Last Update 07 Nov 25

Fair value Increased 9.47%ODP: Acquisition Agreement Will Drive Margin Improvement And Unlock Shareholder Value

Analysts have raised their price target for ODP Corporation from $31.67 to $34.67, citing improved profit margin forecasts and a reduced discount rate following recent acquisition developments.

Analyst Commentary

Following the recent acquisition agreement, analysts have weighed in with a range of viewpoints regarding ODP Corporation's outlook and valuation.

Bullish Takeaways- Bullish analysts highlight improved profit margin forecasts, which could result in stronger earnings performance than previously anticipated.

- The reduced discount rate suggests increased confidence in ODP's risk profile and stable cash flows going forward.

- Potential synergies from the acquisition may unlock additional value and support the raised price target.

- Some see the acquisition premium as a reflection of ODP's underlying value, indicating the deal terms offer shareholders a solid exit opportunity.

- Bearish analysts caution that the downgrade to Market Perform reflects limited upside potential following the acquisition offer at $28 per share.

- There is uncertainty about future strategic direction, as changes under the new ownership could impact execution on previously announced growth initiatives.

- The agreed transaction price is below the revised price target, suggesting potential valuation disconnect or missed growth opportunities for existing investors.

- Concerns remain about integration and execution risks, which could affect the company’s ability to fully realize margin improvements.

What's in the News

- ODP Corporation has entered into a definitive agreement to be acquired by an affiliate of Atlas Holdings for $28 per share in cash. This represents a 34% premium to the closing share price on September 19, 2025. Upon completion, ODP will become a privately held company, and shares will no longer be listed on the NASDAQ stock exchange. (Key Developments)

- ACR Ocean Resources LLC is involved in the acquisition, with the total transaction value estimated at approximately $840 million. The transaction includes up to $975 million in committed financing from Atlas Holdings affiliates as well as specific provisions for termination fees and equity awards for shareholders. (Key Developments)

- The Board of Directors of The ODP Corporation unanimously approved the transaction, which remains subject to antitrust review, regulatory approvals, and a shareholder vote. The deal is expected to close by the end of 2025. (Key Developments)

- A Special/Extraordinary Shareholders Meeting for ODP Corporation is scheduled for December 5, 2025. (Key Developments)

Valuation Changes

- Fair Value: Increased from $31.67 to $34.67. This reflects a more optimistic outlook for ODP’s intrinsic valuation.

- Discount Rate: Decreased from 12.24% to 10.65%. This indicates reduced perceived risk and a lower required return.

- Revenue Growth: Marginally declined from -2.86% to -2.96%, signaling slightly more negative growth expectations.

- Net Profit Margin: Significantly improved from 2.53% to 11.49%. This suggests higher expected profitability.

- Future P/E: Dropped from 8.38x to 2.05x. This implies analysts now expect higher future earnings relative to price.

Key Takeaways

- Shifting toward a solutions-focused B2B model and growing high-margin services is stabilizing earnings and driving long-term profitability.

- Strategic investments in digital infrastructure and supply chain optimization are improving efficiency, reducing costs, and strengthening free cash flow.

- Structural decline in core office supply and retail segments, slow progress in new business streams, and ongoing cost challenges threaten ODP's long-term revenue growth and profitability.

Catalysts

About ODP- Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

- ODP's rapid expansion into the hospitality sector and success in onboarding large customer contracts (e.g., CoreTrust) is beginning to deliver incremental sales, positioning the company to benefit from growing demand for outsourced business services and accelerating B2B revenue growth in the second half of the year and beyond

- likely improving overall company revenue and earnings.

- The transformation to a solutions-centric B2B model, with an increasing share of revenue from adjacency categories and managed services, is driving a shift toward higher-margin recurring revenue streams, supporting long-term net margin expansion and more stable earnings.

- Strategic investments in digital infrastructure, supply chain optimization (e.g., Veyer's 90%+ third-party revenue growth), and inventory management are reducing working capital requirements and SG&A expenses, resulting in stronger free cash flow generation and improved net income.

