Key Takeaways

- Declining demand for fuel and tobacco, coupled with shifting consumer habits, threatens core sales and compresses store margins.

- Inadequate modernization and acquisition risks, along with rising regulatory and labor costs, challenge operational efficiency and earnings sustainability.

- Focused execution on dealerization, loyalty program growth, store remodels, and high-margin categories is boosting profitability, customer engagement, and organic sales, supporting earnings stability.

Catalysts

About Arko- Through its subsidiary, operates a chain of convenience stores in the United States.

- The long-term decline in gasoline consumption due to accelerating electric vehicle adoption and the electrification of transportation directly threatens Arko’s core revenue base, risking significant erosion of fuel gross margins as the market steadily shifts away from traditional fuels.

- Persistent increases in health consciousness, regulatory scrutiny, and mounting restrictions on tobacco and vape products—categories that currently contribute nearly 40% of Arko’s in-store sales—will likely drive sustained pressure on high-margin merchandise revenue, resulting in margin compression and negative same-store sales growth.

- Arko's ongoing reliance on fuel sales and the limited evidence of differentiation or significant modernization in its convenience offerings leaves it acutely vulnerable to long-term e-commerce competition, last-mile delivery disruptions, and consumer preference shifts, which threaten both traffic and ancillary in-store purchases and thus overall revenue growth.

- Aggressive dealerization and acquisition strategies carry integration and execution risk; potential failure to realize projected synergies or preserve existing sales volumes due to licensing delays and operational complexity could result in margin erosion and stall planned improvements in operating income.

- Rising labor costs, tighter compliance regimes, and the growing burden of environmental mandates or carbon taxes are set to structurally elevate Arko’s cost base, especially in rural and low-volume markets, further reducing net margins and challenging the sustainability of current earnings projections.

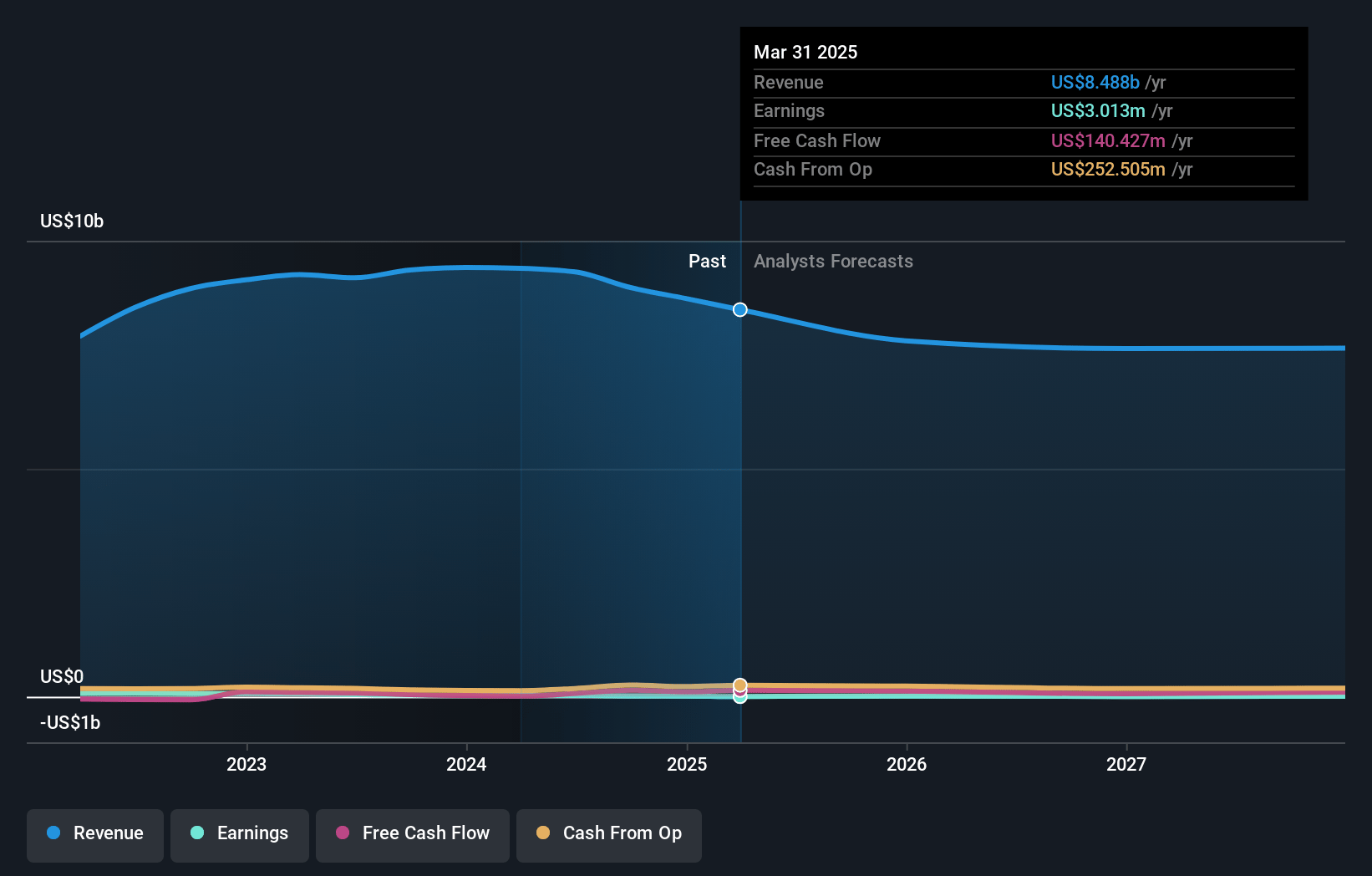

Arko Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arko compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arko's revenue will decrease by 4.1% annually over the next 3 years.

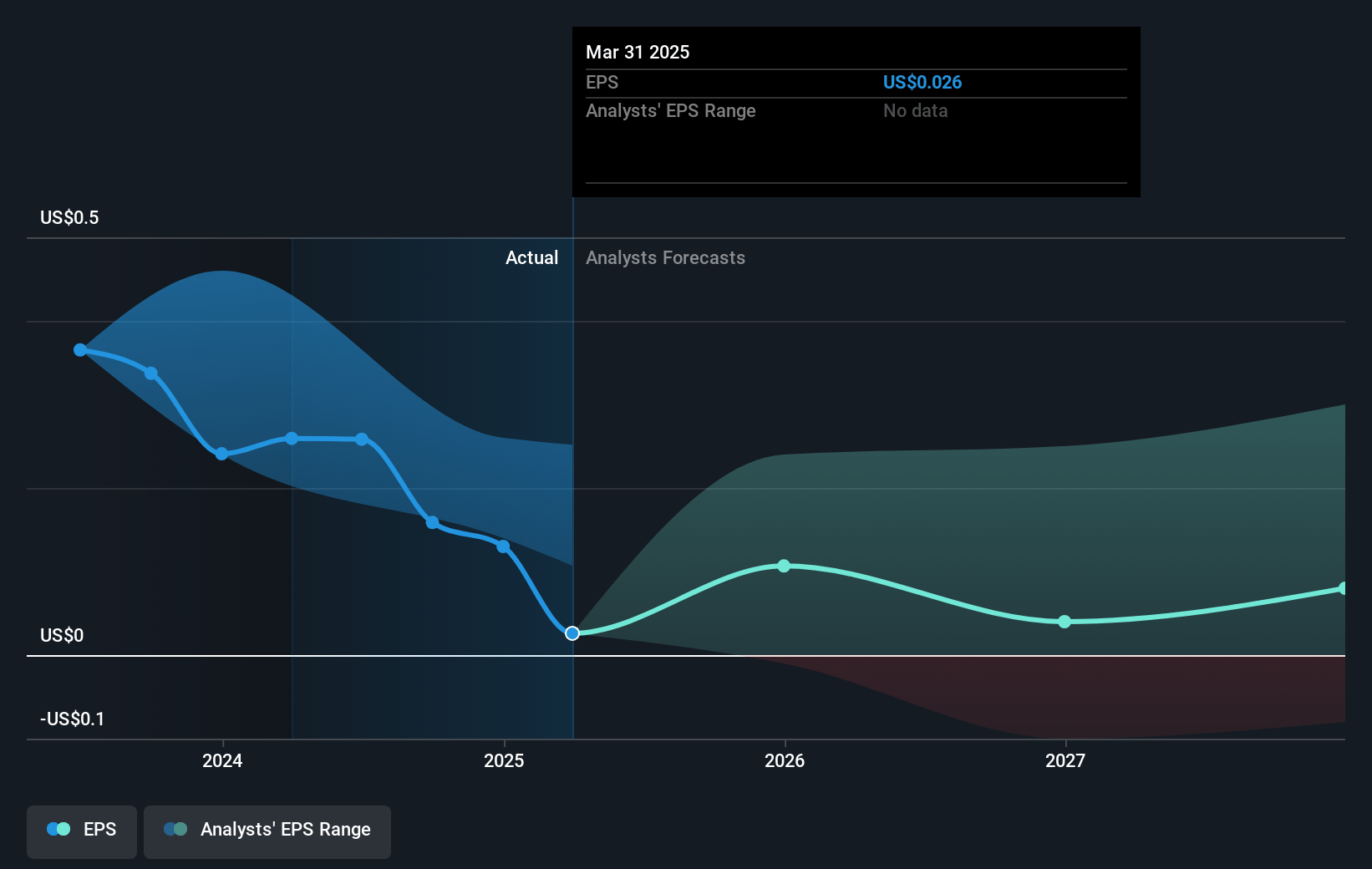

- The bearish analysts are not forecasting that Arko will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arko's profit margin will increase from 0.0% to the average US Specialty Retail industry of 4.4% in 3 years.

- If Arko's profit margin were to converge on the industry average, you could expect earnings to reach $329.1 million (and earnings per share of $3.05) by about July 2028, up from $3.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.1x on those 2028 earnings, down from 163.0x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Arko Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s disciplined execution of its dealerization strategy is generating accretive operating income, with management expecting a cumulative annualized benefit in excess of $20 million, which could improve operating margins and long-term earnings.

- Expansion and strong performance of Arko’s Fast Rewards loyalty program, with 11% year-over-year growth in enrolled memberships and higher per-visit spend, highlights increasing customer engagement and potential for higher same-store sales and revenue growth over time.

- The rollout of store remodels focused on high-margin foodservice, with successful pilots potentially leading to wider implementation from 2026 onward, could attract higher traffic and drive organic growth, thereby enhancing both top-line revenue and net margins.

- Investments in high-margin categories such as Other Tobacco Products (OTP) are capturing market share and driving basket growth, which, if sustained, could offset declines in other categories and support stable or growing gross profit.

- Industry fuel margin strength and constructive trends in wholesale and fleet segments are leading to robust segment-level operating income, with management proactively optimizing costs and capital allocation, which could support both earnings stability and improved shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arko is $4.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arko's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $7.5 billion, earnings will come to $329.1 million, and it would be trading on a PE ratio of 2.1x, assuming you use a discount rate of 11.6%.

- Given the current share price of $4.31, the bearish analyst price target of $4.5 is 4.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.