Key Takeaways

- Shifting toward a solutions-focused B2B model and growing high-margin services is stabilizing earnings and driving long-term profitability.

- Strategic investments in digital infrastructure and supply chain optimization are improving efficiency, reducing costs, and strengthening free cash flow.

- Structural decline in core office supply and retail segments, slow progress in new business streams, and ongoing cost challenges threaten ODP's long-term revenue growth and profitability.

Catalysts

About ODP- Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

- ODP's rapid expansion into the hospitality sector and success in onboarding large customer contracts (e.g., CoreTrust) is beginning to deliver incremental sales, positioning the company to benefit from growing demand for outsourced business services and accelerating B2B revenue growth in the second half of the year and beyond

- likely improving overall company revenue and earnings.

- The transformation to a solutions-centric B2B model, with an increasing share of revenue from adjacency categories and managed services, is driving a shift toward higher-margin recurring revenue streams, supporting long-term net margin expansion and more stable earnings.

- Strategic investments in digital infrastructure, supply chain optimization (e.g., Veyer's 90%+ third-party revenue growth), and inventory management are reducing working capital requirements and SG&A expenses, resulting in stronger free cash flow generation and improved net income.

- ODP's national delivery capabilities and focus on supply chain resilience, coupled with proactive management of tariff impacts, enhance its value proposition in a corporate environment that increasingly demands reliable, proximate supply partners-helping stabilize and grow enterprise business lines, thus supporting future revenue.

- The Optimize for Growth plan's ongoing rationalization of underperforming stores and distribution assets is driving higher operating leverage and cost efficiencies, providing a pathway to expand net earnings as the business mix shifts away from lower-margin and declining retail toward growth sectors.

ODP Future Earnings and Revenue Growth

Assumptions

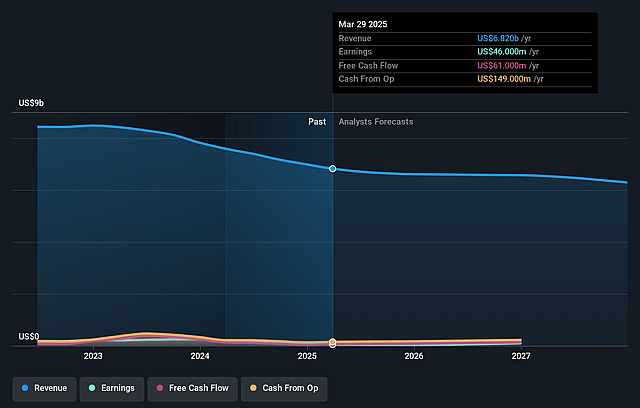

How have these above catalysts been quantified?- Analysts are assuming ODP's revenue will decrease by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 2.5% in 3 years time.

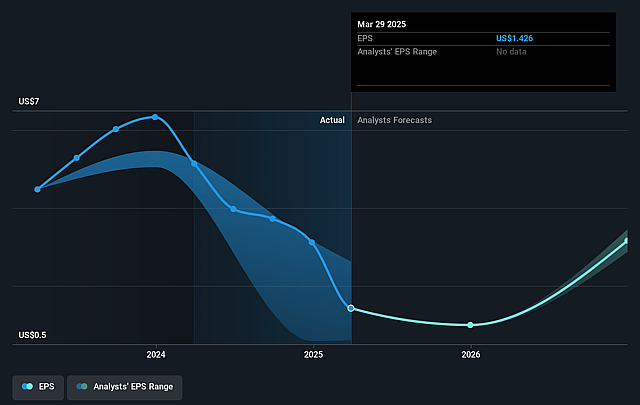

- Analysts expect earnings to reach $155.2 million (and earnings per share of $5.16) by about August 2028, up from $50.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, down from 12.1x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

ODP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing decline in ODP's total revenue-down 8% year-over-year-with persistent decreases in both retail and B2B sales signals long-term headwinds as secular demand for traditional office supplies and physical store formats wanes, threatening the company's ability to return to sustainable top-line growth and pressuring future revenues and earnings.

- Planned and ongoing store closures (e.g., 23 in Q2, 60 fewer than prior year) reflect shrinking retail foot traffic and continued secular migration to e-commerce, highlighting a legacy fixed cost structure that risks operating deleverage if comparable sales continue to decline, negatively impacting net margins and operating income.

- Despite momentum in the hospitality and adjacent sectors, management repeatedly characterizes these initiatives as "still small" and "early stage," introducing uncertainty around the timing, scale, and margin profile of new business streams necessary to offset structural declines in core office supply categories-posing a risk to sustained improvements in revenue and earnings growth.

- Persistent restructuring and impairment charges (e.g., $16 million in Q2) highlight organizational challenges in executing its transformation and optimizing its cost base; if new B2B and hospitality revenue streams fail to scale rapidly, ODP may face ongoing restructuring-related cash outflows, further straining free cash flow and reducing capital available for reinvestment or shareholder returns.

- Continued softness in enterprise spending and increased competition from both large e-commerce players and industry consolidation may place downward pressure on pricing, reduce ODP's negotiating leverage with suppliers, and challenge its ability to grow gross margins-especially as a significant portion of its business remains exposed to price-based competition and digital disruption.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.667 for ODP based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $41.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $155.2 million, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $20.15, the analyst price target of $31.67 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.