- ODP's national delivery capabilities and focus on supply chain resilience, coupled with proactive management of tariff impacts, enhance its value proposition in a corporate environment that increasingly demands reliable, proximate supply partners-helping stabilize and grow enterprise business lines, thus supporting future revenue.

- The Optimize for Growth plan's ongoing rationalization of underperforming stores and distribution assets is driving higher operating leverage and cost efficiencies, providing a pathway to expand net earnings as the business mix shifts away from lower-margin and declining retail toward growth sectors.

ODP Future Earnings and Revenue Growth

Assumptions

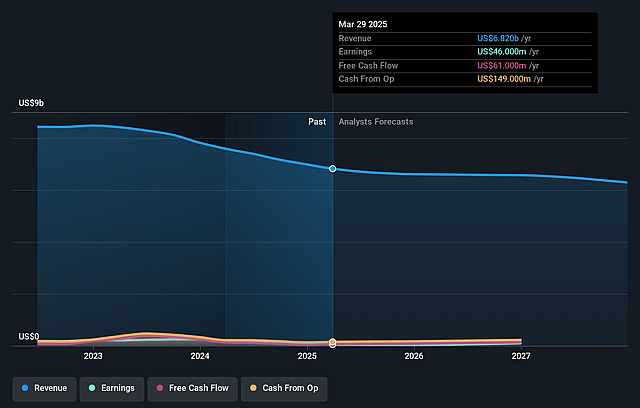

How have these above catalysts been quantified?- Analysts are assuming ODP's revenue will decrease by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 2.5% in 3 years time.

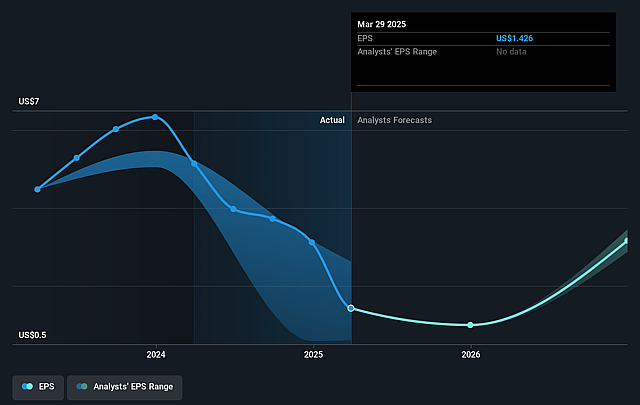

- Analysts expect earnings to reach $155.0 million (and earnings per share of $5.16) by about September 2028, up from $50.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, down from 12.4x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.24%, as per the Simply Wall St company report.

ODP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing decline in ODP's total revenue-down 8% year-over-year-with persistent decreases in both retail and B2B sales signals long-term headwinds as secular demand for traditional office supplies and physical store formats wanes, threatening the company's ability to return to sustainable top-line growth and pressuring future revenues and earnings.

- Planned and ongoing store closures (e.g., 23 in Q2, 60 fewer than prior year) reflect shrinking retail foot traffic and continued secular migration to e-commerce, highlighting a legacy fixed cost structure that risks operating deleverage if comparable sales continue to decline, negatively impacting net margins and operating income.

- Despite momentum in the hospitality and adjacent sectors, management repeatedly characterizes these initiatives as "still small" and "early stage," introducing uncertainty around the timing, scale, and margin profile of new business streams necessary to offset structural declines in core office supply categories-posing a risk to sustained improvements in revenue and earnings growth.

- Persistent restructuring and impairment charges (e.g., $16 million in Q2) highlight organizational challenges in executing its transformation and optimizing its cost base; if new B2B and hospitality revenue streams fail to scale rapidly, ODP may face ongoing restructuring-related cash outflows, further straining free cash flow and reducing capital available for reinvestment or shareholder returns.

- Continued softness in enterprise spending and increased competition from both large e-commerce players and industry consolidation may place downward pressure on pricing, reduce ODP's negotiating leverage with suppliers, and challenge its ability to grow gross margins-especially as a significant portion of its business remains exposed to price-based competition and digital disruption.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.667 for ODP based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $155.0 million, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 12.2%.

- Given the current share price of $20.63, the analyst price target of $31.67 is 34.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ODP?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.