Last Update 18 Dec 25

Fair value Increased 3.40%GAP: Turnaround Momentum And Q3 Execution Will Support Durable Margin Recovery

Analysts nudged their average price target on Gap modestly higher, with fair value estimates rising by about $1 to reflect stronger than expected Q3 momentum across brands, improving revenue growth expectations, and growing confidence in the company’s turnaround strategy despite only incremental changes to long term profitability assumptions.

Analyst Commentary

Street research following Gap's latest results points to a more constructive stance on the stock, with multiple firms lifting price targets into the mid to high 20 dollar range and several upgrades into positive rating territory. The moves reflect improving confidence in the durability of recent momentum and the credibility of management's turnaround playbook.

Bullish Takeaways

- Bullish analysts highlight a "beat and raise" Q3 performance and a developing flywheel effect in core banners, supporting higher growth expectations and justifying target prices moving toward the low to mid 30 dollar range for some.

- Consistent outperformance, including multiple consecutive positive comp quarters and repeated EPS beats, is seen as validating the brand reinvigoration and disciplined leadership strategy, which in turn is viewed as warranting premium execution multiples versus recent history.

- Long term opportunities in Athleta and newer categories such as beauty are viewed as underappreciated growth drivers that could expand operating margins toward double digit levels and support further upside to current valuation.

- Improving gross margin performance, aided by better assortment, pricing power, and reduced promotional intensity, is viewed as a key lever for sustained earnings growth even if top line expansion moderates.

Bearish Takeaways

- Bearish analysts, while raising price targets modestly, largely retain Neutral or Market Perform stances, arguing that the current share price already reflects near term strength and a meaningful portion of the turnaround benefit.

- Visibility into longer term profitability across all banners is still seen as limited, particularly given tariff headwinds and the need to sustain AUR gains without eroding traffic, which constrains upside to valuation multiples.

- Some remain cautious on execution risk as the company balances product innovation, marketing investments, and cost discipline across a complex multi brand portfolio, leaving less room for error if consumer demand softens.

- Despite better than expected Q3 trends, a subset of the Street continues to frame the risk or reward as balanced into future quarters, and prefers clearer evidence of durable mid cycle margins before moving to more aggressive targets.

What's in the News

- Gap completed its multiyear share repurchase program announced in February 2019, retiring 39,828,667 shares, or 10.66% of shares outstanding, for a total of $750.56 million (company filing).

- The company provided an update indicating no additional shares were repurchased between August 3, 2025 and November 1, 2025 under the existing authorization. This signals the program's formal completion (company filing).

- Gap raised full year 2025 guidance and now expects net sales growth of 1.7% to 2.0%, tightening the range upward from the prior 1.0% to 2.0% outlook (company guidance).

- The retailer also increased its forecast for 2025 net interest income to approximately $20 million, up from prior guidance of about $15 million. This reflects an improved balance sheet and cash position (company guidance).

Valuation Changes

- The fair value estimate has risen slightly to $28.65 from $27.71, reflecting modestly stronger growth expectations.

- The discount rate has increased marginally to 9.92% from 9.77%, implying a slightly higher required return on equity risk.

- Revenue growth has edged higher to roughly 2.23% from 2.10%, signaling a small upgrade to top line assumptions.

- The net profit margin has slipped slightly to about 5.94% from 5.98%, indicating a minor downward adjustment to long term profitability.

- The future P/E multiple has risen modestly to about 14.0x from 13.4x, pointing to somewhat greater confidence in the earnings outlook.

Key Takeaways

- Strong value positioning, digital investments, and brand reinvigoration are driving customer engagement, stable demand, and long-term margin expansion.

- Operational discipline, portfolio optimization, and sustainable sourcing initiatives position Gap for future growth and enhanced competitive advantage.

- Persistent operational and strategic challenges-including trade risks, brand underperformance, inventory missteps, and rising competition-threaten profitability, revenue growth, and market positioning.

Catalysts

About Gap- Operates as an apparel retail company.

