Key Takeaways

- Aggressive store closures and rising operational costs threaten Torrid's margins and earnings, with e-commerce growth not fully offsetting brick-and-mortar declines.

- Dependence on the plus-size segment and heightened competition increase vulnerability to market shifts, sustainability trends, and ongoing margin pressure.

- Expansion of digital channels, targeted cost-saving strategies, and brand innovation are expected to drive profitability, attract younger customers, and strengthen Torrid's financial position.

Catalysts

About Torrid Holdings- Provides apparel, intimates, and accessories for curvy women in North America.

- The accelerating shift to e-commerce and direct-to-consumer shopping is reducing traffic and productivity in Torrid's brick-and-mortar locations, which has forced the company into a major store closure program that may not fully preserve revenues or margins as planned, risking sustained erosion in comparable sales and longer-term gross margin compression.

- Torrid's ongoing reliance on the plus-size women's apparel market sharply limits diversification potential, leaving the company exposed to any broader slowdown in apparel consumption and vulnerable to secular trends toward reduced clothing purchases due to rising consumer sustainability concerns, which threatens revenue growth and overall earnings stability.

- Torrid faces rising labor costs, persistent inflation, and incremental tariffs, with the company already projecting up to fifteen million dollars in annual tariff-related cost headwinds and ongoing input cost pressures that management has only partially offset, raising the risk of further margin contraction and net income deterioration if cost inflation persists.

- Intensifying competition from digital-first plus-size brands and aggressive online retailers is expected to drive further price wars and promotional dependency, as evidenced by Torrid's increased promotional activity and marketing spend to maintain conversion, ultimately putting sustained pressure on gross and net margins.

- The company's high store closure rate and large brick-and-mortar expense base, coupled with ongoing overhead and loyalty program investment requirements, may outpace realized efficiency gains or customer retention, leading to diminishing returns, slower free cash flow growth, and increased risk to Torrid's ability to achieve projected margin expansion and support future earnings.

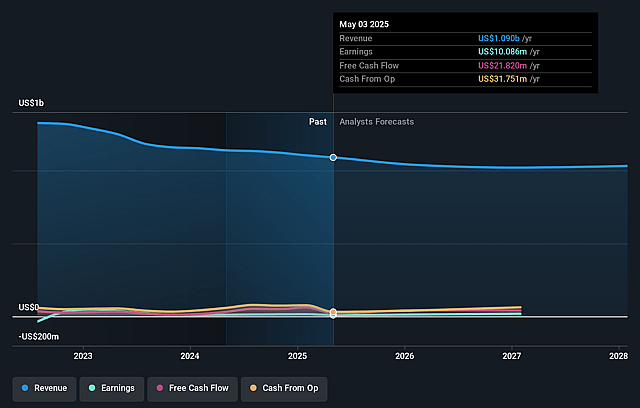

Torrid Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Torrid Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Torrid Holdings's revenue will decrease by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.3% today to 0.7% in 3 years time.

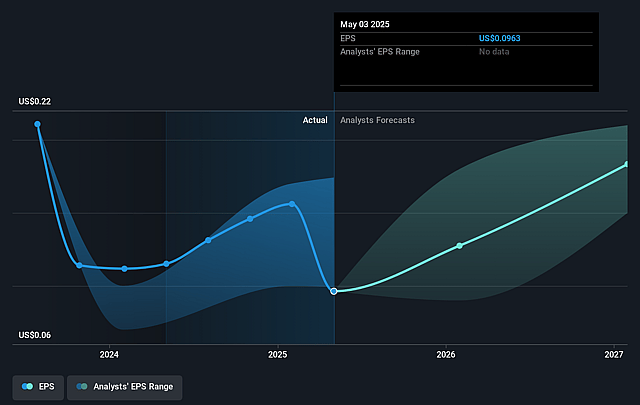

- The bearish analysts expect earnings to reach $7.1 million (and earnings per share of $0.07) by about September 2028, up from $3.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, down from 54.0x today. This future PE is greater than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 5.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Torrid Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth and strong customer engagement of Torrid's new sub-brands are enabling both higher-margin sales and attracting new, younger demographics, which could significantly accelerate revenue growth and drive EBITDA margin expansion in the coming years.

- The company's successful transition to an omnichannel model-reflected in digital sales now surpassing 70% of total demand and outperforming customer retention post-store closures-positions Torrid to benefit from long-term secular trends in e-commerce, supporting both sales and profitability.

- Strategic closure of underperforming stores, coupled with aggressive marketing and customer retention efforts, are expected to generate substantial cost savings and 150–250 basis points of adjusted EBITDA margin expansion, which should bolster net earnings and free cash flow over the long term.

- Growing free cash flow is set to be used for both share repurchases and debt reduction, potentially enhancing shareholder value and improving the strength of the company's balance sheet, thus supporting higher earnings per share in the future.

- Torrid's continuous investment in product innovation, customer analytics, and opening price point offerings addresses evolving consumer needs in the plus-size segment-tapping into a growing and increasingly fashion-conscious market-which could result in higher revenue and improved gross margins over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Torrid Holdings is $1.75, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Torrid Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $1.75.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $969.1 million, earnings will come to $7.1 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.81, the bearish analyst price target of $1.75 is 3.4% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.