Key Takeaways

- Massive ecosystem investments and AI-driven operations are expected to swiftly boost earnings power and operating margins, outpacing competitors.

- Expanding dominance in rural, international, and agricultural markets positions PDD to capture new revenue streams and achieve sustained growth.

- Heavy investment in subsidies and ecosystem support risks undermining profitability, while fierce competition and global uncertainties threaten long-term growth and market share.

Catalysts

About PDD Holdings- A multinational commerce group that owns and operates a portfolio of businesses.

- While analyst consensus expects PDD Holdings' ecosystem investments to incrementally boost revenue and margins over time, the unprecedented scale and multi-year duration of programs like the RMB 100 billion merchant support could accelerate platform consolidation, decisively outpacing competitors and turning today's margin compression into a dramatic rebound in earnings power within just a few years.

- Analysts broadly agree that logistics and supply chain upgrades will drive efficiency; however, PDD's targeted dominance in rural and remote markets-where order growth is already over 40%-sets the stage for exponential expansion in previously untapped consumer segments, potentially fueling above-market revenue growth and lasting gross margin uplift.

- PDD's aggressive global push with Temu is still in its infancy, yet as global consumers rapidly adopt online shopping and trust in cross-border e-commerce rises, Temu's platform could scale to become a top global digital marketplace, unlocking vast incremental revenue streams and substantial international profit contribution.

- The company's increasing integration of advanced AI in supply chain management, merchandising, and product innovation supports highly personalized and dynamic commerce, suggesting future operating leverage and margin breakthroughs beyond what the traditional e-commerce model allows.

- By embedding itself as the essential platform for agricultural innovation and direct-from-source supply chains, PDD is well positioned to capture structural shifts in food and produce distribution, enabling it to absorb volume from offline channels and capturing higher share of value-added services, bolstering long-term revenue and gross profits.

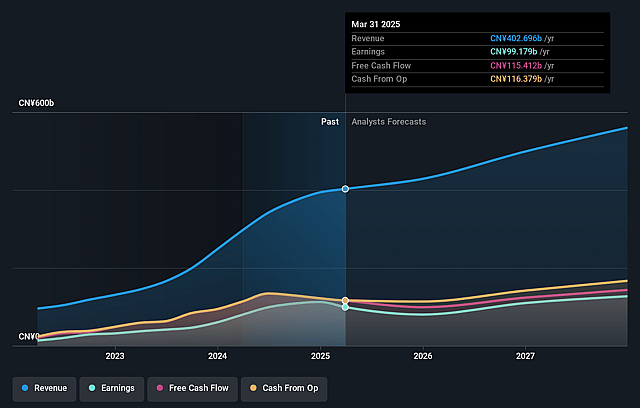

PDD Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PDD Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PDD Holdings's revenue will grow by 30.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 23.9% today to 19.1% in 3 years time.

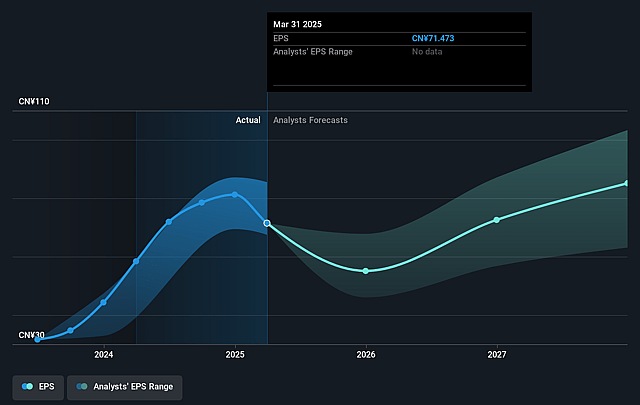

- The bullish analysts expect earnings to reach CN¥174.9 billion (and earnings per share of CN¥116.93) by about September 2028, up from CN¥97.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Multiline Retail industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

PDD Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management repeatedly emphasized that revenue growth has slowed and profit margins have declined due to intensified industry competition and substantial investments in merchant support programs, which may lead to lower or volatile earnings going forward.

- The company's strategic focus on long-term ecosystem investments, such as the RMB 100 billion support program and fee reduction initiatives, signals a willingness to sacrifice near

- and potentially mid-term profitability, which could weigh on net income and cash flow if revenue growth does not re-accelerate.

- PDD's core business remains highly dependent on price-sensitive sectors like agriculture and rural regions, which may limit average order value and dampen long-term top-line expansion, especially if broader consumer preferences shift toward premium or sustainable brands.

- Comments from management indicate mounting domestic competition, with rivals continually investing in new business models and platforms, which could erode PDD's market share and force the company to maintain or increase costly subsidies, further squeezing net margins.

- The global business is still in its early stages and faces rising regulatory scrutiny, rapidly changing external environments, and potential friction as geopolitical tensions rise, all of which could hinder international expansion and temper future revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PDD Holdings is $173.89, which represents two standard deviations above the consensus price target of $143.5. This valuation is based on what can be assumed as the expectations of PDD Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $176.54, and the most bearish reporting a price target of just $117.14.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥916.3 billion, earnings will come to CN¥174.9 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 8.8%.

- Given the current share price of $126.06, the bullish analyst price target of $173.89 is 27.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.