Key Takeaways

- Growth is supported by shifting demographics, expanded omnichannel presence, and strengthening store footprint in high-potential southern markets.

- Supply chain diversification and enhanced brand initiatives increase operational resilience, customer retention, and adaptability to changing consumer habits.

- Reliance on showrooms, rising costs, supply chain risks, and a weak housing market threaten profitability amid increased discounting and shifts to online shopping.

Catalysts

About Haverty Furniture Companies- Operates as a specialty retailer of residential furniture and accessories in the United States.

- Rising household formation among millennials and Gen Z, coupled with an aging U.S. housing stock, is expected to drive long-term demand for home furnishings, positioning Haverty for steady revenue growth as these cohorts enter peak home-buying years and invest in their homes.

- Haverty's accelerated investments in omnichannel retail-including website enhancements, improved digital marketing efficiency via AI, and expansion of web sales (up 8.4% in Q2)-are likely to broaden the company's market reach, drive incremental digital revenue, and future-proof earnings against ongoing shifts in consumer shopping habits.

- Proactive supply chain realignment, including reducing exposure to China amid tariff uncertainties and deepening partnerships with vendors in Vietnam and other regions, should boost operational resilience, stabilize gross margins, and help avoid inventory shortages, thereby supporting future earnings growth.

- Strategic plans to grow physical store presence in attractive southern and southeastern U.S. markets-regions with rising homeownership and favorable demographics-improves the company's ability to capture market share, reinforcing the potential for higher long-term revenue and leverage of fixed costs over a broader base.

- Sustained focus on brand strength, customer loyalty, and differentiated in-home design services, supported by new point-of-purchase and tagging initiatives, is likely to increase customer retention and repeat business, driving both higher customer lifetime value and a more durable revenue stream.

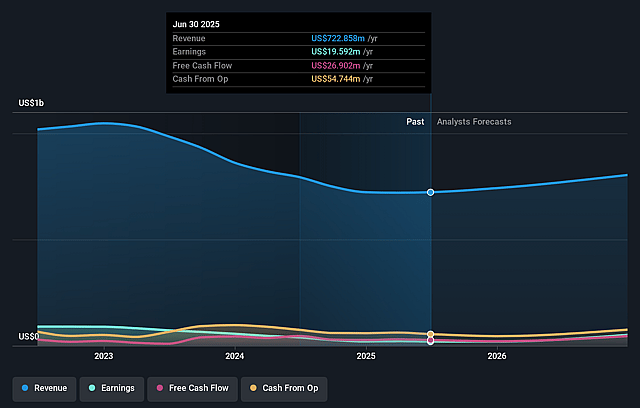

Haverty Furniture Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Haverty Furniture Companies's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 12.1% in 3 years time.

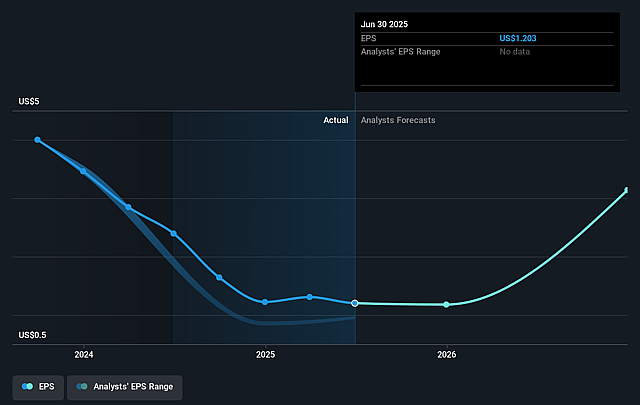

- Analysts expect earnings to reach $107.4 million (and earnings per share of $6.6) by about September 2028, up from $19.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.3x on those 2028 earnings, down from 19.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Haverty Furniture Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to face pressures from a struggling housing market, driven by high interest rates and rising home prices, which can suppress overall long-term demand for home furnishings and negatively impact revenue growth.

- Tariff uncertainty and supply chain challenges-especially related to shifting production from China to Vietnam-create ongoing risks around input costs, pricing power, and inventory reliability, which could materialize as compressed gross margins or operational disruptions affecting earnings.

- Elevated promotional activity and a more aggressive discounting environment across the industry may drive incremental traffic in the short term but risks eroding brand perception, compressing margins, and reducing profitability if sustained over the long term.

- The company's continued reliance on a large physical showroom network entails high fixed occupancy and operating costs, which may limit flexibility, especially as e-commerce grows and consumer shopping behaviors shift, putting pressure on net margins and long-term earnings.

- Rising SG&A expenses-including increases in advertising, occupancy, and administrative costs that are outpacing revenue growth-could further pressure operating leverage and diminish the company's ability to grow earnings unless sales growth accelerates meaningfully.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.0 for Haverty Furniture Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $889.6 million, earnings will come to $107.4 million, and it would be trading on a PE ratio of 5.3x, assuming you use a discount rate of 9.6%.

- Given the current share price of $23.54, the analyst price target of $29.0 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.