Key Takeaways

- Shrinking demand for traditional office products and increased competition from large e-commerce players will drive ongoing declines in revenue, margins, and market share.

- Operational risks, shifting customer habits, and store closures will undermine profitability and make long-term earnings recovery increasingly uncertain.

- The company’s B2B expansion, operational streamlining, and strong financial discipline position it for sustainable profit growth and resilience against supply chain disruptions.

Catalysts

About ODP- Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

- Accelerating digital adoption and the continued shift towards hybrid and remote work environments will likely suppress long-term demand for traditional office products and core consumables, resulting in gradual revenue contraction for ODP’s legacy business and muted growth in newer segments.

- Further penetration by dominant e-commerce competitors, such as Amazon and Walmart, is expected to erode ODP’s already declining market share in both retail and B2B channels, leading to continued margin compression and lower operating income.

- Sustainability initiatives and the move towards paperless office environments are anticipated to steadily diminish relevance for ODP’s traditional product lines, which accounted for a substantial portion of sales and cash flow, putting persistent downward pressure on total revenue and gross margin.

- Execution risks and uncertainty surrounding ODP’s ongoing business transformation, including delays in onboarding new B2B contracts and supply chain diversification efforts, will likely contribute to ongoing volatility in earnings, impairments, and restructuring charges, undermining long-term earnings visibility.

- The long-term trend of shrinking foot traffic, ongoing physical store closures, and the inability to clearly differentiate value-added offerings versus low-cost online competitors point to further decline in same-store sales and profitability, creating structural headwinds for overall net margins and shareholder returns.

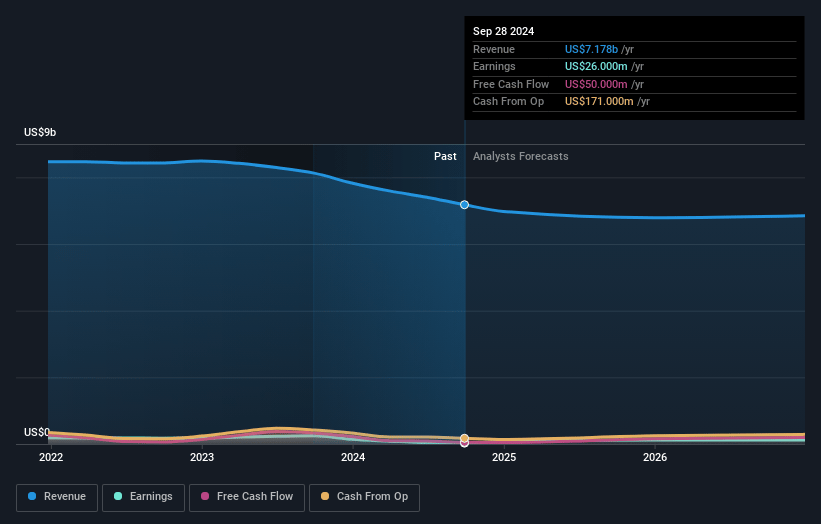

ODP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ODP compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ODP's revenue will decrease by 3.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.7% today to 1.1% in 3 years time.

