Last Update07 May 25Fair value Decreased 9.01%

Key Takeaways

- Diversified omnichannel ecosystem and strategic acquisitions stabilize revenue and enhance market share despite fluctuating consumer sentiment.

- Aftersales growth and optimized capital allocation through acquisitions and share repurchases improve earnings and shareholder returns amid market volatility.

- Uncertainty from tariffs and operational inefficiencies may threaten Lithia Motors' revenue, earnings, and profitability amidst rising costs and market challenges.

Catalysts

About Lithia Motors- Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

- Lithia Motors is leveraging its diverse omnichannel ecosystem, which spans retail, digital, and fleet channels across North America and the United Kingdom, to meet customer needs at various affordability levels. This diversification and alignment with market dynamics have the potential to stabilize revenue growth despite fluctuations in consumer sentiment and market conditions.

- The company's aftersales business, representing about 40% of gross profit, is strategically positioned to benefit from tariff-driven market changes. As these operations continue to grow and capture value through increased customer engagement and unit volumes, this could positively impact net margins and contribute to steady earnings growth.

- Lithia Motors' focus on strategic acquisitions and the optimization of its dealer network, particularly in high-profitability regions like the Southeast and South Central United States, could unlock further revenue opportunities. They target high-performing stores and geographies to enhance operational efficiency and profitability, aiming to significantly increase market share from its current level to 5%.

- The expansion and maturation of financing operations through Driveway Finance Corporation (DFC) provide growing contributions to Lithia Motors' earnings. With a focus on improved capital efficiency and disciplined growth in high credit tiers, its financial operations could increase earnings per share significantly compared to traditional lending, due to higher profitability per loan arrangement.

- The company's capital allocation strategy balances acquisitions with aggressive share repurchases, supported by strong free cash flow generation. Lithia Motors plans to continually repurchase shares at attractive valuations, which could enhance earnings per share even in times of subdued revenue growth, providing a shareholder return cushion against market volatility.

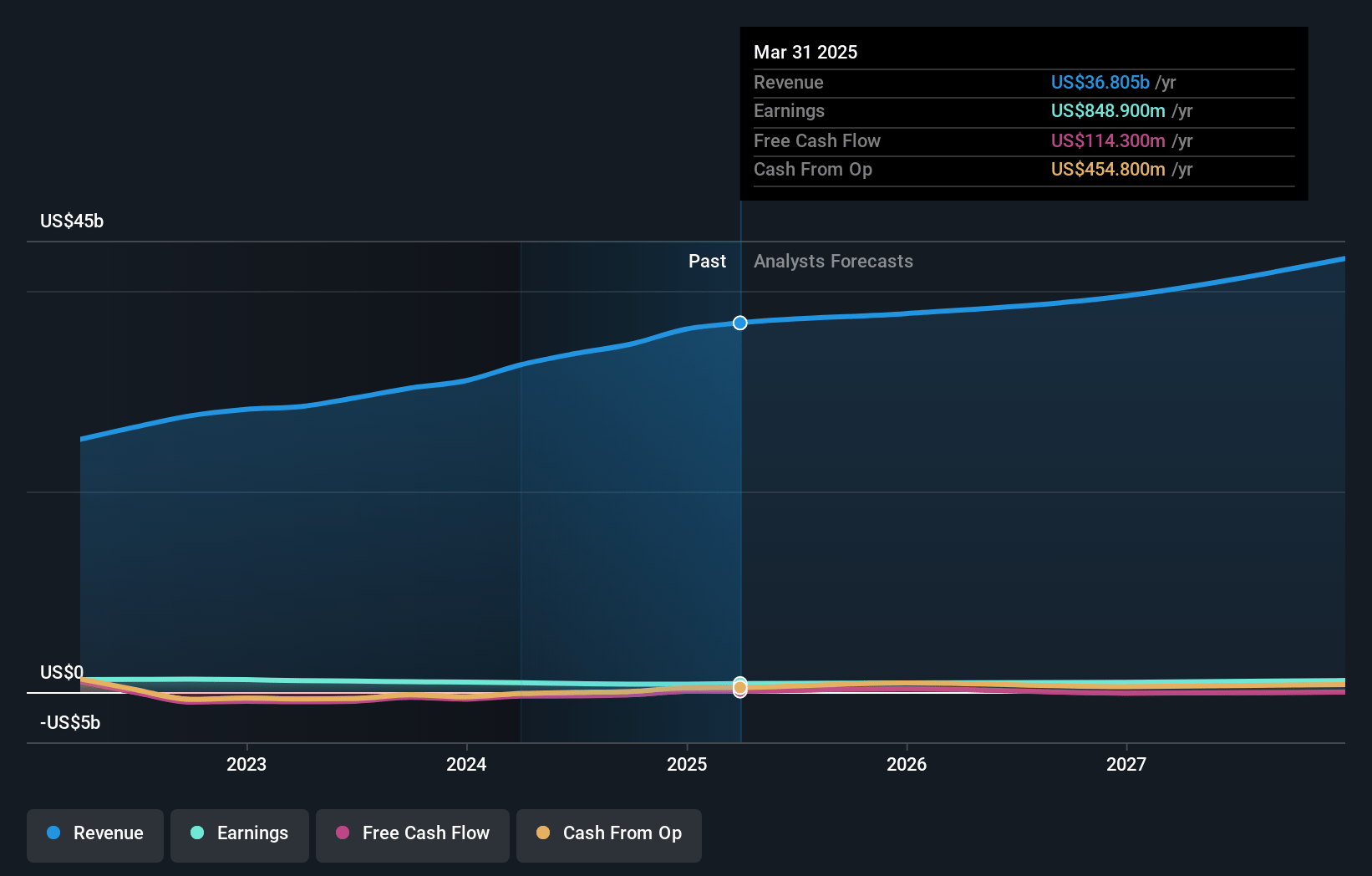

Lithia Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lithia Motors compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lithia Motors's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.3% today to 2.8% in 3 years time.

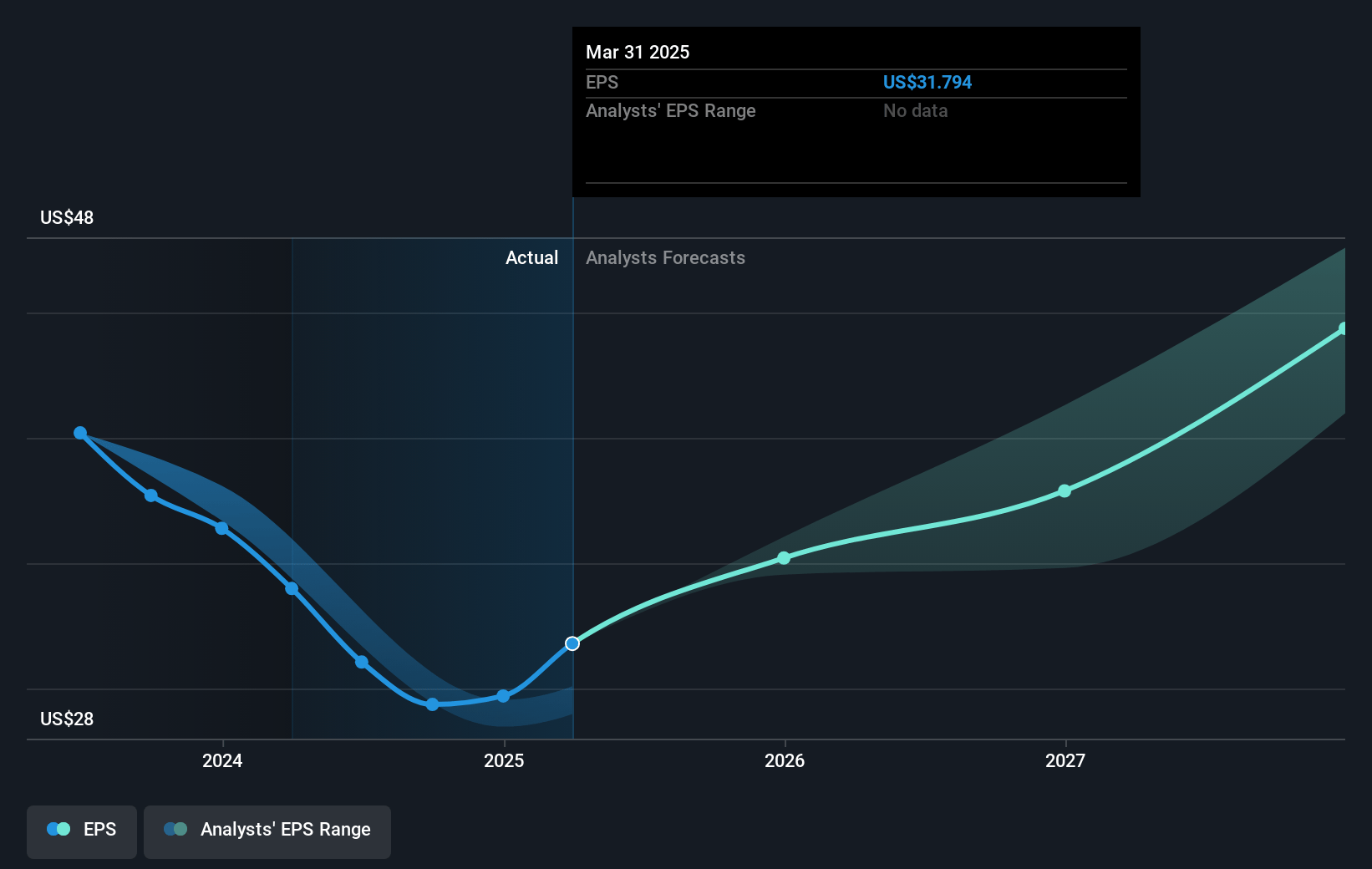

- The bearish analysts expect earnings to reach $1.0 billion (and earnings per share of $40.98) by about May 2028, up from $848.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 9.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to decline by 5.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Lithia Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty surrounding tariffs and their potential impact on vehicle prices poses a risk to Lithia Motors' future revenue and net margins.

- A possible decline in U.S. SAAR to the 14-15 million range due to extended tariffs could negatively affect Lithia Motors' earnings and market growth prospects.

- The significant regional variation in gross profit performance, with the Southeast and South Central regions showing weaker same-store gross profits, may impact overall earnings and net margins.

- Reliance on acquisitions and share buybacks as key components of Lithia Motors' growth strategy might divest focus from operational improvements, potentially affecting future profitability and EPS.

- Rising SG&A costs as a percentage of gross profit, coupled with the challenge of reducing personnel costs over the next 5 years, could influence Lithia Motors' net margins and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lithia Motors is $305.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lithia Motors's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $465.0, and the most bearish reporting a price target of just $305.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $37.1 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $295.94, the bearish analyst price target of $305.0 is 3.0% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.