Key Takeaways

- Rising geopolitical tensions, regulatory scrutiny, and macroeconomic pressures are complicating international expansion and eroding PDD's growth prospects and profitability outlook.

- Heavy reliance on subsidies, fee reductions, and ecosystem investments keeps margins under pressure, with increased competition and slowing consumer demand amplifying long-term earnings risks.

- Large-scale investment in merchant and supply chain support positions PDD Holdings for sustained ecosystem growth, improved competitiveness, and long-term earnings resilience despite near-term margin pressures.

Catalysts

About PDD Holdings- A multinational commerce group, owns and operates a portfolio of businesses.

- The ongoing and escalating geopolitical tensions-particularly increased tariffs, tightening trade restrictions, and regulatory hurdles between China and key international markets-are creating significant headwinds for PDD Holdings' global expansion. This limits revenue growth potential from markets outside China and adds volatility to cross-border earnings.

- The substantial increase in regulatory scrutiny globally, including stricter data privacy, cross-border e-commerce regulations, and digital platform oversight, will continue raising compliance costs and operational complexity for the company, placing downward pressure on net margins and limiting operational agility.

- Intensifying competition in both the domestic Chinese e-commerce market and overseas markets, combined with PDD's inherent limitations as a third-party marketplace compared to integrated or first-party platforms, forces the company to maintain heavy promotional subsidies and deep discounts. This structure keeps customer acquisition costs high and puts significant and ongoing pressure on gross margin and operating profit.

- The company's increasingly aggressive merchant support and fee reduction programs, such as the recently announced RMB 100 billion support package, are structurally depressing take rates and earnings. The expansion of ecosystem investments is leading to a pronounced and sustained contraction in net income and operating profit margin, with no guaranteed return timeline as revenue growth decelerates.

- Slowing macroeconomic growth, weakening consumer confidence in China, and rising cost of logistics and fulfilment are expected to continue eroding demand for discretionary spending and raise cost-to-serve for PDD. This dynamic suppresses revenue growth while simultaneously reducing operating leverage, resulting in weaker earnings and long-term profitability risks.

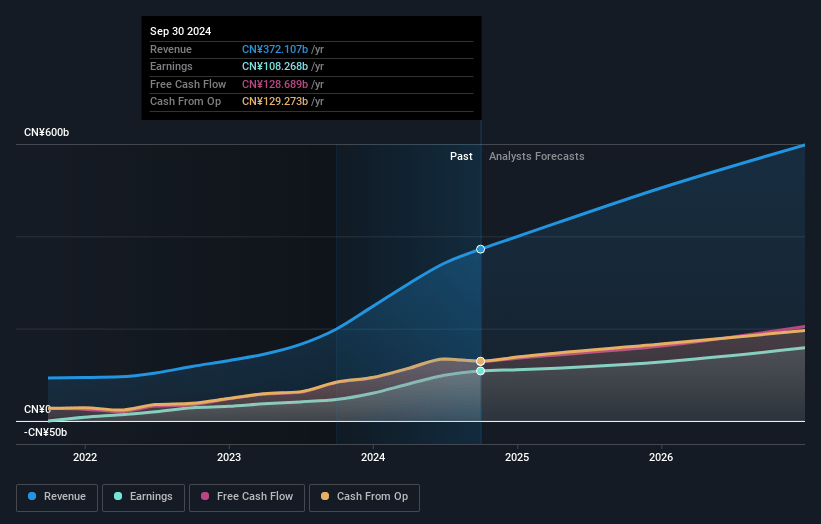

PDD Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on PDD Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming PDD Holdings's revenue will grow by 8.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 24.6% today to 19.7% in 3 years time.

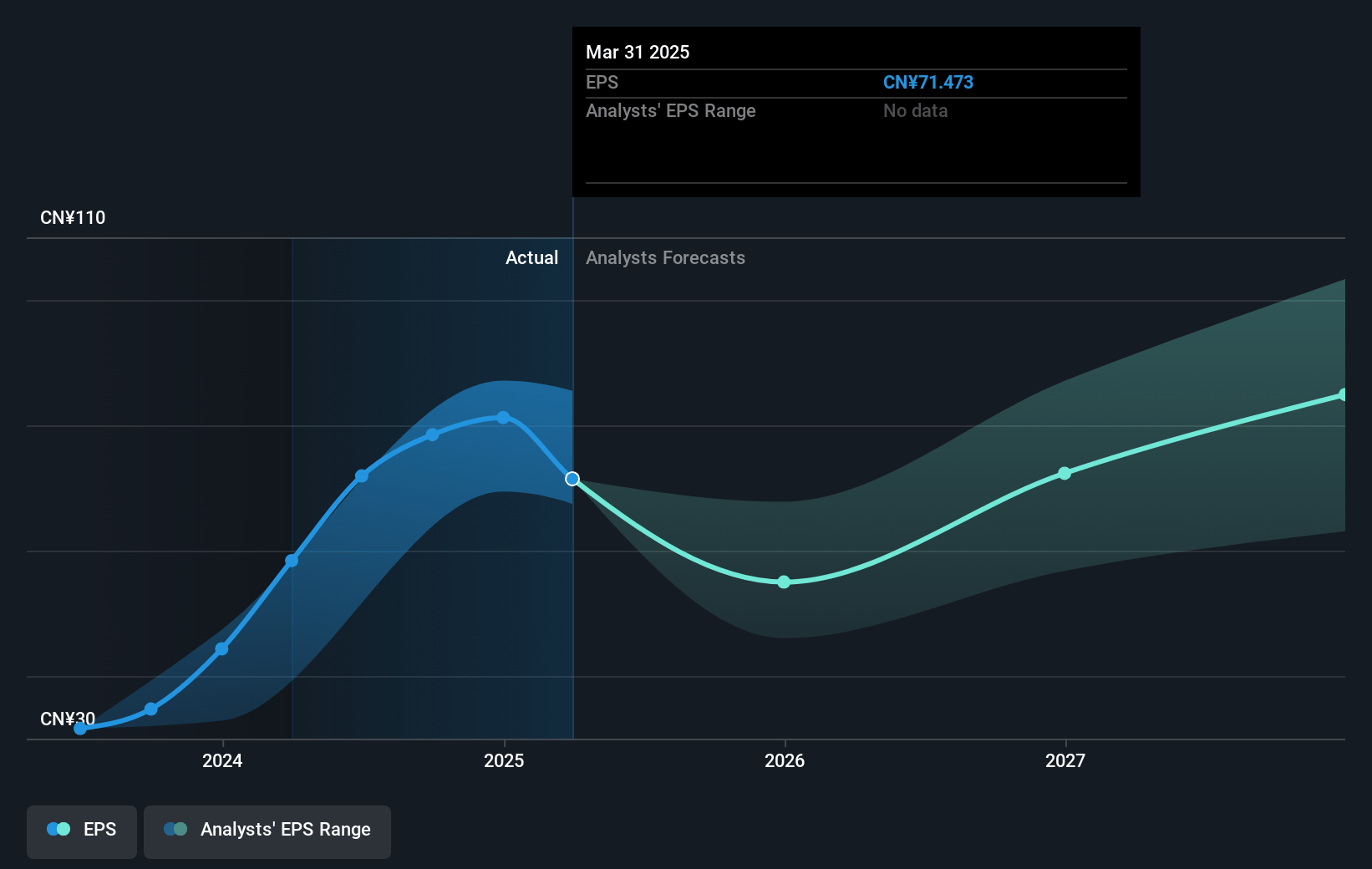

- The bearish analysts expect earnings to reach CN¥100.7 billion (and earnings per share of CN¥66.07) by about July 2028, up from CN¥99.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, down from 12.1x today. This future PE is lower than the current PE for the US Multiline Retail industry at 15.8x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

PDD Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained, large-scale investments in merchant support programs such as the RMB 100 billion initiative may strengthen the long-term health and loyalty of PDD's merchant ecosystem, which could ultimately improve gross merchandise value and drive higher revenue growth once the returns on these investments start to materialize.

- Expanding comprehensive support to small and medium-sized merchants and continued focus on supply chain modernization may enable PDD to differentiate its platform, boost merchant competitiveness, and create a healthier ecosystem, potentially leading to improved customer retention, higher engagement, and stronger earnings over the long term.

- The active development of digital and data-driven supply chain solutions, along with targeted agricultural initiatives, increases operational efficiency for merchants and can accelerate value creation for both buyers and sellers, providing a structural basis for operating margin expansion in the future.

- Despite margin pressures from promotional spend and competitive subsidies, the company's ongoing ability to drive double-digit revenue growth (10% year-over-year in the most recent quarter) while scaling marketing and transaction services signals underlying strength that could translate into resilient topline and ultimately earnings improvement, especially as operating leverage improves.

- By building long-term supply chain know-how, deepening technology integration, and expanding into new categories and international markets, PDD Holdings positions itself to capture secular growth in global e-commerce and value-oriented retail demand, which may lead to a rebound in net income and support share price appreciation over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for PDD Holdings is $88.31, which represents two standard deviations below the consensus price target of $125.57. This valuation is based on what can be assumed as the expectations of PDD Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.42, and the most bearish reporting a price target of just $87.14.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥512.1 billion, earnings will come to CN¥100.7 billion, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of $118.46, the bearish analyst price target of $88.31 is 34.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.