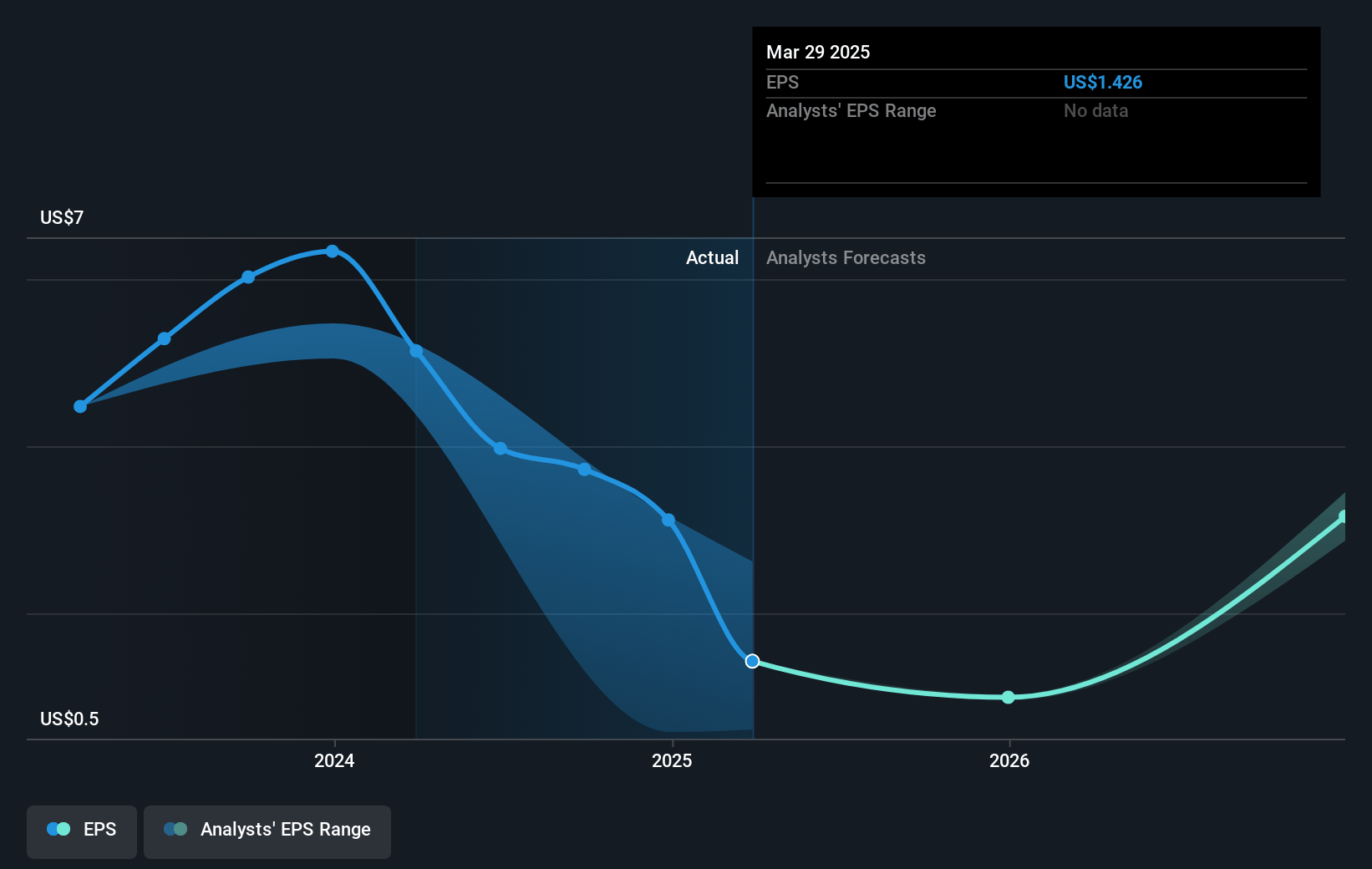

- The bearish analysts expect earnings to reach $65.8 million (and earnings per share of $2.67) by about July 2028, up from $46.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, down from 13.0x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

ODP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ODP’s accelerated B2B pivot, including the recent onboarding of large contracts like CoreTrust and expansion into new verticals such as the hospitality sector, provides substantial avenues for recurring, higher-margin revenue growth, which could drive long-term improvement in both sales and earnings.

- Sustained improvement in comparable store sales trends, loyalty program enrollments, and targeted merchandising strategies in the retail segment are resulting in margin stabilization and increased cash flow, suggesting that retail may remain a consistent source of profitability and support for revenue.

- The company’s Optimize for Growth restructuring plan is actively reducing fixed costs and streamlining operations, allowing for greater operational flexibility, which should positively impact net margins and free cash flow over the long term.

- ODP has demonstrated robust cash generation and a strengthening balance sheet, with significant liquidity and low debt, which enables strategic investment in growth initiatives and reduces the likelihood of financial distress impacting earnings or shareholder returns.

- Effective mitigation of tariff risks through diversified supply sourcing and pricing strategies, as well as strong vendor relationships, reduces long-term susceptibility to cost inflation and supply chain disruptions, supporting margin stability and earnings consistency into the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ODP is $17.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ODP's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $65.8 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $19.9, the bearish analyst price target of $17.0 is 17.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.