Last Update07 May 25Fair value Decreased 5.99%

Key Takeaways

- Growing digital and recurring revenue streams, alongside efficient operations, improve margins and diversify earnings for greater long-term profitability.

- Strategic acquisitions and focus on high-margin services expand market presence and enhance sustainable revenue and earnings growth.

- Disruptive industry trends, integration risks, slow tech adoption, financial vulnerability, and evolving consumer preferences threaten Lithia Motors’ traditional dealership model and long-term growth prospects.

Catalysts

About Lithia Motors- Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

- Accelerating adoption of digital platforms like Driveway and GreenCars enables Lithia to capture a significantly larger share of the rapidly growing online car buying market, which is likely to drive outsized top-line growth as more consumers shift to e-commerce channels for vehicle purchases.

- The expanding and aging U.S. vehicle fleet, combined with increasingly complex vehicle technology, increases demand for high-margin service and parts revenue; Lithia’s scale and focus on service strengthen its ability to profit from this durable trend, supporting both higher revenue and improved net margins.

- Continued execution of a disciplined acquisition strategy and network optimization, especially targeting more profitable regions and dealership groups, broadens Lithia’s footprint and delivers operational synergies, which can enhance overall earnings power and support sustainable long-term growth in both revenue and net margins.

- The company’s investments in operational efficiency—including automation, better vendor contracts, and leveraging technology platforms like Pinewood—are expected to drive down SG&A expenses as a percentage of gross profit, offering meaningful improvement in net margins and expanding Lithia’s normalized EPS.

- Strengthening contributions from adjacencies such as Driveway Finance and fleet management provide high-margin, recurring revenue streams that diversify Lithia’s earnings, making overall profitability more resilient and supporting a path to higher earnings per share as these segments scale.

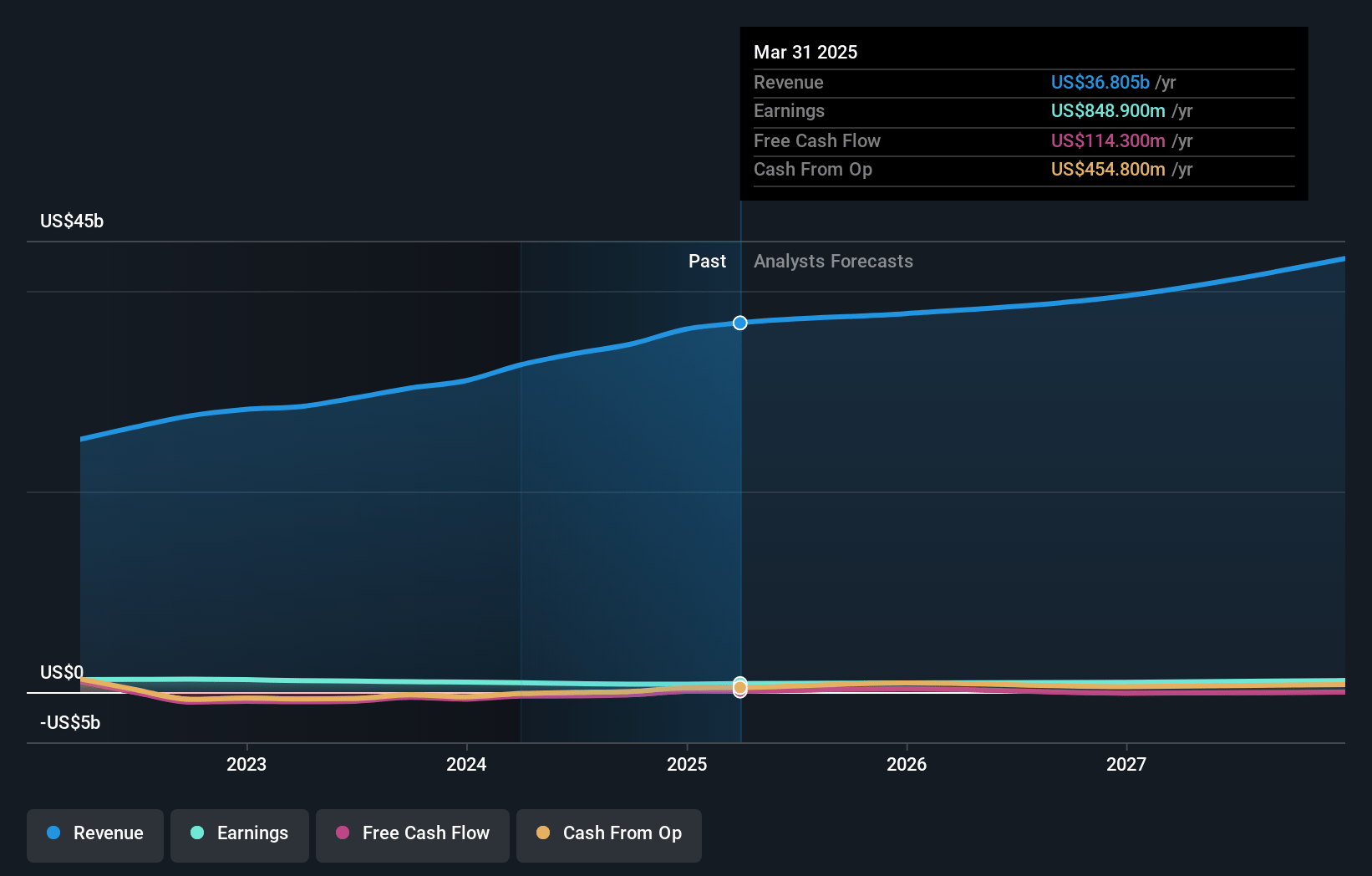

Lithia Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lithia Motors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lithia Motors's revenue will grow by 8.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.3% today to 2.7% in 3 years time.

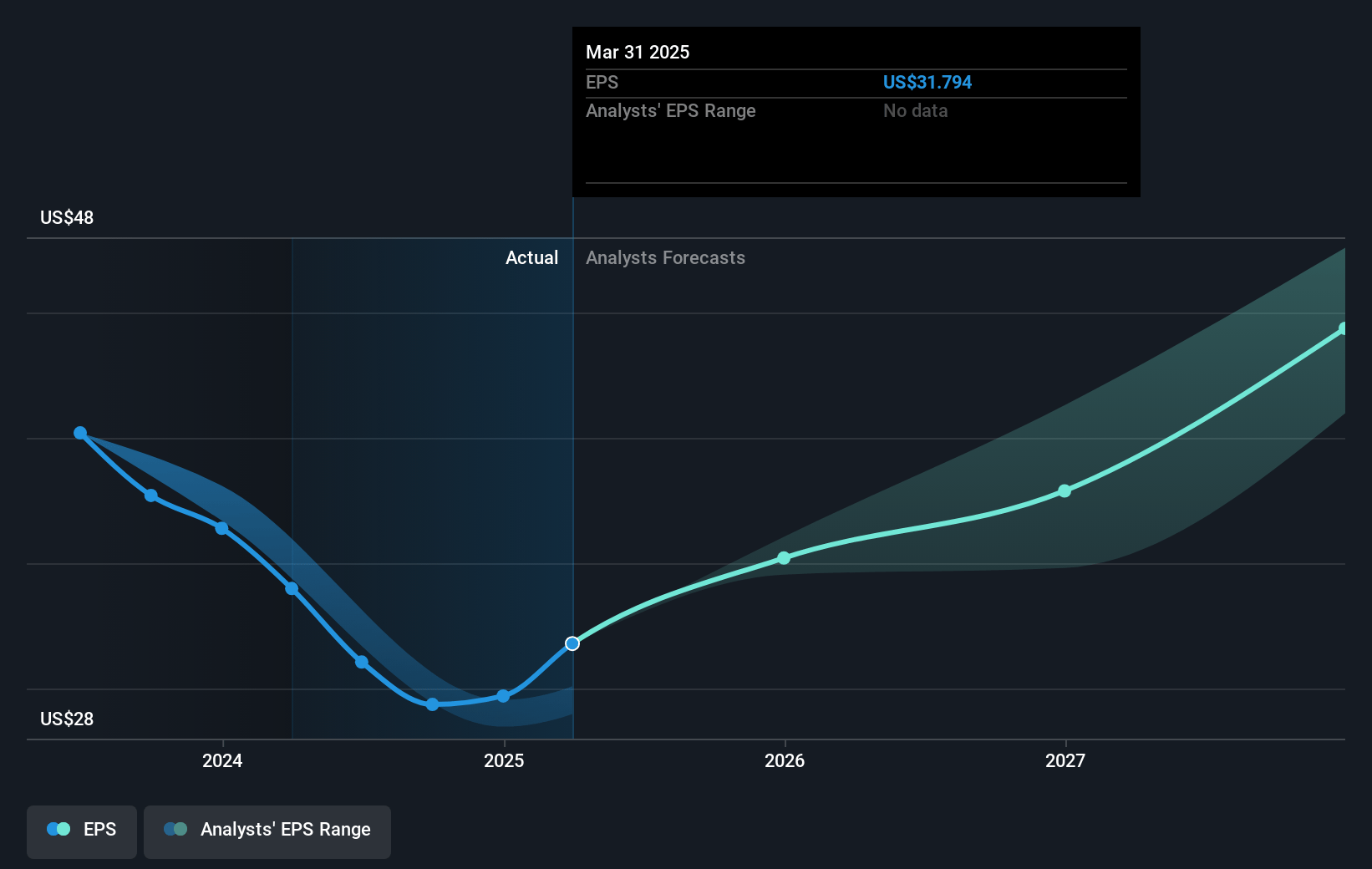

- The bullish analysts expect earnings to reach $1.3 billion (and earnings per share of $47.58) by about May 2028, up from $848.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, up from 9.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to decline by 5.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Lithia Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating industry-wide shift toward electric vehicles and direct-to-consumer sales models from OEMs could bypass Lithia Motors' traditional dealership network, ultimately reducing new vehicle sales and putting pressure on long-term revenue growth.

- Persistent margin pressure from Lithia’s aggressive acquisition-driven growth strategy raises the risk of integration challenges, inefficiencies, and elevated operating costs, which may negatively affect net margins and overall profitability.

- Slower pace of technology adoption compared to digital-first competitors and the broader e-commerce trend could leave Lithia at a disadvantage in capturing digital retail share, threatening revenue growth and eroding competitive advantage over time.

- Increased leverage from ongoing expansion and acquisitions, as indicated by a net leverage ratio at the upper end of their long-term target, raises vulnerability to interest rate hikes or economic downturns, which could lead to constrained earnings and cash flows.

- Secular changes in consumer behavior, such as the growth in urbanization and shifts toward mobility alternatives like ridesharing and subscription services, threaten to reduce long-term demand for traditional car ownership and dealership retail sales, thereby impacting both revenue and long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lithia Motors is $465.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lithia Motors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $465.0, and the most bearish reporting a price target of just $305.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $46.9 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 11.4%.

- Given the current share price of $297.08, the bullish analyst price target of $465.0 is 36.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.