Narratives are currently in beta

Key Takeaways

- Expansion of Murphy USA's store network and strategic initiatives are designed to optimize retail margins and drive consistent earnings growth.

- Share repurchase commitments aim to improve earnings per share and boost shareholder value over time.

- Persistent competition affects non-fuel revenue, while rising expenses and capital projects may strain margins and cash flow, with performance and earnings variability.

Catalysts

About Murphy USA- Engages in marketing of retail motor fuel products and convenience merchandise.

- Murphy USA is accelerating organic growth with a robust real estate pipeline, as evidenced by the increase in capital expenditure guidance to $500 million to $525 million for 2024. This investment is expected to drive revenue and earnings growth in 2025 and beyond.

- The company's efforts in expanding its store network are set to generate predictable and consistent incremental EBITDA in the upcoming years, which may positively impact overall earnings and shareholder value.

- Murphy USA's strategic initiatives to enhance its merchandise offerings and leverage core traffic-driving categories like fuel and nicotine are designed to optimize retail margins and drive revenue growth.

- The anticipated improvements in QuickChek's promotional activities and the newly launched QuickChek Rewards program are expected to boost in-store sales, thus enhancing net margins and overall earnings.

- Committed share repurchases, with $1.1 billion remaining under board authorization, are expected to improve earnings per share and enhance shareholder value over time.

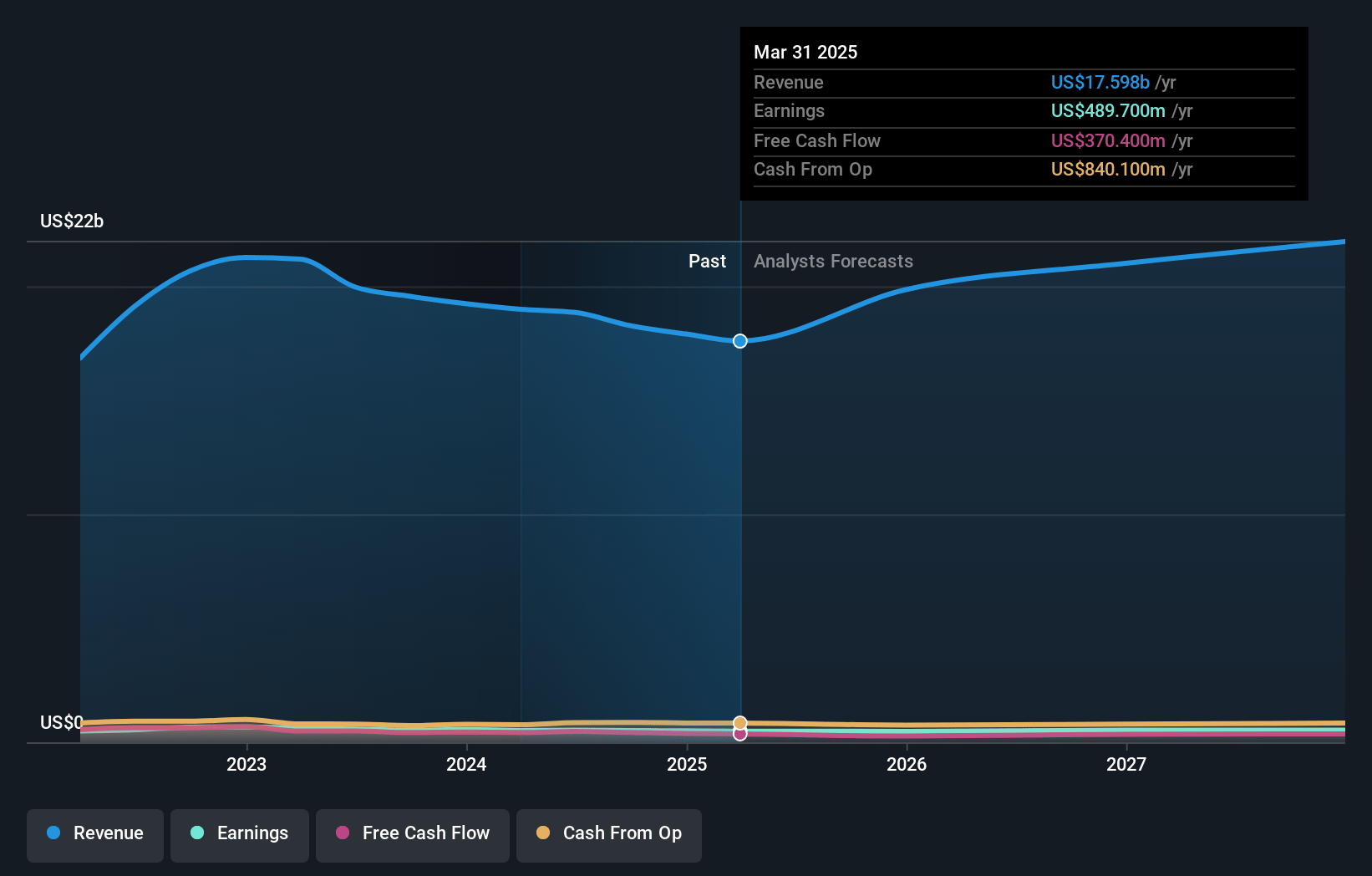

Murphy USA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Murphy USA's revenue will grow by 6.8% annually over the next 3 years.