- Gap's accessible price positioning and demonstrated value focus-seen in Old Navy's consistent category leadership and strong execution in core categories like denim and active-positions the company to benefit from the ongoing shift toward value-conscious consumer behavior, supporting stable demand and revenue growth.

- Ongoing investments in digital technology, supply chain optimization, and omni-channel retail (e.g., tech-driven inventory management, AI in demand planning, modernized media mix) enable Gap to better serve consumers' expectation for seamless integration across digital and physical, driving efficiency gains and supporting margin expansion over the long term.

- Brand reinvigoration strategies (especially at Old Navy, Gap, and Banana Republic), including product innovation, viral marketing campaigns, and strategic collaborations, are producing stronger customer engagement, increased traffic, higher average unit retails (AUR), and improved brand equity-laying a foundation for sustained revenue and earnings growth.

- Continued improvement in cost structure (portfolio rationalization, store optimization, SG&A leverage, disciplined inventory management) and rigorous operational discipline are freeing up capital for growth investments and have supported expanded operating margins despite external pressures like tariffs, with further margin improvement expected as tariff impact is mitigated.

- Gap's leadership in sustainable sourcing, increasing circular initiatives (like resale/collaborative platforms), and supply chain agility align with rising consumer preference for sustainable and ethically-produced apparel as well as industry moves toward integrated, responsive inventory models-providing a strategic differentiator that can enhance long-term competitive positioning and support both top-line growth and gross margin resilience.

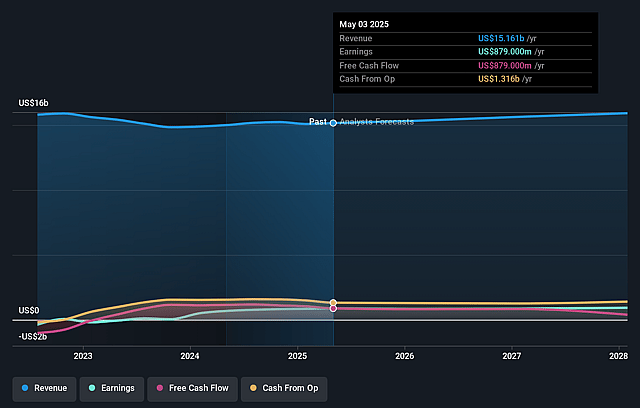

Gap Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gap's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 6.0% in 3 years time.

- Analysts expect earnings to reach $956.2 million (and earnings per share of $2.69) by about September 2028, up from $889.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $808 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 10.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.81%, as per the Simply Wall St company report.

Gap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing exposure to tariff headwinds and evolving trade policy poses a structural risk-while mitigation is underway, tariffs have already caused a 100–110 basis point hit to operating margin and $150–175M in lost earnings power, with future trade disputes or escalation potentially creating recurring cost pressure and volatility, impacting net margins and earnings.

- Chronic underperformance and brand execution issues at Athleta, now in a "reset" year with -11% net sales and -9% comps, show continued vulnerability to category misalignment and poor product/marketing fit, risking further revenue stagnation and dragging on consolidated earnings until a turnaround is proven.

- Flat net sales performance company-wide, with only 1% comparable sales growth and a reliance on a few high-performing brands (Gap, Old Navy, Banana Republic), signals limited underlying revenue momentum; this exposes the company to greater risk if demand trends soften, key categories falter, or promotional activity increases.

- Elevated inventory levels (+9% YoY) due to accelerated receipts and higher input costs/tariffs highlight structural inventory management challenges; such issues could force markdowns and aggressive discounting (as seen at Athleta), compressing gross margins and undermining earnings consistency.

- Heightened competitive pressures from fast-fashion and digital-native brands, ongoing shifts toward e-commerce, and changing consumer preferences (including sustainability and experience over goods) continue to threaten Gap's market share, limit international expansion prospects, and increase the need for costly adaptation, posing risk to long-term revenue growth and net margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.376 for Gap based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $16.0 billion, earnings will come to $956.2 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 9.8%.

- Given the current share price of $24.1, the analyst price target of $24.38 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Gap?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.