Key Takeaways

- Persistent labor issues and delayed production capacity are limiting near-term revenue and margin improvement despite strong long-term industry drivers.

- High customer concentration and OEM vertical integration pose ongoing risks to recurring revenue stability and earnings consistency.

- Dependence on major OEMs, cost pressures, and industry headwinds are constraining margins and earnings, while customer concentration and competition increase revenue volatility and risk.

Catalysts

About Ichor Holdings- Engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally.

- While ongoing investment in semiconductor manufacturing driven by accelerated AI, data center, and cloud buildout should create long-term revenue growth opportunities for Ichor, the company's persistent hiring and retention issues at its US machining operations have limited its ability to meet customer demand, constraining both near-term revenue realization and operational leverage necessary to improve gross margins.

- Although the company is gaining traction with new proprietary product qualifications, such as flow control and valve product lines that could expand its addressable market and improve margins over time, delays in internal capacity ramp and slower-than-expected customer production ramps risk pushing out the realization of these margin accretion benefits, potentially weighing on earnings for several quarters.

- While localization of semiconductor supply chains and new fab construction in Western markets are likely to drive longer-term demand for Ichor's fluid delivery subsystems, uncertainty around the timing of customer capital expenditures-particularly as some major US OEMs push out their investments-may cause Ichor's top-line growth in the next year to trail the broader secular tailwinds.

- Despite Ichor's strategy to increase internal content and automation-which is intended to structurally lift gross margins-the company's short-term margin profile remains vulnerable due to elevated operating costs, ongoing external purchases of components, and a reliance on achieving higher production volumes to reach scale efficiencies; this dynamic creates risk for sustainable margin expansion and impacts net income growth.

- Even as the complexity of semiconductor nodes and the push for greater supply chain reliability are expected to benefit established suppliers like Ichor in the long term, high customer concentration and the risk of increased vertical integration among key OEM customers pose a threat to recurring revenue stability and could contribute to earnings volatility if customer priorities shift.

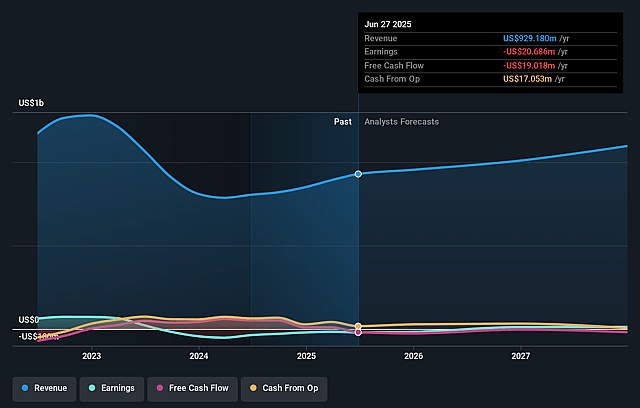

Ichor Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ichor Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ichor Holdings's revenue will grow by 6.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.2% today to 1.6% in 3 years time.

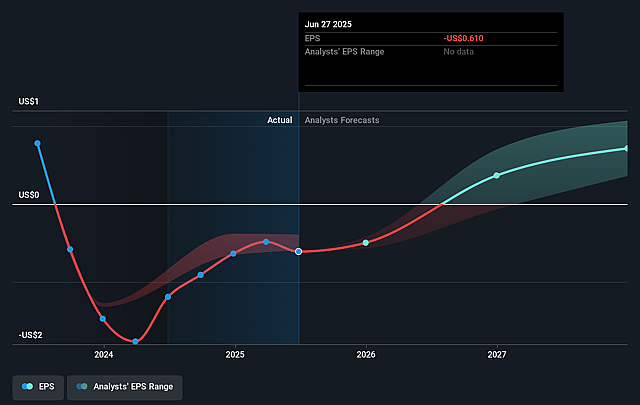

- The bearish analysts expect earnings to reach $17.7 million (and earnings per share of $0.5) by about September 2028, up from $-20.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 50.5x on those 2028 earnings, up from -28.0x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.4x.

- Analysts expect the number of shares outstanding to grow by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.25%, as per the Simply Wall St company report.

Ichor Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent hiring and retention challenges, especially in U.S. manufacturing operations, are limiting Ichor's ability to ramp internal supply, which directly constrains gross margin expansion and reduces potential earnings.

- Increased operational costs from higher headcount needs, healthcare expenses, and facility consolidation charges are pressing the company's operating margins, and further restructuring could impact net income if these costs remain elevated.

- Heavy reliance on a small number of major semiconductor OEM customers exposes Ichor to customer concentration risk, so delays or cuts in these customers' capital expenditures-as seen with U.S. OEMs recently-can lead to revenue volatility and less predictable top-line growth.

- Ongoing industry headwinds, including slowing EUV tool builds, weaker advanced packaging growth, and delays in capacity expansion in certain end markets like silicon carbide, may stall revenue momentum and make Ichor's run-rate targets harder to achieve.

- Intensifying vertical integration and internal content initiatives among key competitors and customers could lead to commoditization and increased pricing pressure for fluid delivery subsystems, potentially reducing gross margins and long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ichor Holdings is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ichor Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $17.7 million, and it would be trading on a PE ratio of 50.5x, assuming you use a discount rate of 11.2%.

- Given the current share price of $16.88, the bearish analyst price target of $18.0 is 6.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.