Key Takeaways

- Heavy reliance on Southeast and Texas markets heightens vulnerability to regional downturns, limiting opportunities for growth and geographic diversification.

- Industry-wide promotions, e-commerce competition, and supply chain uncertainties threaten gross and net margins, constraining the company's pricing power and revenue growth.

- Macroeconomic and industry headwinds, cost pressures, weak sales trends, and heightened promotional activity are straining Haverty's margins, growth prospects, and long-term profitability.

Catalysts

About Haverty Furniture Companies- Operates as a specialty retailer of residential furniture and accessories in the United States.

- Although continued investments in digital marketing and omnichannel initiatives are beginning to drive web sales growth and increased organic traffic, Haverty's still faces the risk that a prolonged consumer shift to e-commerce may further erode physical store traffic, constraining same-store sales recovery and putting downward pressure on total revenue.

- While demographic factors such as Millennials and Gen Z entering peak home-buying years could boost long-term household formation and overall demand for home furnishings, persistent housing affordability challenges alongside high interest rates and slowdowns in housing turnover threaten to significantly limit top-line growth.

- Despite proactive efforts to optimize the supply chain, relocate production away from China, and prepare for tariff changes, ongoing tariff uncertainty and potential labor shortages in Vietnam introduce the potential for unpredictable spikes in product and freight costs, which could erode gross margins if not fully offset through pricing.

- Although investments in store portfolio refinement and disciplined inventory management might support future margin expansion and revenue per square foot, the company's highly concentrated presence in the Southeast and Texas markets increases exposure to regional economic weakness, limiting geographic diversification and inhibiting robust earnings growth.

- Even as the business positions itself to capture the shift toward differentiated, branded furniture and leverages its service and delivery strengths, increasing industry-wide promotional activity, heavier discounting, and new direct-to-consumer entrants are likely to continue squeezing net margins and diminishing long-term pricing power.

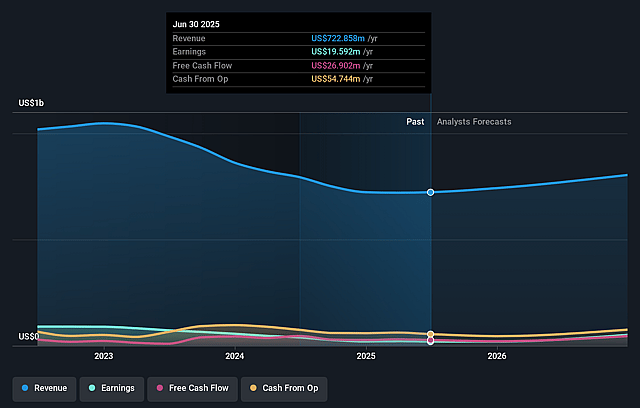

Haverty Furniture Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Haverty Furniture Companies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Haverty Furniture Companies's revenue will grow by 6.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.7% today to 14.8% in 3 years time.

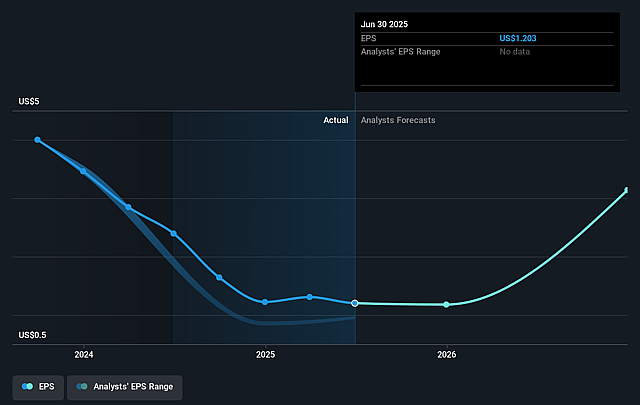

- The bearish analysts expect earnings to reach $130.1 million (and earnings per share of $8.04) by about September 2028, up from $19.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.5x on those 2028 earnings, down from 19.4x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Haverty Furniture Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness in the U.S. housing market, high interest rates, and constrained affordability may structurally limit demand for big-ticket furniture purchases, potentially depressing Haverty's long-term revenue growth trajectory.

- Ongoing supply chain volatility and uncertainty surrounding tariffs, especially with shifting production out of China and potential challenges in Vietnam, could result in sustained cost pressures or inventory disruptions, threatening gross margins and operational consistency.

- Increased industry-wide reliance on aggressive promotional activity and discounting to drive traffic-as seen in both Haverty's and competitors' recent strategies-risks eroding net margins and undermining long-term pricing power, pressuring profitability.

- Comparable store sales continue to trend negative, and store expansion plans are not translating into net new units in the short term; this may indicate underlying weakness in core markets and raises concerns about the company's ability to expand its customer base and increase revenue over time.

- Rising selling, general, and administrative expenses outpacing sales growth, amid only modest digital and omnichannel gains, may hinder operating margin improvement and slow earnings growth if not offset by a substantial turnaround in traffic or improved sales productivity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Haverty Furniture Companies is $23.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Haverty Furniture Companies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $881.7 million, earnings will come to $130.1 million, and it would be trading on a PE ratio of 3.5x, assuming you use a discount rate of 9.7%.

- Given the current share price of $23.37, the bearish analyst price target of $23.0 is 1.6% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.