Key Takeaways

- Increasing regulatory scrutiny and trade tensions present growing risks to the company's international expansion, supply chain stability, and future revenue growth.

- Persistent reliance on discounts, rising marketing costs, and global economic headwinds are compressing margins and curbing both user growth and profitability.

- Heavy investment in support programs, rural expansion, digital innovation, and global initiatives positions PDD Holdings for stronger loyalty, new revenue streams, and sustained earnings growth.

Catalysts

About PDD Holdings- A multinational commerce group that owns and operates a portfolio of businesses.

- The ongoing escalation of global regulatory scrutiny, particularly around data privacy, antitrust, and digital commerce, is expected to significantly increase compliance costs and operational complexity for PDD Holdings as it expands internationally, which is likely to further erode net margins and suppress long-term profitability.

- Intensifying trade tensions between China and key international markets such as the United States and Europe have the potential to disrupt supply chains, impose additional tariffs, and result in stricter export controls, thereby capping cross-border growth and putting severe pressure on future revenue expansion for Temu and other international businesses.

- The company's heavy overreliance on deep discounting, fee reductions, and aggressive merchant support programs in a bid to defend market share has already caused a marked slowdown in revenue growth and substantial compression of GAAP and non-GAAP operating margins, and these margin pressures are likely to persist or worsen as competition further intensifies.

- Global economic headwinds, including slowing consumer demand in both developed and emerging markets due to persistent macroeconomic slowdowns, demographic shifts, and adverse weather events, are poised to limit gross merchandise volume growth for PDD Holdings and constrain its ability to achieve meaningful top-line expansion, threatening both revenue and earnings trajectories over the long run.

- Continued escalation in customer acquisition costs driven by digital marketing competition and an increasingly saturated user base will make it significantly harder to grow active users and monetize existing ones efficiently, directly undermining earnings power and exacerbating declines in profitability as sales and marketing expenses grow as a proportion of revenue.

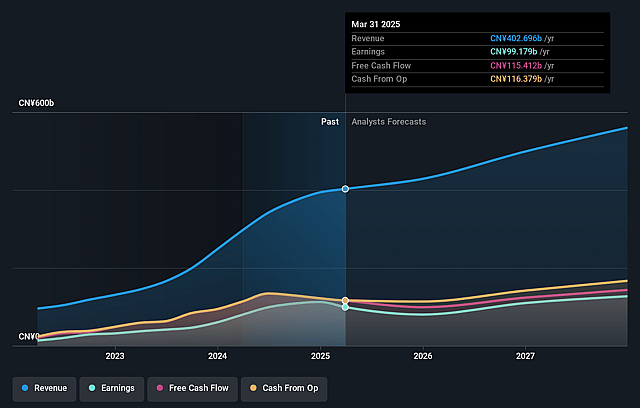

PDD Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on PDD Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming PDD Holdings's revenue will grow by 7.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.9% today to 20.3% in 3 years time.

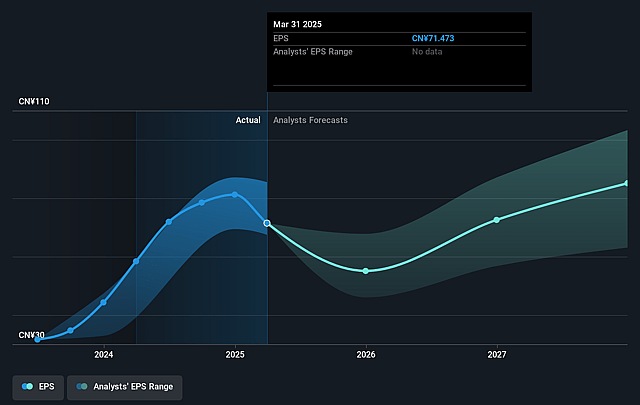

- The bearish analysts expect earnings to reach CN¥103.2 billion (and earnings per share of CN¥67.58) by about September 2028, up from CN¥97.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from 12.9x today. This future PE is lower than the current PE for the US Multiline Retail industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

PDD Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained and significant investment in merchant and consumer support programs-including the RMB 100 billion support initiative, fee reductions, and logistics subsidies-may drive long-term improvements in platform stickiness, merchant loyalty, and increased order volumes, ultimately supporting higher overall revenues and user retention.

- The successful expansion and deepening of Duo Duo Grocery, now covering 70% of Chinese villages and efficiently connecting local agriculture to consumers, positions PDD Holdings to capture more rural consumption as online retail penetration rises, which can bolster gross merchandise volume and future revenue growth.

- The platform's focus on empowering merchants through digitalization, smart supply chains, and branded offerings facilitates ongoing product innovation and differentiation, which could improve platform competitiveness and allow net margins to expand as operational efficiencies scale.

- International business units, particularly global e-commerce and localized supply chains, are gaining consumer trust and seeing steady demand in overseas markets, indicating potential for Temu and other cross-border initiatives to unlock new revenue streams and enhance overall earnings power over time.

- Resilient and rising online consumption in China-supported by government pro-consumption policies, recent category sales surges during major shopping festivals, and a robust merchant ecosystem-suggests strong long-term secular demand, which creates a foundation for improved net income and earnings stability as the investment cycle normalizes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for PDD Holdings is $117.14, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PDD Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $176.54, and the most bearish reporting a price target of just $117.14.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥508.3 billion, earnings will come to CN¥103.2 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of $124.7, the bearish analyst price target of $117.14 is 6.5% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PDD Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.