Key Takeaways

- Expansion to a national banner and rebanner strategy aimed at premium markets are key for revenue and profitability growth, tapping into higher-income households.

- Digital-first marketing and strategic acquisitions are enhancing efficiency, growth, and market share, with synergies and continued M&A driving future earnings.

- External factors, including weather, tariffs, and economic pressures, threaten to disrupt operations and impact revenue, margins, and investor confidence.

Catalysts

About Shoe Carnival- Operates as a family footwear retailer in the United States.

- Shoe Carnival's strategic plan to expand Shoe Station from a regional to a national banner is expected to drive long-term revenue growth by attracting higher-income households and offering a premium shopping experience, with rebannered stores projected to increase sales by over 10% in the second full year. This will likely positively impact revenue growth and profitability.

- The rebanner strategy, which includes transitioning 51% of Shoe Carnival's store fleet to Shoe Station within 24 months, aims to capture market share and customer segments more aligned with higher income and premium products. This strategic shift is anticipated to increase net margins and earnings by over 20% in 2027 from these stores.

- Shoe Carnival's digital-first marketing approach is contributing to higher efficiencies and profitable growth during key shopping periods. By continuing to leverage digital strategies, the company aims to sustain sales and margin improvements, thus enhancing earnings and net margins.

- The positive performance of recent acquisitions, such as Rogan's Shoes, with synergy capture exceeding expectations, provides a framework and confidence for further M&A opportunities, which can strategically boost revenues and earnings through geographic expansion and customer diversification.

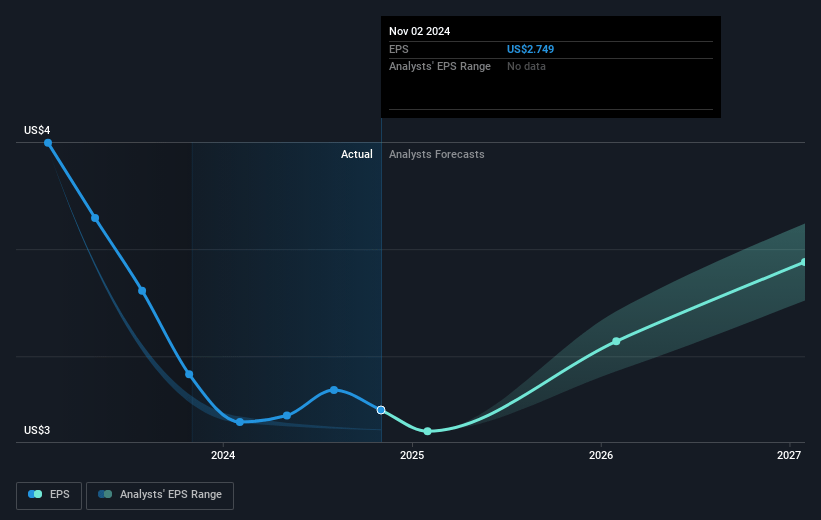

- Despite near-term investments associated with the rebanner strategy costing approximately $0.65 reduction in EPS in fiscal 2025, the rapid payback within a 2-3 year horizon is expected to significantly increase the profit contribution from rebannered stores over 20%, signaling future earnings growth.

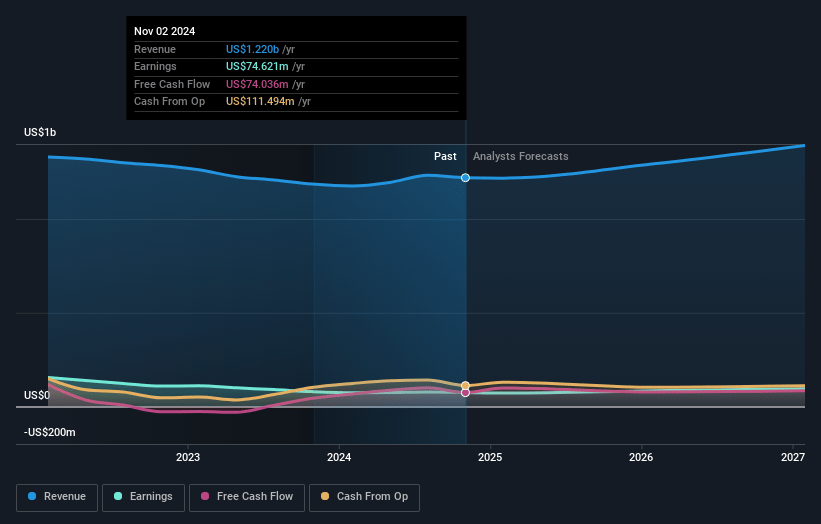

Shoe Carnival Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shoe Carnival's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.1% today to 2.7% in 3 years time.

- Analysts expect earnings to reach $33.4 million (and earnings per share of $1.21) by about May 2028, down from $73.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, up from 6.5x today. This future PE is greater than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

Shoe Carnival Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company anticipates continued declines in consumer spending from lower-income households during non-event periods, which could negatively impact revenue and overall sales growth.

- The warm weather and disappointing boot season affected sales, indicating that unseasonable weather conditions could further impact seasonal inventory turnover and gross margins.

- There are expected near-term costs due to the rebannering strategy, including store closures and a $0.65 EPS reduction, potentially affecting earnings in the short term.

- Uncertainties surrounding tariffs, inflation, and geopolitical factors could disrupt supply chains and lead to increased costs, adversely affecting net margins.

- A wider guidance range for 2025 signals anticipated volatility and uncertain consumer spending, which could impact revenue stability and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.5 for Shoe Carnival based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $33.4 million, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of $17.6, the analyst price target of $21.5 is 18.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.