Last Update 08 Aug 25

Analysts maintained Ichor Holdings’ price target at $24.17, citing optimism over improving semiconductor demand, memory market recovery, and anticipated revenue growth.

Analyst Commentary

- Encouragement from improving NAND and enterprise solid-state drive demand signals heading into the second half of 2025.

- Raised expectation for Ichor Holdings' revenue growth due to strengthening semiconductor industry trends.

- Anticipation of a recovery in memory market cycles benefiting the company's core business.

- Increased confidence in the company’s ability to capitalize on sector tailwinds.

- Bullish analysts see potential for margin expansion as demand recovers.

What's in the News

- Ichor Holdings announced a CEO transition plan; Jeff Andreson will remain CEO until a successor is found and then serve as Executive Advisor through August 2026.

- The company issued third quarter 2025 guidance, expecting revenue between $225 million and $245 million and GAAP diluted EPS in the range of $0.12 to $0.18.

- Ichor Holdings was dropped from multiple Russell growth indices, including the Russell 2000, 2500, 3000, Microcap, and Small Cap Comp Growth indices.

Valuation Changes

Summary of Valuation Changes for Ichor Holdings

- The Consensus Analyst Price Target remained effectively unchanged, at $24.17.

- The Net Profit Margin for Ichor Holdings remained effectively unchanged, at 1.86%.

- The Consensus Revenue Growth forecasts for Ichor Holdings remained effectively unchanged, at 6.9% per annum.

Key Takeaways

- Secular demand growth and government incentives are expanding Ichor's market opportunity, supporting above-industry and more predictable long-term revenue growth.

- New proprietary product launches and vertical integration are set to boost margins and diversify revenue through higher content per tool and increased manufacturing efficiency.

- Hiring challenges, weak demand, operational issues, and leadership uncertainty are constraining Ichor's growth, margin expansion, and revenue predictability.

Catalysts

About Ichor Holdings- Engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally.

- Ongoing digital transformation in industries such as automotive, healthcare, and industrial automation is driving secular demand growth for advanced semiconductor manufacturing; this is expected to support sustained long-term order growth for Ichor's fluid delivery subsystems, positioning the company for above-industry revenue growth as these trends accelerate.

- The company is making material progress with the qualification and commercialization of new proprietary products like flow controllers and valves, which expand Ichor's addressable market and increase content per tool, providing a foundation for diversified and higher-margin revenues in future quarters as production ramps.

- Vertical integration and ramping of internal manufacturing capacity for critical components are expected to significantly enhance gross margins once hiring and retention issues are resolved-this operational inflection can drive meaningful net margin expansion as new products shift from qualification to scaled commercial production.

- Stronger partnerships and increased direct qualifications with wafer fab equipment OEMs and end device manufacturers are improving recurring order visibility and share of wallet, which should lead to greater earnings predictability in future periods.

- Government incentives for domestic semiconductor production (e.g., US CHIPS Act) continue to underwrite new fab investments and equipment demand in the US, expanding Ichor's customer base and serving as a catalyst for longer-term top line revenue growth.

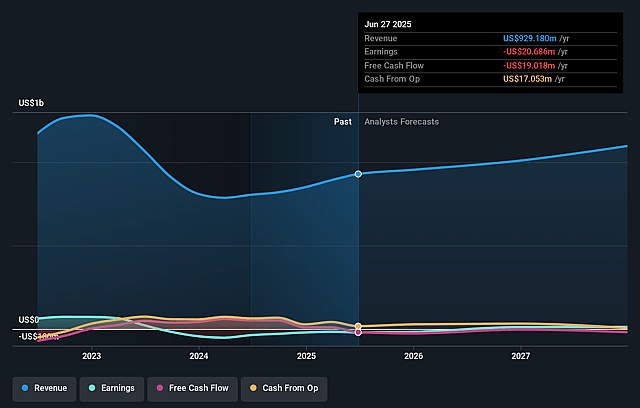

Ichor Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ichor Holdings's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.2% today to 1.9% in 3 years time.

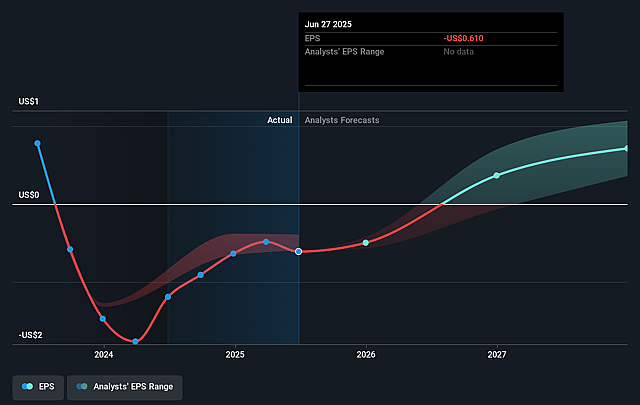

- Analysts expect earnings to reach $21.1 million (and earnings per share of $0.78) by about September 2028, up from $-20.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.9x on those 2028 earnings, up from -26.7x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.32%, as per the Simply Wall St company report.

Ichor Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent hiring and retention challenges in Ichor's U.S. operations, especially in specialized post-machining and clean room roles, are limiting production capacity and constraining the ramp of internal component supply, restricting both current and potential future revenue growth and delaying needed gross margin expansion.

- Revenue growth momentum has recently stalled below the targeted $250 million quarterly run rate due to external factors such as a slowing EUV build, delayed CapEx investments by a major U.S. semiconductor manufacturer, and ongoing weak demand in nontraditional markets like silicon carbide-which could signal customer and end-market concentration risks resulting in revenue volatility.

- Despite internal progress with new product qualifications (valves and flow control), the timeline for these proprietary, higher-margin products to significantly improve gross margins is unclear and highly dependent on end-customer production ramps and volume adoption, leaving net margins at risk if these transitions are delayed or underwhelming.

- Ichor continues to face thin gross margins (Q2 gross margin at just 12.5%) primarily due to operational execution issues and ongoing external sourcing, with management only cautiously guiding for incremental margin improvement-a condition that exposes the company to heightened downside risk from any further operational, pricing, or cost pressures that could compress net earnings.

- With CEO succession underway and a period of leadership uncertainty, the company may experience execution risk or strategic drift at a critical time when scaling internal supply, securing new product wins, and managing external market slowdowns are all essential, potentially impacting both the predictability of future earnings and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.167 for Ichor Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $21.1 million, and it would be trading on a PE ratio of 56.9x, assuming you use a discount rate of 11.3%.

- Given the current share price of $16.07, the analyst price target of $24.17 is 33.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ichor Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.