Last Update 12 Dec 25

Fair value Decreased 14%ICHR: Pull Ins And Project Delays Will Set Up Rebound Opportunity

Analysts have trimmed their price target on Ichor Holdings to $30.00 from $35.00, citing weaker Q4 guidance tied to earlier Q3 pull ins from key customers, expected softness at mid tier accounts, and project push outs in its highest margin segment.

Analyst Commentary

Bullish analysts acknowledge the near term pressure on Ichor Holdings, but emphasize that the revised price target still implies meaningful upside from current trading levels. They argue that the recent pullback has more than discounted softer Q4 guidance and project timing issues, and they frame the setup as favorable for long term investors willing to look through near term volatility.

Despite the lowered target, these analysts maintain a positive stance on the shares, pointing to Ichor's strategic positioning within the semiconductor capital equipment supply chain and the potential for operating leverage as demand normalizes. In their view, the drivers behind the weaker outlook are largely timing related rather than structural, which preserves the longer term earnings power of the business.

They also highlight that Ichor's exposure to its largest customers, while creating short term lumpiness, positions the company to benefit disproportionately when order patterns stabilize and the next wave of programs ramps. As visibility improves and deferred projects in higher margin areas resume, bullish analysts see scope for valuation to move closer to historical averages.

Bullish Takeaways

- The revised price target still reflects upside potential versus current levels, which suggests the market may be over-penalizing near term guidance risk.

- Softness in Q4 is viewed as primarily timing driven, with Q3 pull-ins and project push-outs expected to normalize, which could support a recovery in revenue and margins.

- Strong relationships with top tier customers are seen as strategic assets that can support growth once semiconductor spending cycles re-accelerate.

- High margin segments, though temporarily pressured, are expected to rebound as deferred projects return to the pipeline, reinforcing the longer term earnings and cash flow outlook.

What's in the News

- Chief Executive Officer Jeffrey Andreson has notified the Board of his decision to resign, effective November 3, 2025, with the company stating his departure is not due to any disagreement over operations, policies, or practices (Key Developments)

- The Board has appointed current Chief Technology Officer Philip Barros as Chief Executive Officer, also effective November 3, 2025, elevating a long tenured engineering leader with experience at both Ichor and Applied Materials (Key Developments)

- For the fourth quarter ended December 26, 2025, Ichor issued revenue guidance of $210 million to $230 million, with a midpoint of $220 million, reflecting management’s expectations for near term demand (Key Developments)

- The company also guided GAAP diluted EPS for the same quarter to a range of $(0.33) to $(0.17), with a midpoint of $(0.25), highlighting ongoing margin and earnings pressure in the current cycle (Key Developments)

Valuation Changes

- The Fair Value Estimate has been reduced from $34.96 to $30.00, signaling a moderate downward revision in intrinsic value expectations.

- The Discount Rate has risen slightly from 11.21% to 11.52%, reflecting a modestly higher perceived risk profile or required return.

- Revenue Growth has been trimmed from 8.08% to 7.46%, indicating a small downgrade to the medium term topline outlook.

- Net Profit Margin has increased significantly from 1.52% to 3.72%, implying a more optimistic view of future profitability despite near term pressures.

- The Future P/E has fallen sharply from 97.3x to 32.9x, suggesting a materially lower multiple being applied to forward earnings in the updated valuation framework.

Key Takeaways

- Accelerated component qualifications and proprietary integrations position Ichor to gain substantial market share and achieve significantly higher, sustainable margins through industry adoption.

- Strategic benefits from localization trends, persistent demand for advanced semiconductors, and operational efficiency improvements set the stage for outsized growth and elevated profitability.

- Hiring constraints, customer concentration, limited diversification, pricing pressure, and industry shifts threaten revenue stability, margin growth, and long-term profitability.

Catalysts

About Ichor Holdings- Engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally.

- While analyst consensus expects Ichor to outpace wafer fab equipment growth, there is a real possibility Ichor could take substantially more market share as their internal component qualifications accelerate, positioning the company to capture a disproportionate share of the high-growth advanced-node and EUV tool market; this could support outsized revenue growth and a step-change in gross margin far beyond consensus projections.

- Analyst consensus highlights structurally higher margins from in-sourcing, but with successful full product-level integrations (such as the recent full Ichor content gas box qualification at a major end customer), Ichor could unlock not just high-teens but sustainably 20 percent or higher gross margins as its proprietary content and IP become standard across more customers' production lines, drastically boosting long-term net earnings.

- Ichor is poised to benefit ahead of peers from the accelerating reshoring and localization of semiconductor manufacturing in the US and Europe, which is likely to translate into higher-margin R&D partnerships and recurring regional revenue streams, significantly de-risking the revenue base and enabling premium pricing power that can lift average selling prices and operating margins.

- With global digitalization and the proliferation of AI, 5G, IoT, and electric vehicles creating persistent demand for more advanced and complex semiconductor devices, Ichor's rapid product innovation-especially in next-gen flow control and valve solutions-is positioned to turn secular device complexity into a multi-year upgrade cycle, dramatically expanding their addressable market, customer penetration, and long-term top-line growth.

- The company's newly streamlined global operational footprint, ongoing cost discipline, and ability to tightly align capacity with those of major semiconductor production hubs positions it to rapidly scale profitability as soon as hiring and output issues are resolved, setting up Ichor for large boosts in operating leverage and free cash flow as volumes recover, well ahead of street expectations.

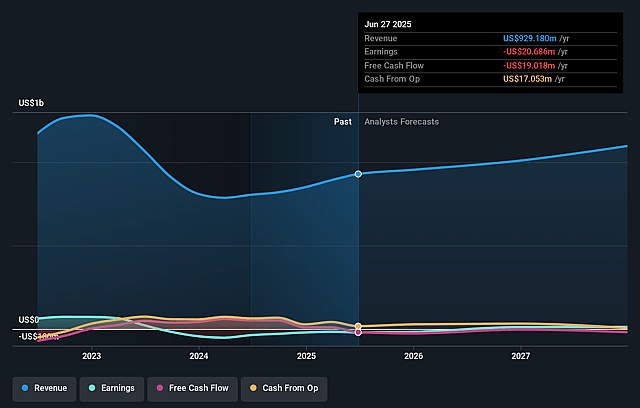

Ichor Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ichor Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ichor Holdings's revenue will grow by 8.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.2% today to 1.5% in 3 years time.

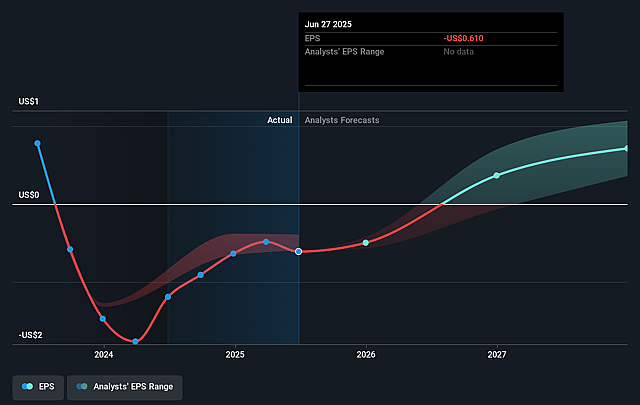

- The bullish analysts expect earnings to reach $17.8 million (and earnings per share of $1.5) by about September 2028, up from $-20.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 97.3x on those 2028 earnings, up from -27.2x today. This future PE is greater than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.21%, as per the Simply Wall St company report.

Ichor Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing hiring and retention challenges within Ichor's key U.S. operations are limiting their ability to scale internal component supply, which directly constrains output, delays margin expansion, and poses a risk to both revenue growth and improving net margins if not resolved over the long term.

- High customer concentration, with a reliance on a few major semiconductor OEMs, leaves Ichor exposed to significant revenue volatility if any of these customers reduce or delay capital expenditures, as has occurred with some U.S. and EUV equipment customers recently affecting top-line revenue stability.

- Intense pricing pressure from consolidating semi-cap customers and a competitive OEM supply chain continues to limit gross margin expansion, making it difficult for Ichor to achieve its target profitability and compressing net margins over time.

- The company's strategy remains heavily focused on its core fluid delivery subsystems, so limited diversification increases the risk that changes in semiconductor manufacturing processes or technology-such as increased automation, advanced packaging plateauing, or customer preferences shifting away from traditional products-could erode future revenue and earnings.

- Industry-wide cyclical downturns and increasing vertical integration by top semiconductor OEMs threaten to reduce demand for outsourced subsystems, which could further dampen Ichor's order pipeline, slow revenue growth, and pressure both net margins and stable earnings long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ichor Holdings is $34.96, which represents two standard deviations above the consensus price target of $24.17. This valuation is based on what can be assumed as the expectations of Ichor Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $17.8 million, and it would be trading on a PE ratio of 97.3x, assuming you use a discount rate of 11.2%.

- Given the current share price of $16.41, the bullish analyst price target of $34.96 is 53.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ichor Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.