Key Takeaways

- Investments in merchant support, AI, and technology upgrades are set to boost platform adoption, operational efficiency, and long-term margin improvement.

- Early-stage international expansion and alignment with value-driven social commerce trends position PDD for sustained outsized growth and market share gains.

- Heavy spending on platform and merchant support, fierce competition, and global risks may suppress profitability, slow revenue growth, and constrain international expansion for the foreseeable future.

Catalysts

About PDD Holdings- A multinational commerce group, owns and operates a portfolio of businesses.

- Analyst consensus views the RMB 10 billion and RMB 100 billion merchant support programs as drivers for incremental merchant retention and ecosystem resilience, but the magnitude of high-quality merchant ecosystem upgrades and operational leverage could be underestimated, potentially setting the stage for an accelerated rebound in revenue growth and substantial operating margin expansion as investments cycle through.

- While analysts broadly focus on fee reductions and merchant support as pathways to margin stabilization, the reality is these proactive investments-especially in digital supply chain transformation and platform-wide technology enablement-could trigger a structural lowering of merchant costs and rapid adoption of the platform by underserved SME merchants, allowing PDD to capture a significantly outsized share of future e-commerce growth and deliver long-duration earnings upside.

- The company's aggressive international expansion-especially through Temu-is still in the early innings, and with ongoing digital payment adoption and cross-border e-commerce acceleration, PDD is positioned to expand its addressable market at a far faster rate than consensus expects, underpinning sustained multi-year top line growth.

- PDD's rapid deployment of AI-driven operational efficiencies and data-driven logistics-as evidenced by ongoing investment in technology and automation-will likely result in a step-function improvement in fulfillment cost, user engagement, and advertising ROI, directly translating into higher net margins and stronger platform monetization.

- The accelerating global trend toward value-driven consumption and discovery-based social commerce aligns perfectly with PDD's gamified, low-cost, and highly interactive platform model, enabling not just customer retention but viral growth and heightened wallet share, providing a powerful tailwind for revenue and long-term earnings expansion.

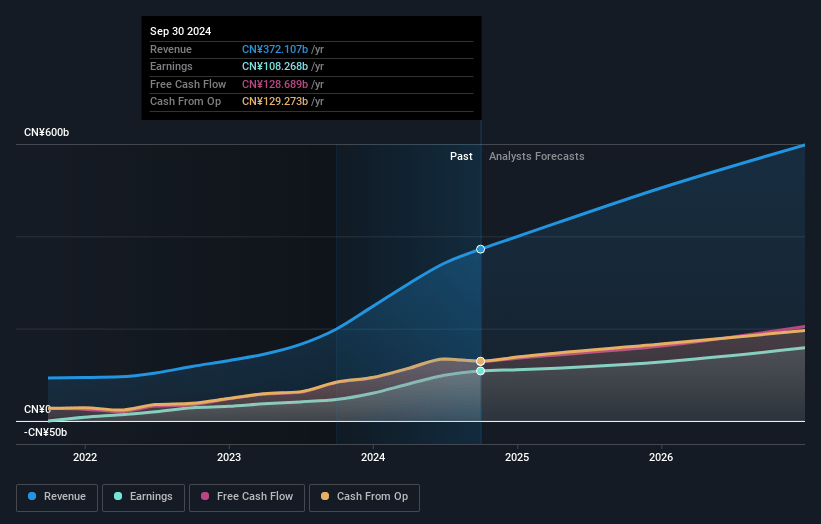

PDD Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PDD Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PDD Holdings's revenue will grow by 30.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 24.6% today to 17.5% in 3 years time.

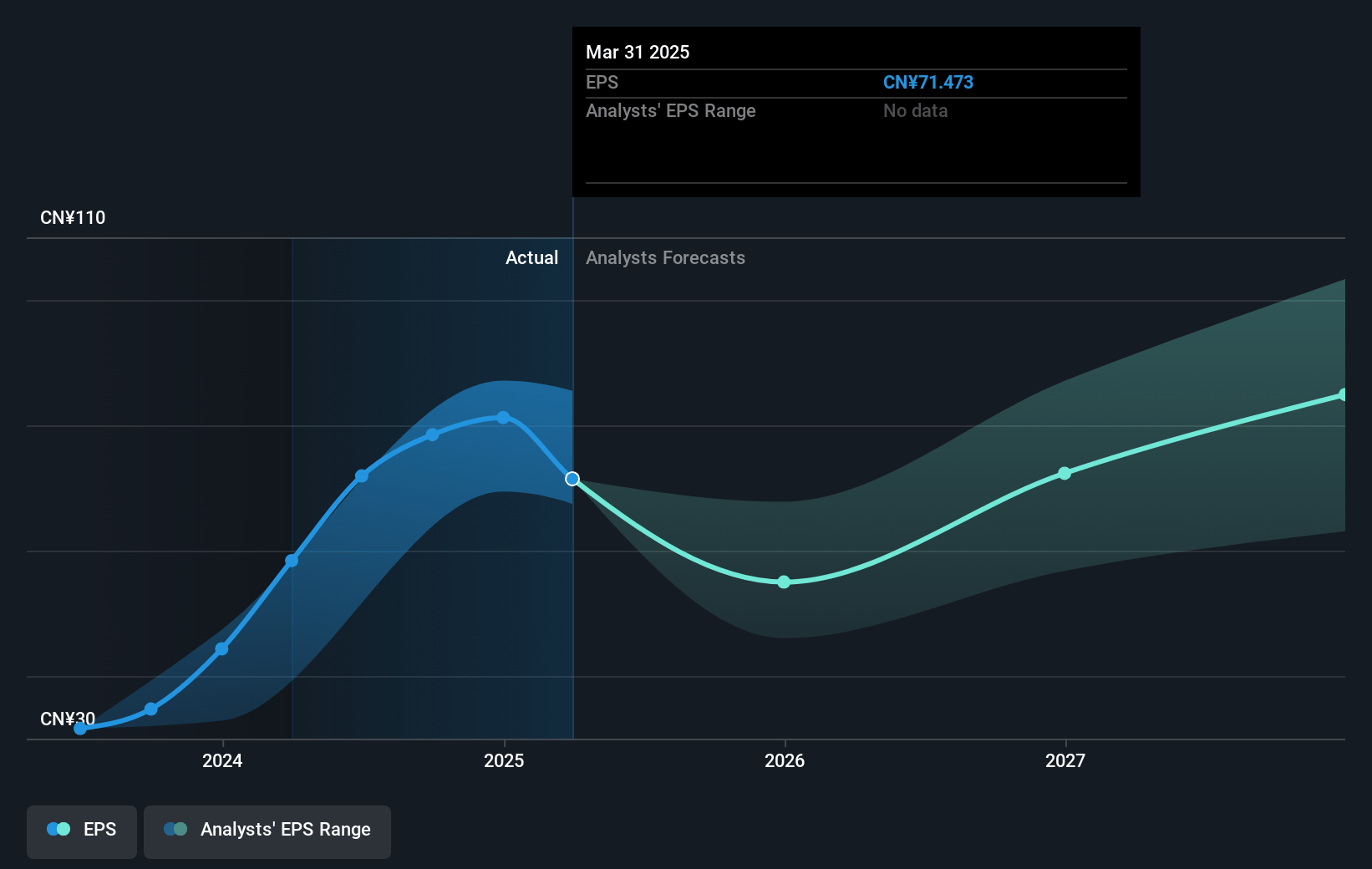

- The bullish analysts expect earnings to reach CN¥157.1 billion (and earnings per share of CN¥108.2) by about July 2028, up from CN¥99.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 11.8x today. This future PE is lower than the current PE for the US Multiline Retail industry at 15.8x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.77%, as per the Simply Wall St company report.

PDD Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained high levels of investment in merchant and platform support initiatives, such as the RMB 100 billion support program and extensive discount programs, are significantly reducing operating profit margins and profitability, with management explicitly stating that this pressure is expected to persist over a considerable period, which could challenge long-term earnings growth.

- Management notes a slowdown in revenue growth due to both scaling effects and external uncertainties, and signals that the mismatch between business investment cycles and return cycles may continue, potentially leading to muted or even falling revenue in the absence of clear catalysts for reacceleration.

- Intensified competition, especially from first-party e-commerce models and national subsidy programs, puts PDD Holdings at a structural disadvantage because its third-party marketplace model limits its ability to pass policy incentives directly to consumers, thereby pressuring both revenue growth and market share in the long run.

- Geopolitical instability and new trade barriers such as tariffs have created significant operational and adaptation challenges for merchants, particularly in global markets, which directly risk slowing international expansion and thus constraining future revenue streams.

- The company's strategy of prioritizing ecosystem and merchant well-being over short-term profitability, while potentially fostering long-term strength, means ongoing elevated expense ratios, which may structurally suppress net margins and reduce earnings power well beyond the near term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PDD Holdings is $162.83, which represents two standard deviations above the consensus price target of $125.57. This valuation is based on what can be assumed as the expectations of PDD Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.42, and the most bearish reporting a price target of just $87.14.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥897.2 billion, earnings will come to CN¥157.1 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 8.8%.

- Given the current share price of $115.04, the bullish analyst price target of $162.83 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.