Narratives are currently in beta

Key Takeaways

- Carvana's strategic integration of ADESA sites and efficient infrastructure use drive scalable growth and enhanced profitability with minimal capital expenditure.

- Robust inventory sourcing and targeted advertising efforts boost unit growth, profitability, and customer acquisition, supporting strong revenue expansion.

- Carvana's complex and capital-intensive model, inventory challenges, and market dynamics pose risks to margins, earnings growth, and financial flexibility amidst macroeconomic uncertainties.

Catalysts

About Carvana- Operates an e-commerce platform for buying and selling used cars in the United States.

- Carvana's investment in highly differentiated customer experience and business model quality has enabled it to achieve rapid growth and profitability, suggesting continued revenue growth and potential market share expansion.

- The integration of ADESA sites, utilizing existing infrastructure for reconditioning, allows for more efficient scaling with minimal CapEx, potentially improving net margins by reducing inbound/outbound shipping distances and lowering costs.

- Carvana's ability to leverage existing infrastructure and unlock additional capacity at reconditioning centers sets the stage for scalable future growth, supporting higher earnings potential as the company targets up to 3 million retail units per year.

- Carvana's inventory sourcing strategies, including direct customer sourcing and retail marketplace, are driving unit growth and profitability, likely bolstering both retail GPU and other GPU, contributing to robust revenue growth.

- Increased advertising spend to improve brand awareness and trust, particularly as inventory expands, is likely to enhance customer acquisition efficiency, supporting revenue growth and potentially improving net margins over the long term.

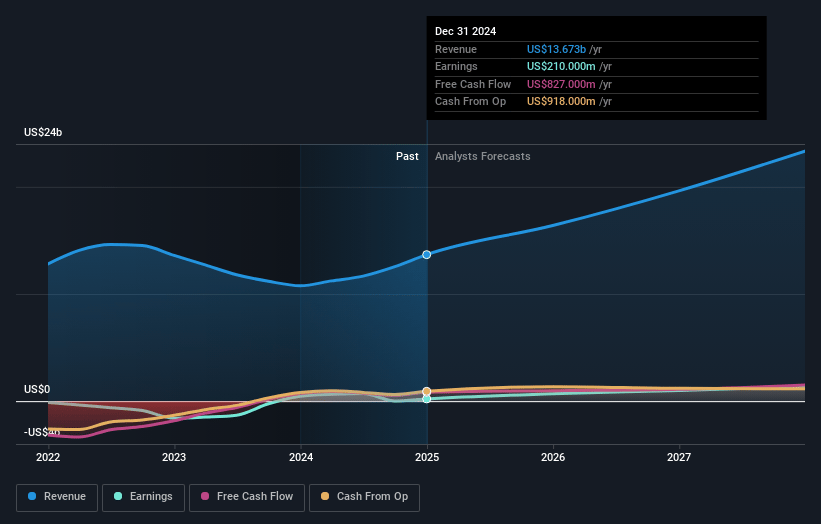

Carvana Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Carvana's revenue will grow by 18.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.1% today to 5.2% in 3 years time.

