Key Takeaways

- Shifting consumer preferences toward digital-native and fast fashion brands threaten Gap's relevance, risking market share losses and shrinking brick-and-mortar revenues.

- Operational and cost pressures from sustainability demands, digital underinvestment, and industry headwinds will continue to challenge margins and earnings stability.

- Brand revitalization, digital expansion, cost control, and store optimization are fueling market share gains, margin growth, and stronger earnings despite industry challenges.

Catalysts

About Gap- Operates as an apparel retail company.

- The accelerating consumer pivot towards e-commerce and digital-native and direct-to-consumer fashion brands will continue to erode mall traffic and diminish Gap's legacy brick-and-mortar revenues, putting long-term pressure on total revenues and risking ongoing store closures.

- Rapidly evolving consumer demand for fast fashion, on-trend styles, and niche DTC offerings threatens to make Gap's traditional portfolio less relevant-especially among younger demographics-leading to market share losses and a slower pace of revenue growth over time.

- Gap's supply chain restructuring to meet mounting sustainability and ethical sourcing expectations will pose persistent operational complexity, raising costs and compressing net margins as regulatory scrutiny and consumer sustainability concerns intensify across global markets.

- The company's chronic underinvestment in digital transformation relative to agile competitors, coupled with operational inefficiencies in inventory management and an outsized physical footprint, will inhibit its ability to defend margins and stabilize earnings in an increasingly omnichannel retail environment.

- Structural industry headwinds-including surging labor costs in key sourcing markets, intensified price competition from online and DTC rivals, and ongoing geopolitical and supply chain disruptions-will combine to erode gross margins and limit long-term earnings resilience.

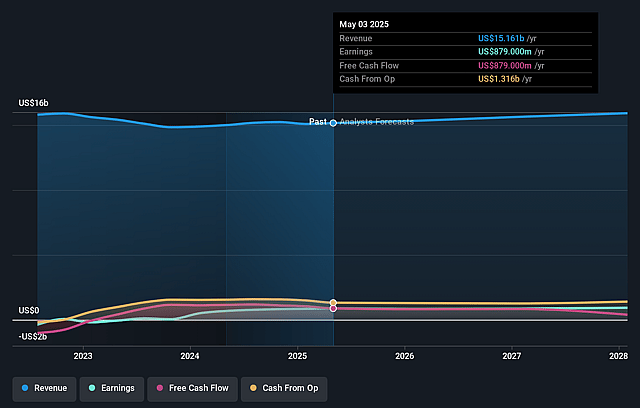

Gap Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Gap compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Gap's revenue will grow by 1.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.8% today to 5.3% in 3 years time.

- The bearish analysts expect earnings to reach $832.1 million (and earnings per share of $2.2) by about August 2028, down from $879.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 9.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 19.4x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.95%, as per the Simply Wall St company report.

Gap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gap and Old Navy have achieved consecutive quarters of market share gains and positive comparable sales, fueled by brand reinvigoration, innovation in key categories like denim and activewear, and strong customer response, which could drive long-term revenue growth.

- The company is effectively executing on a shift toward an asset-light model by investing in technology and closing underproductive stores, which has resulted in ROD (rent, occupancy, and depreciation) leverage, supporting gross margin expansion and improved operating margins.

- Investments in e-commerce and digital transformation have made Gap Inc. the number one branded apparel e-commerce business in the US, with robust online sales growth and an omnichannel presence, positioning it for continued expansion of its addressable market and potential margin improvement.

- Tight cost controls, disciplined SG&A management, and ongoing cost saving initiatives-such as supply chain diversification, inventory optimization, and process automation-are boosting net margins and earnings resilience, even amidst industry headwinds like tariffs.

- The revival of core brands and successful collaborations, particularly those attracting younger generations and higher-income cohorts, are expanding the customer base, enhancing brand equity, and strengthening pricing power, which could translate into outperforming same-store sales and sustainable earnings improvement over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Gap is $19.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Gap's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $15.6 billion, earnings will come to $832.1 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of $21.42, the bearish analyst price target of $19.0 is 12.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives