Key Takeaways

- New sub-brands and tech-enabled personalization are attracting younger, loyal customers, accelerating revenue and margin growth prospects long-term.

- Lease flexibility and omnichannel strategy allow rapid adaptation, cost efficiency, and strengthen Torrid's position as inclusive fashion trends expand its core market.

- Heavy reliance on physical stores, limited brand scope, and supply chain challenges expose Torrid to margin pressures amid shifting consumer trends and intensifying digital competition.

Catalysts

About Torrid Holdings- Provides apparel, intimates, and accessories for curvy women in North America.

- While analyst consensus expects new sub-brands and expanded product assortment to broaden Torrid's consumer base, these launches are actually sparking a generational turnover toward younger, higher-LTV customers and driving stronger-than-forecast full-price sell-through, suggesting a multi-year revenue and gross margin acceleration as these sub-brands scale and are joined by even more targeted launches.

- Analysts broadly agree that store closures and channel optimization will yield cost savings, but this may be understated-the lease flexibility allows Torrid to quickly migrate to more profitable formats, unlock capital for technology upgrades and marketing, and amplify omnichannel conversion, setting up sustained net margin and earnings growth beyond current consensus.

- Torrid is uniquely positioned to benefit from the rapid, ongoing social movement embracing size inclusivity and body positivity, which is expanding its addressable market at a structural level and supports long-term, above-industry sales and customer growth.

- Investments in proprietary fit technology, advanced omnichannel personalization, and inventory agility not only enhance loyalty and repeat purchases but also create a competitive moat that's likely to increase Torrid's average order value and sustain margin expansion.

- Strong e-commerce execution and digital-to-physical integration, combined with the trend toward nearshoring and greater supply chain flexibility, enables Torrid to react swiftly to fashion cycles and demand signals, which can drive higher inventory turnover, boost cash flows, and support further reinvestment into growth.

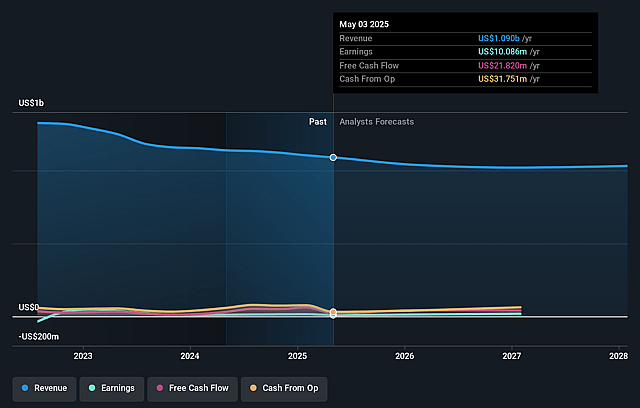

Torrid Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Torrid Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Torrid Holdings's revenue will decrease by 0.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 1.5% today to 1.4% in 3 years time.

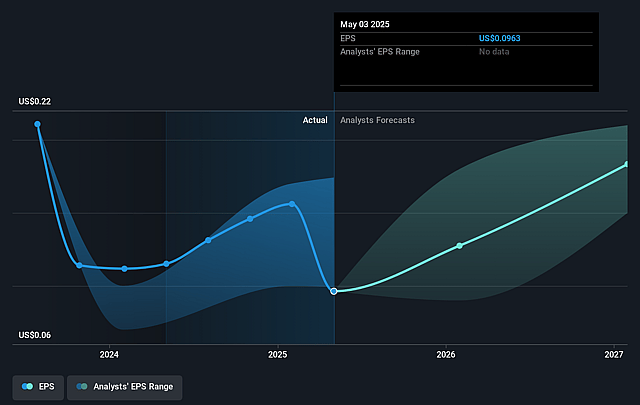

- The bullish analysts expect earnings to reach $15.9 million (and earnings per share of $0.15) by about June 2028, down from $16.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 68.6x on those 2028 earnings, up from 33.0x today. This future PE is greater than the current PE for the US Specialty Retail industry at 15.9x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.59%, as per the Simply Wall St company report.

Torrid Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Torrid's continued high dependence on brick-and-mortar stores and proactive store closures in malls signal vulnerability to the long-term trend of declining mall traffic, which threatens to reduce in-store sales productivity and squeeze net margins as the company absorbs higher fixed costs per location.

- Increasing consumer focus on sustainability and ethical fashion may erode Torrid's brand appeal if it does not invest significantly in supply chain transparency and eco-friendly operations, risking both reputational damage and rising operational expenses that could limit profitability.

- Narrow brand positioning in plus-size women's apparel, while currently yielding loyal customers, may cap long-term revenue growth as the segment matures, competitors enter, and diversification efforts in sub-brands remain modest-limiting the company's ability to offset customer churn and market saturation.

- Persistent e-commerce price competition from global digital-first and direct-to-consumer brands could compress Torrid's gross margins, especially as new, more nimble entrants offer broader choices and lower prices, forcing Torrid to increase promotional activities or markdowns to keep pace, which would hurt earnings.

- Supply chain risks remain material as the need for faster fashion cycles grows; any lag in Torrid's sourcing from new regions, or failure to match the pace of customer demand, could result in higher inventory obsolescence and increased markdowns, putting ongoing pressure on net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Torrid Holdings is $7.8, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Torrid Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.8, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $15.9 million, and it would be trading on a PE ratio of 68.6x, assuming you use a discount rate of 9.6%.

- Given the current share price of $5.16, the bullish analyst price target of $7.8 is 33.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.