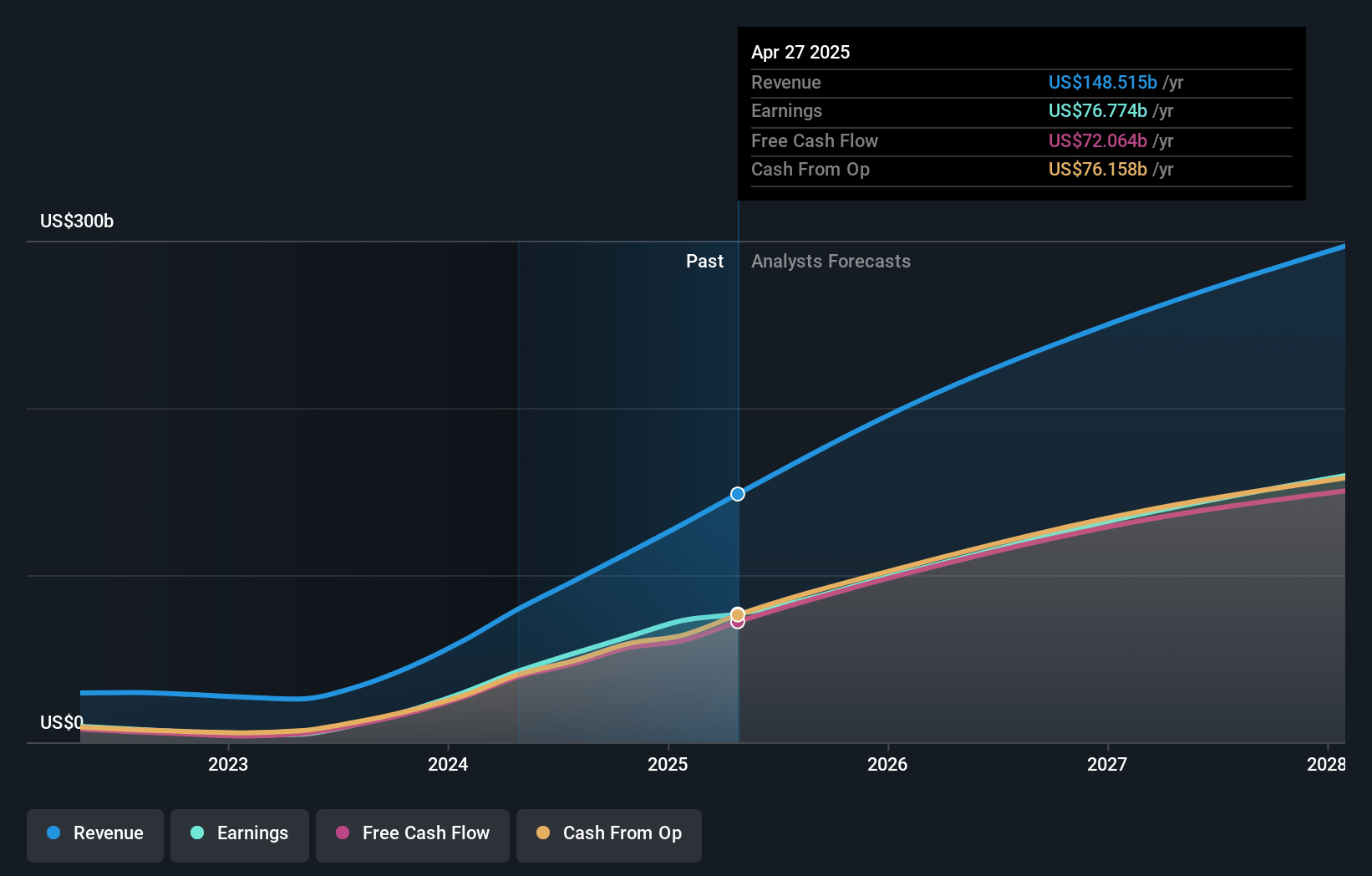

How have these above catalysts been quantified?- Analysts are assuming NVIDIA's revenue will grow by 31.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 55.7% today to 54.5% in 3 years time.