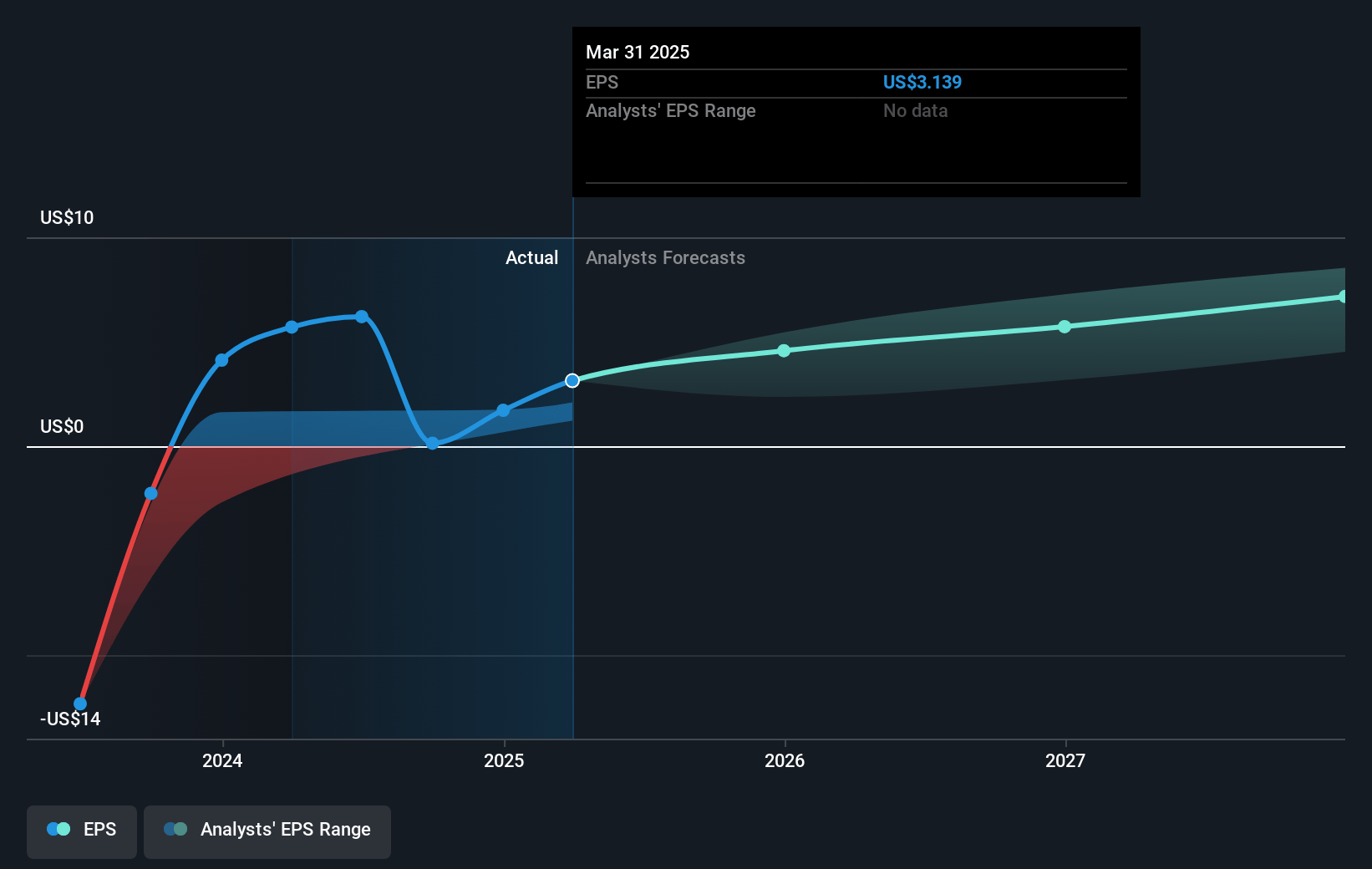

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $4.09) by about November 2027, up from $17.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $459.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 73.4x on those 2027 earnings, down from 1885.5x today. This future PE is greater than the current PE for the US Specialty Retail industry at 16.0x.

- Analysts expect the number of shares outstanding to grow by 8.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Carvana Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Carvana's business is complex, demanding many functional capabilities and is capital-intensive, which could potentially strain net margins and limit financial flexibility in times of market stress or unexpected downturns.

- The company's growth strategy relies heavily on increasing inventory selection and scale efficiencies, but currently remains below target available inventory levels, potentially impacting revenue growth if inventory constraints persist.

- Dependencies on reconditioning infrastructure expansions and integration of ADESA sites may require additional time and capital investment, potentially impacting CapEx and delaying earnings growth if not executed efficiently.

- The decision to increase advertising spend during a time of higher interest rates and lower consumer demand raises questions of cost efficiency and could affect earnings if the anticipated demand growth does not materialize.

- Market dynamics, such as used car depreciation rates and benchmark interest rates, can significantly affect retail and wholesale gross profits, introducing volatility and risk to earnings from external macroeconomic factors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $245.81 for Carvana based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $320.0, and the most bearish reporting a price target of just $108.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $20.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 73.4x, assuming you use a discount rate of 6.9%.

- Given the current share price of $249.43, the analyst's price target of $245.81 is 1.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives