Key Takeaways

- Shifting industry trends and increased competition threaten demand, store traffic, and gross margins, putting pressure on earnings growth for Advance Auto Parts.

- Persistent underinvestment in technology, rising labor costs, and slower replacement cycles are expected to weigh on profitability and hinder margin improvement.

- Investments in supply chain, market expansion, and a focus on professional customers are driving operational efficiency, market share growth, and earnings stability amid favorable industry trends.

Catalysts

About Advance Auto Parts- Engages in the provision of automotive aftermarket parts in the United States and internationally.

- Accelerating adoption of electric vehicles will gradually erode demand for traditional automotive replacement parts, shrinking Advance Auto Parts' core addressable market and putting long-term pressure on revenue as more of the U.S. vehicle fleet transitions away from internal combustion engines.

- Direct-to-consumer strategies by automakers and increasingly sophisticated e-commerce competitors threaten to bypass specialty retailers, which could reduce store traffic and force Advance Auto Parts into more aggressive pricing, compressing gross margins and undermining earnings growth.

- Persistent underinvestment in digital infrastructure and supply chain technology relative to key competitors may continue to drive elevated SG&A, increase inventory inefficiencies, and limit the company's ability to quickly adapt to consumer buying preferences, ultimately weighing on profitability.

- Rising vehicle reliability and longer replacement intervals are expected to decrease the overall frequency of auto part purchases, leading to slower comp store sales growth and diminishing the benefit of new store openings over time.

- Higher labor costs and wage inflation-particularly in markets with a shortage of skilled auto technicians-will steadily increase operating expenses, squeeze net margins, and make it more difficult for Advance Auto Parts to achieve its long-term margin improvement targets.

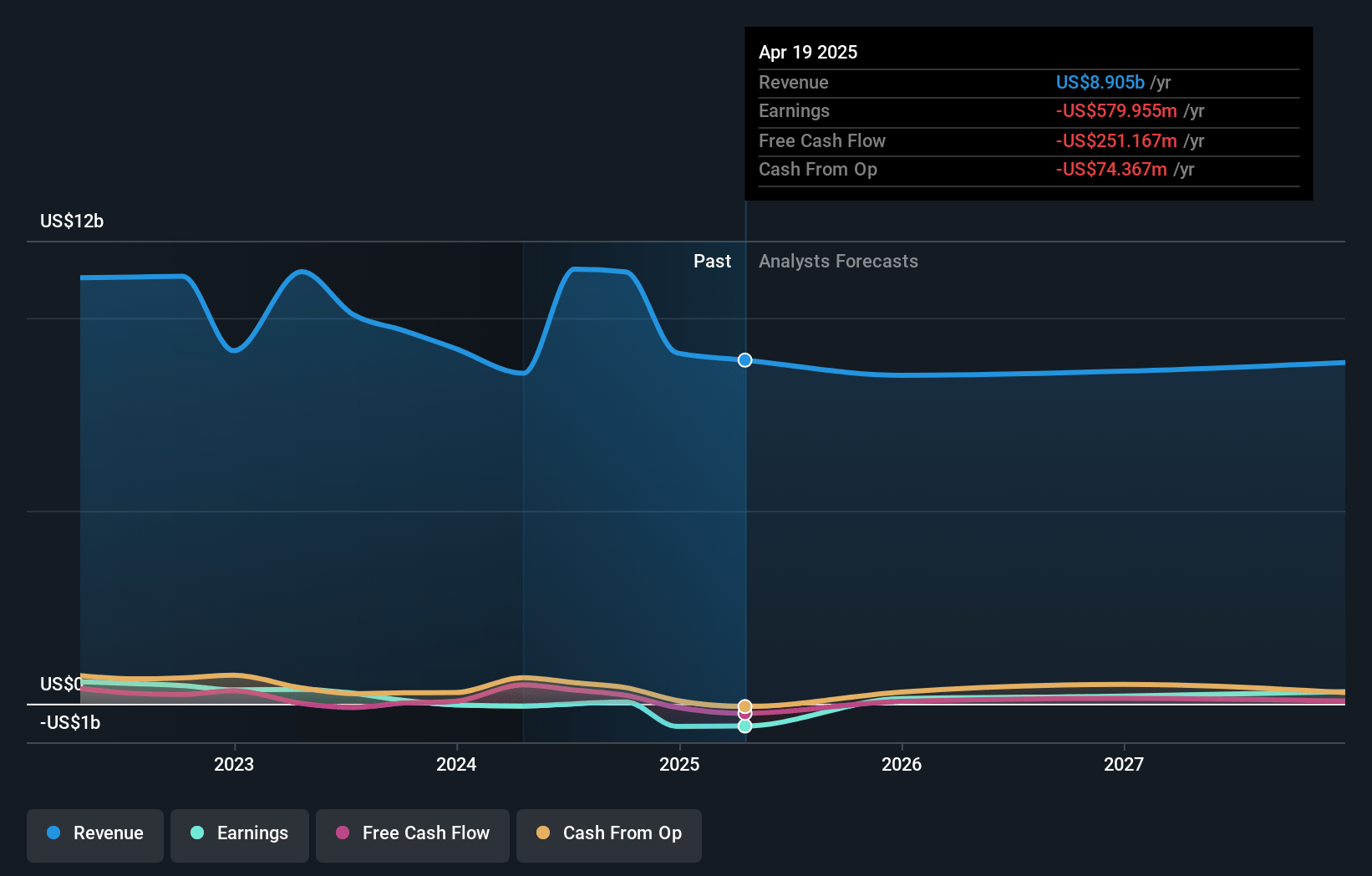

Advance Auto Parts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Advance Auto Parts compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Advance Auto Parts's revenue will decrease by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -6.5% today to 2.5% in 3 years time.

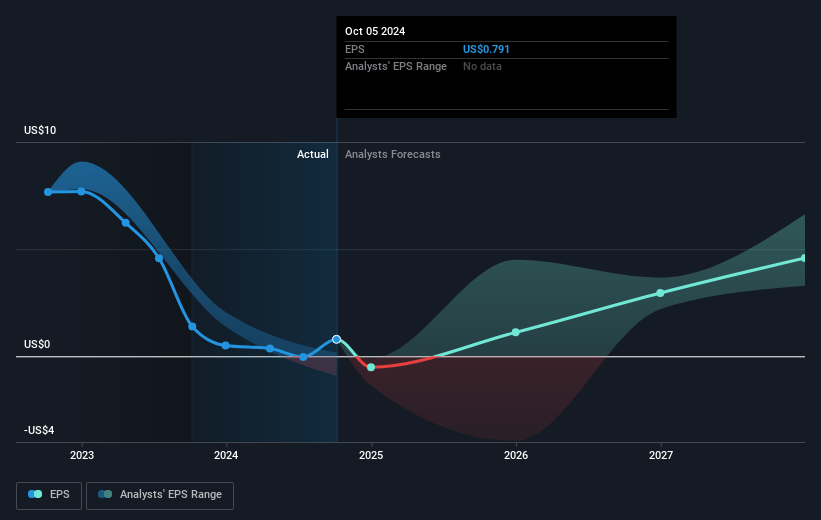

- The bearish analysts expect earnings to reach $211.4 million (and earnings per share of $3.54) by about July 2028, up from $-580.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from -6.9x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.28%, as per the Simply Wall St company report.

Advance Auto Parts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is benefitting from long-term secular trends such as an aging and growing vehicle fleet and the nondiscretionary nature of auto part spending, which together position Advance Auto Parts to see stable or increasing revenue over the coming years.

- Proactive investments in supply chain optimization, store footprint rationalization, and advanced inventory management are expected to improve operational efficiency and drive significant cost savings, which can lead to improved net margins and earnings growth.

- The company's strengthening presence in markets where it holds a top market position and its plan to open over 100 new stores in high-density regions provide opportunities for increased market share and higher revenue, leveraging local market leadership.

- Strategic focus on the professional customer (Pro) business, which has delivered consecutive quarters of sales growth and recurring revenue streams, is likely to enhance long-term earnings stability and reduce exposure to volatile DIY consumer trends.

- Successful vendor collaboration and procurement initiatives are delivering sustained cost reductions in merchandise costs, and the ongoing mitigation of tariff and supply impacts, along with the ability to pass on some costs via pricing, should help protect gross margins and profitability over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Advance Auto Parts is $32.74, which represents two standard deviations below the consensus price target of $47.87. This valuation is based on what can be assumed as the expectations of Advance Auto Parts's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.5 billion, earnings will come to $211.4 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 10.3%.

- Given the current share price of $66.5, the bearish analyst price target of $32.74 is 103.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.