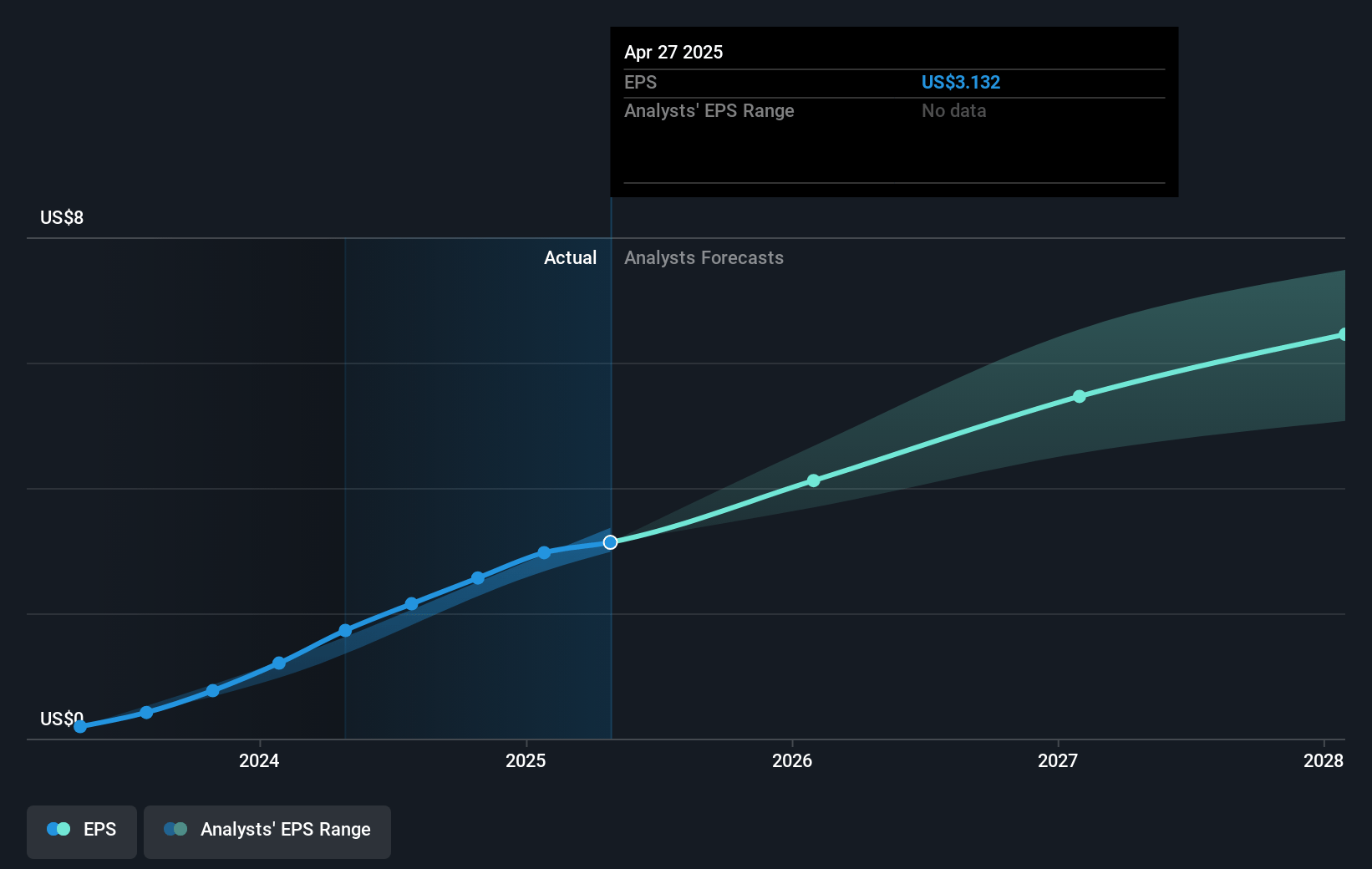

- Analysts expect earnings to reach $141.4 billion (and earnings per share of $5.95) by about November 2027, up from $63.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $190.1 billion in earnings, and the most bearish expecting $102.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2027 earnings, down from 53.2x today. This future PE is greater than the current PE for the US Semiconductor industry at 29.0x.

- Analysts expect the number of shares outstanding to decline by 1.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

NVIDIA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition in the AI and data center market could pressure NVIDIA's future revenue growth, as rival companies develop and offer similar high-performance computing solutions.

- China's market is noted as highly competitive, and ongoing export controls may limit NVIDIA's revenue growth from data center products in the region.

- NVIDIA faces supply chain constraints, particularly in gaming hardware, which may impact revenue if these issues persist and NVIDIA prioritizes data center product supply over gaming.

- The transition to new hardware like Blackwell could lead to initially lower gross margins, impacting earnings as NVIDIA works to optimize production and increase performance efficiency.

- Global economic conditions and geopolitical tensions, including changes in U.S. administration policies or tariffs, could pose risks to NVIDIA's operational costs and revenue from international markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $170.44 for NVIDIA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $259.4 billion, earnings will come to $141.4 billion, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $136.92, the analyst's price target of $170.44 is 19.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$141.74

FV

4.5% undervalued intrinsic discount17.20%

Revenue growth p.a.

140users have liked this narrative

0users have commented on this narrative

38users have followed this narrative

about 1 month ago author updated this narrative

CH

ChadWisperer

Community Contributor

Share of $500bn AI market drops to 60% in 10 years

Summary of Aswath Damodaran's Nvidia narrative and valuation. Damodaran is notoriously conservative and previously sold half his stake in Nvidia.

View narrativeUS$87.09

FV

55.4% overvalued intrinsic discount15.93%

Revenue growth p.a.

12users have liked this narrative

0users have commented on this narrative

16users have followed this narrative

about 2 months ago author updated this narrative

US$175.07

FV

22.7% undervalued intrinsic discount38.24%

Revenue growth p.a.

78users have liked this narrative

0users have commented on this narrative

13users have followed this narrative

3 months ago author updated this narrative