- Analysts are assuming Murphy USA's profit margins will remain the same at 2.8% over the next 3 years.

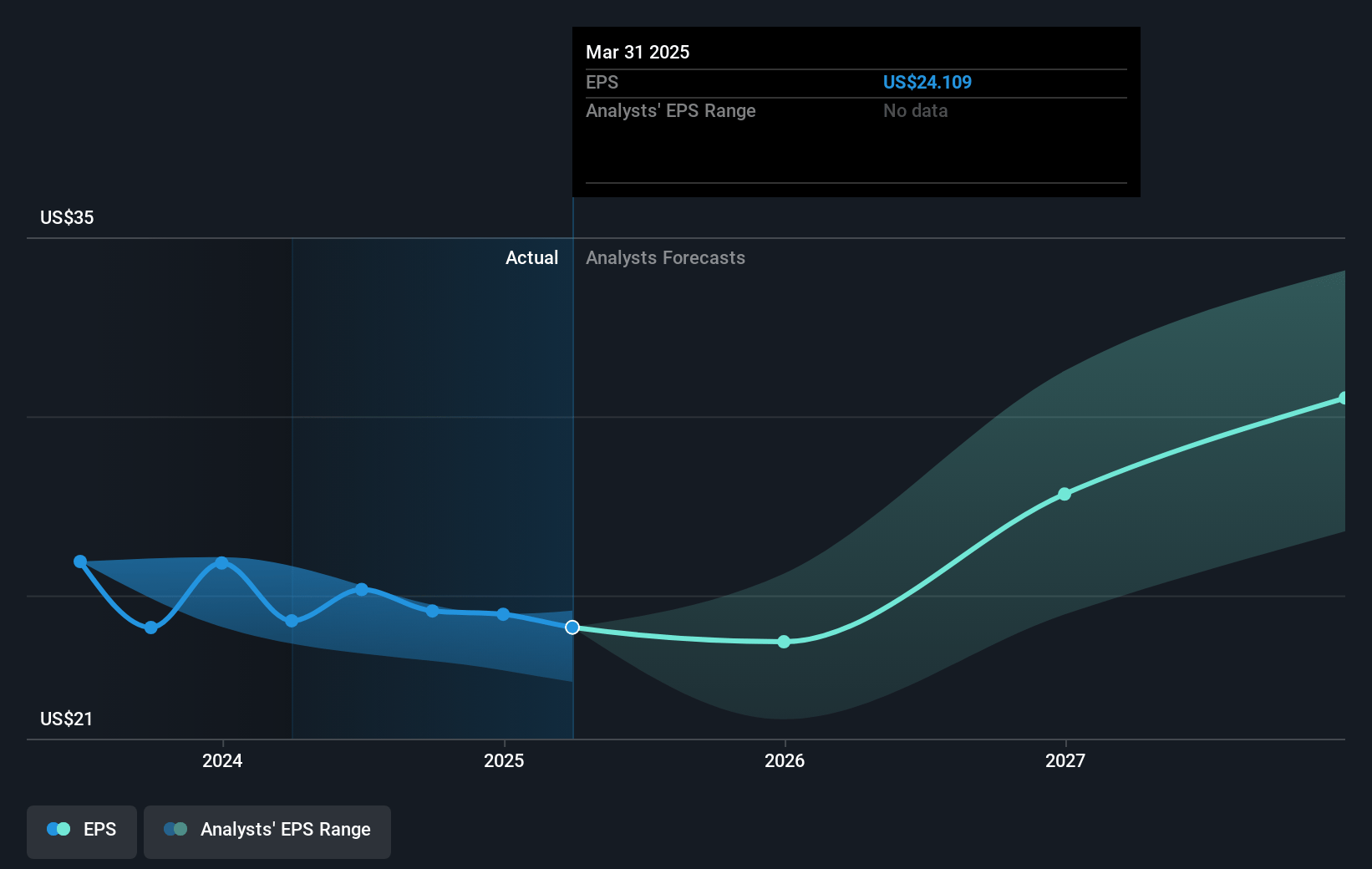

- Analysts expect earnings to reach $623.1 million (and earnings per share of $31.62) by about November 2027, up from $510.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $555.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.6x on those 2027 earnings, down from 20.8x today. This future PE is greater than the current PE for the US Specialty Retail industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 0.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Murphy USA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing pressures from QSR value pricing impacting QuickChek's food and beverage traffic and margins remain a concern, indicating persistent industry competition and affecting non-fuel revenue growth.

- Rising operating expenses, seen as a 4% increase in the third quarter, primarily due to the larger new stores and renovations, suggest potential pressures on net margins if sales growth does not keep pace.

- The acceleration of new stores and 'raze-and-rebuild' projects, while ambitious, involves significant capital expenditures and project timing risks, which could strain cash flows and impact future earnings if not managed well.

- The mixed results across store banners, with QuickChek facing inside traffic headwinds, highlight variability in performance across segments that could impact overall company earnings consistency.

- Fluctuations in fuel margins, tethered closely to market volatility and supply dynamics, could create uncertainty in earnings projections, emphasizing the potential downside in core revenue contributions from fuel sales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $495.0 for Murphy USA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $590.0, and the most bearish reporting a price target of just $370.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $22.3 billion, earnings will come to $623.1 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of $524.3, the analyst's price target of $495.0 is 5.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives