Key Takeaways

- Declining demand for traditional office supplies and rising e-commerce competition are constraining revenue and eroding market share.

- High fixed costs and transformation risks limit margin improvement and signal ongoing pressure on profitability and cash flow.

- Strategic restructuring, sector diversification, and a shift to higher-margin B2B models are positioning ODP for resilient growth, improved margins, and greater long-term financial stability.

Catalysts

About ODP- Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

- Acceleration of digitalization and remote work is causing a consistent decline in demand for traditional office supplies, as reflected by ongoing negative sales growth in ODP's core B2B and retail channels, which will put persistent downward pressure on overall revenue.

- The intense shift of procurement to dominant e-commerce platforms and third-party marketplaces is eroding ODP's market share, increasing pricing competition and suggesting continued contraction of top-line sales and gross margins.

- Despite efforts to reposition into adjacent verticals such as hospitality, ODP's high legacy retail store footprint and associated fixed costs remain a significant overhang as foot traffic and same-store sales drop, ultimately compressing operating leverage and limiting improvements in EBITDA and net margins.

- Execution risks in major business transformation initiatives, highlighted by large restructuring charges and recurring asset impairments, are likely to result in volatile operating expenses and possible sub-optimal returns, reducing long-term net income and free cash flow.

- Technological advancements that enable further digital collaboration and automation continue to shrink the need for ODP's core product segments across all customer types, pointing to a structurally declining addressable market and making long-term revenue and profit growth increasingly unlikely.

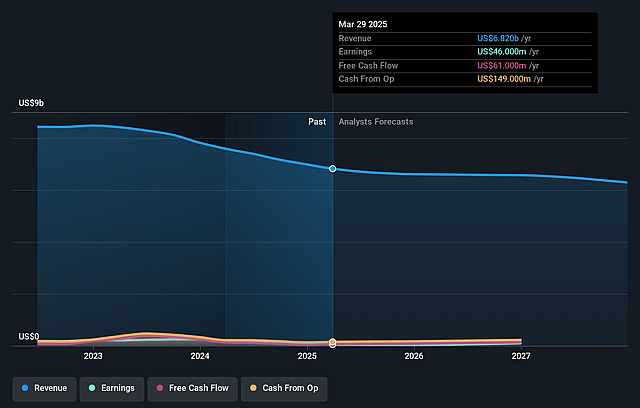

ODP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ODP compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ODP's revenue will decrease by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.7% today to 3.6% in 3 years time.

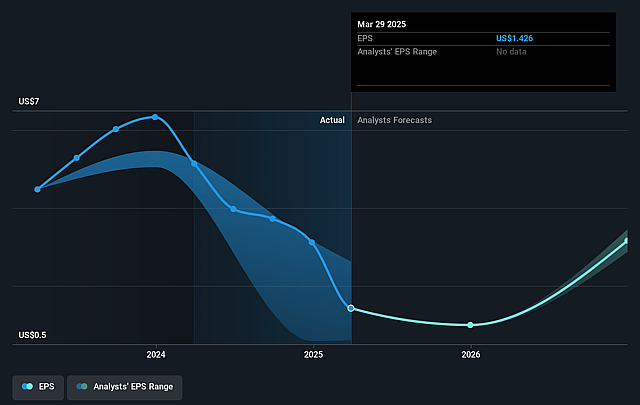

- The bearish analysts expect earnings to reach $218.9 million (and earnings per share of $7.17) by about September 2028, up from $50.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.6x on those 2028 earnings, down from 12.7x today. This future PE is lower than the current PE for the US Specialty Retail industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.26%, as per the Simply Wall St company report.

ODP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ODP's expansion into the rapidly growing hospitality sector, marked by strategic partnerships and onboarding of thousands of new hotel properties, is creating a long-term growth engine that can offset declines in traditional office supply demand, potentially supporting stronger future revenues.

- The successful execution of the Optimize for Growth restructuring plan, with the closure of underperforming stores and facilities, is streamlining fixed costs and improving operating margin efficiency, which can drive sustainable improvements in net margins and earnings.

- Improved working capital management, robust free cash flow generation, and significant debt reduction are strengthening the company's balance sheet and liquidity, giving ODP the flexibility to invest in further growth initiatives and weather market disruptions, which may limit downside risk to cash flow and profitability.

- ODP's pivot towards B2B business models, resulting in higher-margin and recurring revenue streams, is reducing exposure to the cyclical pressures of consumer retail and aligning with secular trends towards outsourced business solutions, supporting stable or growing long-term earnings.

- Investments in adjacent product categories and supply chain capabilities, along with a growing third-party customer base for its Veyer supply chain business, are diversifying revenue streams and increasing operating leverage, which can drive both top-line growth and expanded enterprise value over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ODP is $19.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ODP's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $218.9 million, and it would be trading on a PE ratio of 3.6x, assuming you use a discount rate of 12.3%.

- Given the current share price of $21.16, the bearish analyst price target of $19.0 is 11.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.