Last Update07 May 25Fair value Decreased 2.83%

Key Takeaways

- Investment in digital innovation, omni-channel capabilities, and supply chain modernization is driving higher sales, operational efficiency, and margin expansion.

- Strengthened brand positioning, international expansion, and sustainability focus are supporting market share growth and deeper customer loyalty.

- Ongoing shifts to e-commerce, evolving consumer preferences, and supply chain risks threaten Gap’s brand relevance, profit margins, and prospects for long-term revenue growth.

Catalysts

About Gap- Operates as an apparel retail company.

- Expansion into new international markets, especially in regions where the middle class and disposable income are rising, could unlock significant revenue growth for Gap, as their value-oriented and recognized brands are positioned to capture market share from emerging consumer segments.

- The company's accelerated investment in omni-channel capabilities and digital innovation, including a focus on AI-driven personalization and supply chain agility, is expected to drive higher sales growth, increase customer engagement, and improve operational efficiencies, supporting both revenue and net margin expansion in a retail landscape that continues to shift online.

- Gap’s ongoing reinvigoration of its core brands—especially Old Navy’s leadership in affordable family apparel and Gap’s resurgence in cultural relevance—positions the company to ride the secular trend of consumers seeking value and recognizable brands, which can drive sustained market share gains and top-line growth even during periods of economic uncertainty.

- Modernization of supply chain and inventory management through technology and data analytics is reducing markdowns and stockouts, leading to improved gross margins and more resilient earnings, laying the foundation for long-term profitability.

- The company’s commitment to sustainability and responsible sourcing is strengthening brand perception and customer loyalty among an increasingly sustainability-focused consumer base, which can increase repeat purchases and support stronger revenue growth and enhanced pricing power over time.

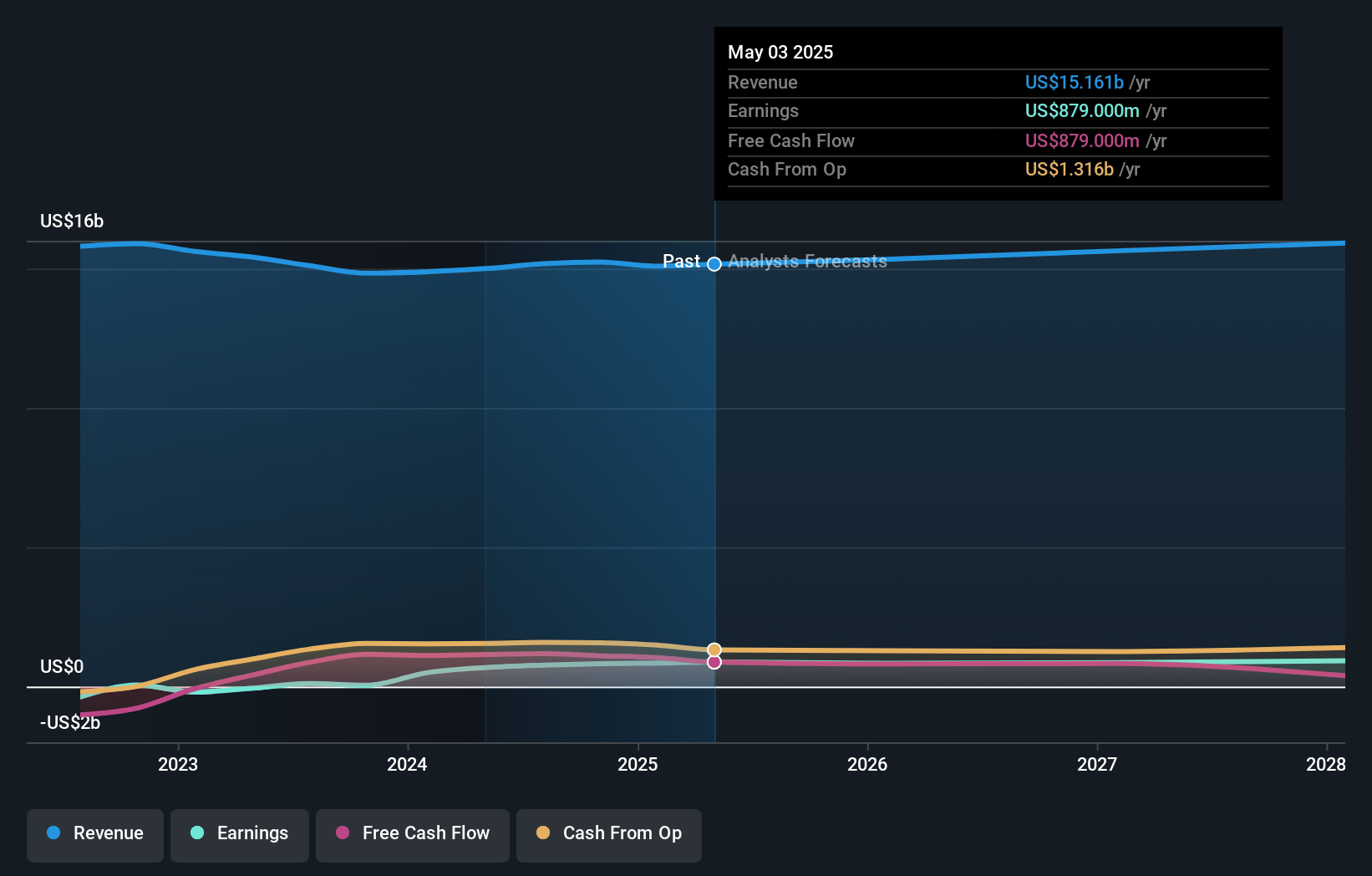

Gap Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gap compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gap's revenue will grow by 2.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 5.6% today to 5.5% in 3 years time.

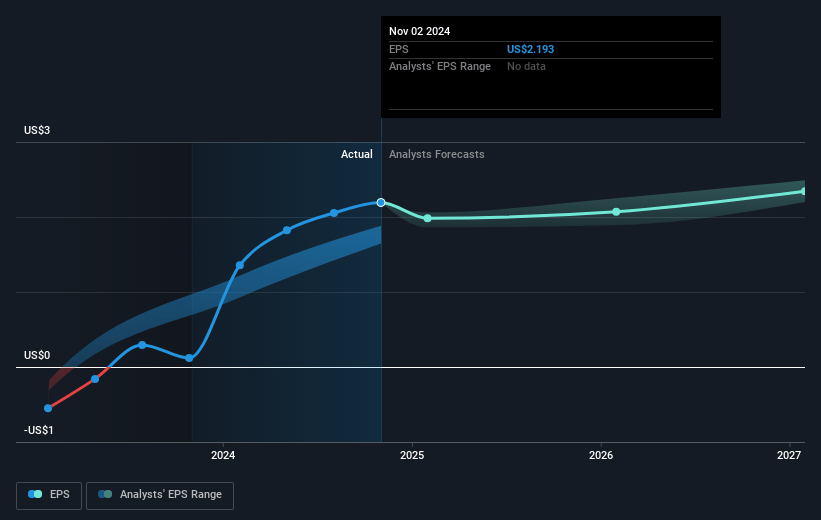

- The bullish analysts expect earnings to reach $887.0 million (and earnings per share of $2.54) by about May 2028, up from $844.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, up from 10.1x today. This future PE is greater than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.98%, as per the Simply Wall St company report.

Gap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gap continues to face the long-term challenge of declining physical store traffic as consumer spending shifts further toward e-commerce and digital-native brands, which could put sustained pressure on its same-store sales and overall revenue growth.

- Shifting consumer preferences toward value-conscious, fast fashion, and unique experiential spending threaten to erode demand for mid-tier, legacy apparel brands like Gap, potentially compressing revenue and stalling brand relevance over the long term.

- Despite recent gains, the Gap brand and its sub-brands remain vulnerable to persistent brand erosion and dilution in an increasingly crowded market, raising the risk of stagnant or declining revenues if reinvigoration efforts falter over time.

- The company remains exposed to supply chain risks, including potential cost increases from global disruptions, geopolitical instability, and stricter sustainability regulations, all of which may drive up cost of goods sold and reduce net margins in future years.

- Store closure initiatives and ongoing underutilization of the retail footprint may free up capital in the short term but could result in significant restructuring charges and a shrinking sales base, which would ultimately weigh on long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gap is $31.54, which represents two standard deviations above the consensus price target of $25.72. This valuation is based on what can be assumed as the expectations of Gap's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $16.1 billion, earnings will come to $887.0 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of $22.65, the bullish analyst price target of $31.54 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives