Last Update 11 Dec 25

Fair value Decreased 0.48%PDD: Execution On Mature Domestic Platform Will Support Future Upside Potential

Analysts have slightly reduced their price target on PDD Holdings by $5 to $135, citing signs of a maturing domestic business and recent stagnation in user engagement metrics as reasons for a more measured growth outlook.

Analyst Commentary

Analysts are converging on a more balanced view of PDD Holdings, with the reduced price target framed as a recalibration to slower, but still positive, growth expectations rather than a structural bear call on the business.

Commentary from the Street points to a company transitioning from hypergrowth to a more normalized expansion phase, with valuation now increasingly tied to execution quality and cash generation rather than rapid user acquisition alone.

Bullish Takeaways

- Bullish analysts view the new $135 price target as still embedding a premium for PDD Holdings relative to peers, reflecting confidence that the platform can maintain above industry growth even as domestic metrics mature.

- They see the current slowdown in daily active users and time spent as a normalization off a high base, and they argue that disciplined spending and better monetization of existing traffic can sustain earnings growth and support the revised valuation.

- Some constructive voices highlight that PDD Holdings strong brand recognition and entrenched user base provide a defensive moat. They note that, if this is coupled with incremental operational efficiencies, it could allow upside versus the now more conservative expectations.

- Overall, bullish analysts characterize the downgrade in rating and target as a risk management move rather than a loss of faith in the longer term structural opportunity. They see potential for positive revisions if engagement trends stabilize.

Bearish Takeaways

- Bearish analysts emphasize that non growth in key engagement indicators, particularly DAUs and time spent, is problematic for a model that historically depended on top of funnel dominance to drive transaction volumes and advertising demand.

- They caution that the maturity of the domestic business limits the scope for easy volume led upside. This places greater pressure on PDD Holdings to execute flawlessly on monetization, new category expansion, and international initiatives to justify its multiple.

- The reduced price target is framed as recognition that prior assumptions on sustained high growth and engagement were too optimistic, with downside risk if competitive intensity rises or user activity weakens further.

- Bearish analysts also warn that a slower growth profile narrows the margin of error for management. They argue that any slip in execution on logistics, merchant support, or promotional efficiency could translate more directly into valuation compression.

Valuation Changes

- The fair value estimate edged down slightly from about $146.91 to $146.21 per share, reflecting a modestly more conservative intrinsic valuation.

- The discount rate decreased marginally from roughly 8.97 percent to 8.94 percent, implying a slightly lower required return on equity risk.

- Revenue growth was effectively unchanged at around 13.5 percent, indicating that long term top line expectations remain stable.

- The net profit margin held steady at approximately 24.1 percent, suggesting no material revision to long term profitability assumptions.

- The future P/E ticked down modestly from about 12.20x to 12.11x, signaling a slightly lower valuation multiple embedded in the updated model.

Key Takeaways

- Investments in ecosystem development, supply chain efficiency, and international expansion are diversifying revenue streams and strengthening PDD's ability to capture e-commerce growth globally.

- Focus on affordability, digitalization, and AI-driven operations is enhancing user acquisition, repeat purchases, and long-term margin improvement amid shifting consumer and macroeconomic trends.

- Aggressive investment, rising competition, and early-stage global expansion risk prolonged margin compression and weaker profitability if ecosystem and diversification efforts fail to deliver returns.

Catalysts

About PDD Holdings- A multinational commerce group that owns and operates a portfolio of businesses.

- PDD Holdings' ongoing and substantial ecosystem investments, including fee reductions, logistics upgrades, and targeted support for SME merchants, are positioning the company to capture a larger share of e-commerce growth both in established regions and underserved remote markets; these efforts are likely to drive higher long-term revenue and enhance user acquisition as overall digital adoption accelerates globally.

- The company is leveraging its Consumer-to-Manufacturer (C2M) model and advancements in supply chain/process digitalization to help manufacturers move up the value chain, increase product innovation, and address consumer needs more efficiently; these improvements are expected to support higher gross margins and net margins over time as scaling and cost efficiency gains materialize.

- PDD's commitment to international expansion, particularly through investment in Temu and global supply chain localization, is enabling penetration into new and rapidly growing consumer markets outside China, diversifying revenue streams and enhancing future topline growth potential as emerging market disposable incomes rise.

- Investments in logistics, agritech, and AI-driven operations-such as broader application of smart agriculture technologies and personalized recommendation engines-should reduce operational frictions, lower delivery costs, and drive repeat purchasing behavior, supporting higher conversion rates and improved operational margins in the medium to long term.

- The company's focus on affordability and value-driven consumption, backed by large-scale consumer giveback and discounting programs, aligns with macro trends favoring budget platforms during economic uncertainty, positioning PDD for market share gains, increased customer lifetime value, and resilient long-term revenue growth.

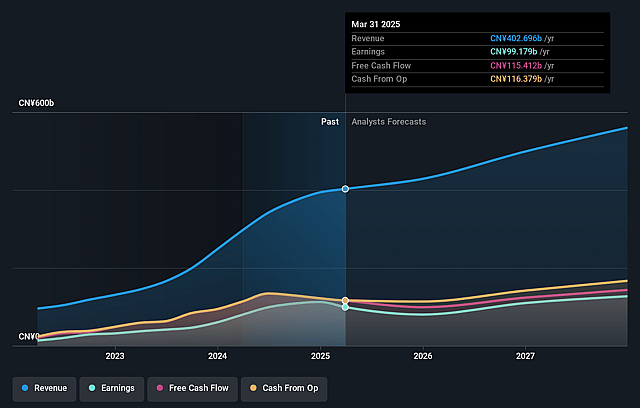

PDD Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PDD Holdings's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.9% today to 26.5% in 3 years time.

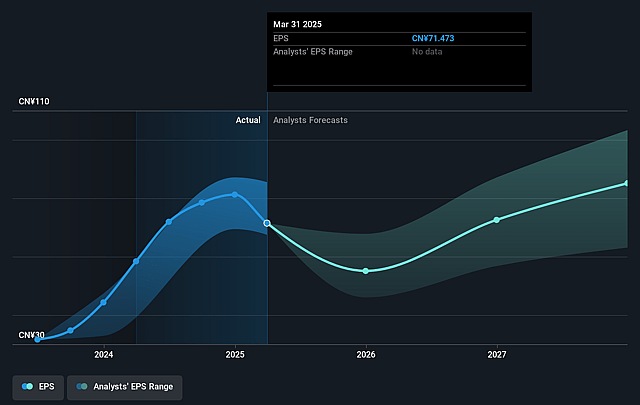

- Analysts expect earnings to reach CN¥147.1 billion (and earnings per share of CN¥99.22) by about September 2028, up from CN¥97.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥95.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from 12.9x today. This future PE is lower than the current PE for the US Multiline Retail industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

PDD Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is making historically large, ongoing investments in merchant and consumer support programs (such as the RMB 100 billion support program), which have already resulted in slower revenue growth and a year-over-year decline in operating profit. Management explicitly signals a willingness to sacrifice profit margins for an extended period, increasing the risk of sustained net margin and earnings pressure if investments do not yield the intended ecosystem improvements.

- Competitive intensity is escalating, with both traditional e-commerce players and new content/platform entrants heavily investing in innovation and new business models. As revenue growth slows and PDD's lead over peers narrows, the company may be forced to continually ramp up spending to compete for customers and retain merchants, posing a risk to long-term profitability and revenue growth.

- There is heightened exposure to investment-return mismatch, as management acknowledges a potentially prolonged lag between the timing of heavy ecosystem investments and future financial returns. If these cyclical or structural investments fail to translate into sustainable customer/merchant loyalty or higher monetization, revenue and net income could underperform for an extended period.

- The ongoing pivot towards global expansion and new business lines (such as Duo Duo Grocery), which management admits are at an early stage and require significant, continuing capital outlays, risks either limited revenue diversification or persistent losses abroad. Failure to execute effectively in international markets or inefficient scaling could depress consolidated profit margins and earnings.

- Intensifying industry headwinds such as pricing pressure from subsidies, fee reductions, and commission cuts-implemented as competitive responses-may become entrenched, leading to a structurally lower gross margin environment that could weigh on long-term operating profits and free cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $143.361 for PDD Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $176.36, and the most bearish reporting a price target of just $117.02.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥555.7 billion, earnings will come to CN¥147.1 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $124.39, the analyst price target of $143.36 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PDD Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.