Key Takeaways

- Supply chain realignment, global vendor partnerships, and digital enhancements are expected to accelerate market share, revenue, and margin gains as uncertainties subside.

- Strategic expansion into high-growth markets and focus on exclusive, high-margin offerings position the company to outperform industry trends through superior customer acquisition and ticket growth.

- Sluggish e-commerce, demographic headwinds, aggressive discounting, regional concentration, and persistent cost pressures threaten Haverty's revenue growth, margins, and operational stability.

Catalysts

About Haverty Furniture Companies- Operates as a specialty retailer of residential furniture and accessories in the United States.

- While analyst consensus expects merchandising initiatives and the resumed special order business to gradually boost future revenue, the ongoing strategic realignment of supply chains and deeper collaborations with global vendors are likely to unlock market share at an accelerating rate once tariff uncertainties dissipate, providing significant upside to both revenue and gross margin.

- Analysts broadly agree that digital platform enhancements and omnichannel marketing will steadily drive growth, but the seamless integration of AI-driven personalization, direct mail, and targeted credit offerings could yield a step-change in customer acquisition and conversion, yielding substantial gains for both top-line sales and operating margin.

- The intersection of strong U.S. population growth and home improvement trends, combined with Haverty's robust store expansion pipeline in high-growth markets, positions the company to outpace industry revenue growth for years to come as new households increasingly prioritize home furnishing.

- With the aging U.S. housing stock fueling a multi-decade replacement and remodeling cycle, Haverty's unique emphasis on personalized, in-home design and exclusive high-margin categories positions it to drive sustained expansion in average ticket and net margin well above industry norms.

- Given its debt-free balance sheet and scale advantages amid rising industry consolidation, Haverty's is poised to capitalize on competitor exits, potentially accelerating EPS growth through operating leverage, margin enhancement, and eventual resumed share buybacks.

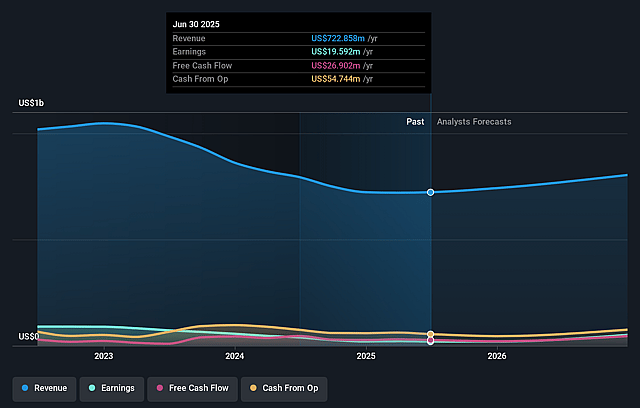

Haverty Furniture Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Haverty Furniture Companies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Haverty Furniture Companies's revenue will grow by 8.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 14.0% in 3 years time.

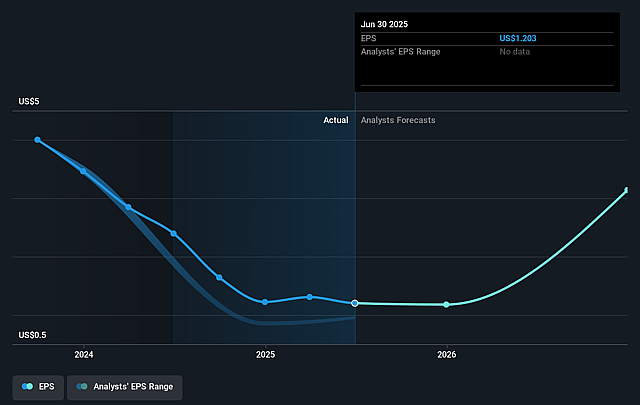

- The bullish analysts expect earnings to reach $130.1 million (and earnings per share of $8.04) by about September 2028, up from $19.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.3x on those 2028 earnings, down from 19.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Haverty Furniture Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent shift to online shopping continues to lessen the importance of brick-and-mortar stores, while Haverty's modest e-commerce gains still lag industry leaders, potentially constraining long-term revenue growth and placing pressure on both earnings and operating margins as more sales move online.

- Demographic shifts such as a slowing rate of household formation and an aging U.S. population may reduce the future demand for Haverty's core product offerings, shrinking their total addressable market and limiting prospects for sustained revenue expansion.

- Intensifying promotional activity across the furniture industry, coupled with Haverty's own more aggressive discounting and marketing investments, could lead to ongoing margin compression, resulting in lower net margins even if sales stabilize or improve.

- The company's geographic concentration in the Southeast and Texas leaves it overexposed to region-specific economic downturns and stagnant population growth, increasing the volatility of its revenue and leading to greater swings in annual earnings.

- Long-term cost inflation and ongoing supply chain disruptions, including tariff uncertainties and labor challenges in Vietnam, increase input costs and operational risk, jeopardizing gross margins and profit consistency despite management's efforts to preserve margin guidance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Haverty Furniture Companies is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Haverty Furniture Companies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $927.7 million, earnings will come to $130.1 million, and it would be trading on a PE ratio of 5.3x, assuming you use a discount rate of 9.6%.

- Given the current share price of $23.54, the bullish analyst price target of $35.0 is 32.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.