Key Takeaways

- Rapid hospitality market penetration, recent B2B wins, and rising hybrid work demand are driving accelerated, margin-resilient top-line growth and recurring revenue.

- Operational discipline, digital transformation, and ESG-focused solutions are strengthening cash flow, supporting reinvestment, and enabling higher-margin, stickier customer relationships.

- Declining core business, slow growth in new segments, restructuring pressures, limited digital expansion, and macroeconomic vulnerabilities all threaten long-term profitability and stability.

Catalysts

About ODP- Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

- While analyst consensus expects hospitality expansion to contribute meaningfully, the actual pace of onboarding and existing customer penetration indicates ODP could secure a dominant share in the $16 billion hospitality supply market much faster than expected, resulting in outsized revenue acceleration and longer-term gross margin improvement as scale grows.

- Analysts broadly agree that recent large B2B contract wins such as CoreTrust will steadily impact future revenue, but with accelerating customer conversion and a rapidly expanding sales pipeline, these contracts are likely to deliver a step-change in ODP's top-line growth and recurring revenue, with the potential to drive above-consensus EBITDA inflection in the next 12–18 months.

- ODP is uniquely positioned to capture the persistent rise in hybrid and remote work by leveraging its advanced distribution network and workspace solutions offering, supporting durable business demand and enabling margin-resilient B2B growth as decentralized work structures become the norm.

- The sharp focus on operational excellence-including aggressive inventory management, cost optimization, and digital transformation-enables faster cash conversion, improved working capital, and robust free cash flow far exceeding prior cycles, which enhances balance sheet strength and provides substantial capacity for reinvestment or accelerated buybacks, driving EPS expansion.

- The company's expanding portfolio of sustainable and digital solutions positions it as a preferred partner for clients prioritizing ESG and business modernization, enabling ODP to command premium pricing, increase customer stickiness, and structurally upgrade margins across its B2B and supply chain operations.

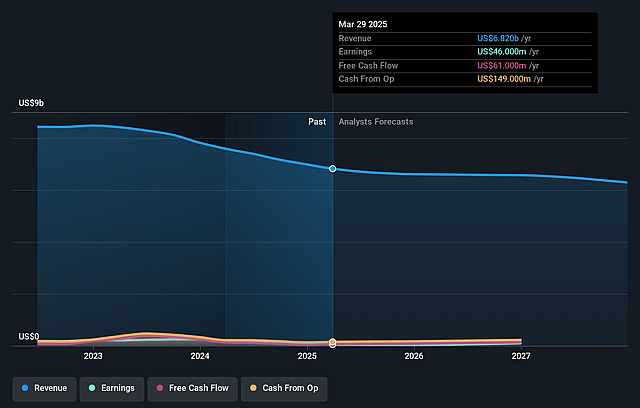

ODP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ODP compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ODP's revenue will decrease by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.7% today to 4.2% in 3 years time.

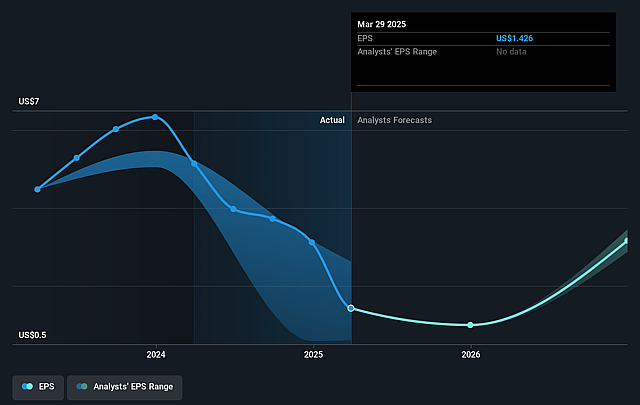

- The bullish analysts expect earnings to reach $252.4 million (and earnings per share of $8.54) by about September 2028, up from $50.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, down from 12.4x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.24%, as per the Simply Wall St company report.

ODP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core office supplies and retail businesses continue to face secular decline, with total revenue falling 8 percent year-over-year and same-store sales down 5 percent, highlighting ongoing headwinds from digitalization, remote work, and shrinking demand, which threatens long-term revenue stability.

- Despite incremental growth efforts in hospitality and B2B, the pace of onboarding new large contracts is slow, and management repeatedly emphasizes that these gains are still in early stages and not yet sufficient to offset declines in traditional categories, making full top-line recovery an uncertain and potentially distant prospect.

- The continued closure of retail stores and distribution centers, as driven by the Optimize for Growth restructuring plan, indicates ongoing pressure from declining customer traffic and higher fixed costs, which could lead to further margin compression and reduced earnings power if the new growth segments do not scale quickly enough.

- Industry-wide competition from large e-commerce platforms and retail consolidation may cause further margin pressure and threaten market share, especially as ODP's digital pivot and international expansion remain limited, increasing revenue and net margin vulnerability to U.S. market disruptions.

- The company's exposure to the cyclical U.S. economy, sensitivity to macroeconomic shocks (such as weakening labor markets), and inability to fully pass through cost increases from tariffs or supplier inflation could undermine net margins and cash flow, increasing profit volatility over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ODP is $41.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ODP's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $252.4 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 12.2%.

- Given the current share price of $20.63, the bullish analyst price target of $41.0 is 49.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ODP?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.