Key Takeaways

- Store renovations, loyalty program expansion, and higher-margin merchandise are driving increased per-store revenue, stronger gross margins, and improved customer retention.

- Dealerization and focus on high-growth markets are boosting operating income, optimizing profitability, and supporting long-term market share expansion.

- Shifting energy trends, changing consumer habits, technological disruption, and competitive pressures threaten Arko's core revenue streams, margins, and sustainability of its current growth strategy.

Catalysts

About Arko- Through its subsidiary, operates a chain of convenience stores in the United States.

- Arko is aggressively pursuing a transformation strategy centered on remodeling stores with elevated foodservice and grab-and-go offerings, as well as enhanced value promotions and loyalty integration. These initiatives directly address evolving consumer demand for convenience, speed, and personalized value, and are set to boost per-store revenue growth and expand gross margins through an increased non-fuel sales mix and higher spending per trip.

- The ongoing dealerization program, which converts company-operated stores into higher-margin wholesale dealer sites, has already delivered millions in incremental annualized operating income and is expected to surpass $20 million in annual operating income benefit at scale. As the pace of store conversions accelerates and associated G&A savings are realized, this will meaningfully improve EBITDA and net margins over the coming years.

- Rollout and expansion of the Fast Rewards loyalty program, combined with data-driven promotional campaigns like Fueling America Future, have already resulted in 35% daily loyalty enrollment growth, increased visit frequency, and higher average basket sizes. As Arko continues to scale digital engagement, these efforts will support steady increases in customer retention, spend per visit, and ultimately, comparable store sales and earnings.

- Investments in higher-margin merchandise categories such as other tobacco products (OTP) and fresh food, as well as data-driven inventory and category management, are reshaping the sales mix toward categories with significantly stronger gross margin profiles. As this continues, Arko is positioned to sustain and grow profitability even in a competitive fuel-pricing and macro environment.

- As suburban population growth and demographic shifts continue to drive rising demand for local, easily accessible retail and fuel options, Arko's strategy of targeted capital deployment in fast-growing markets leverages this trend to support long-term same-store sales and market share gains, underpinning bullish projections for sustained top-line and operating income growth.

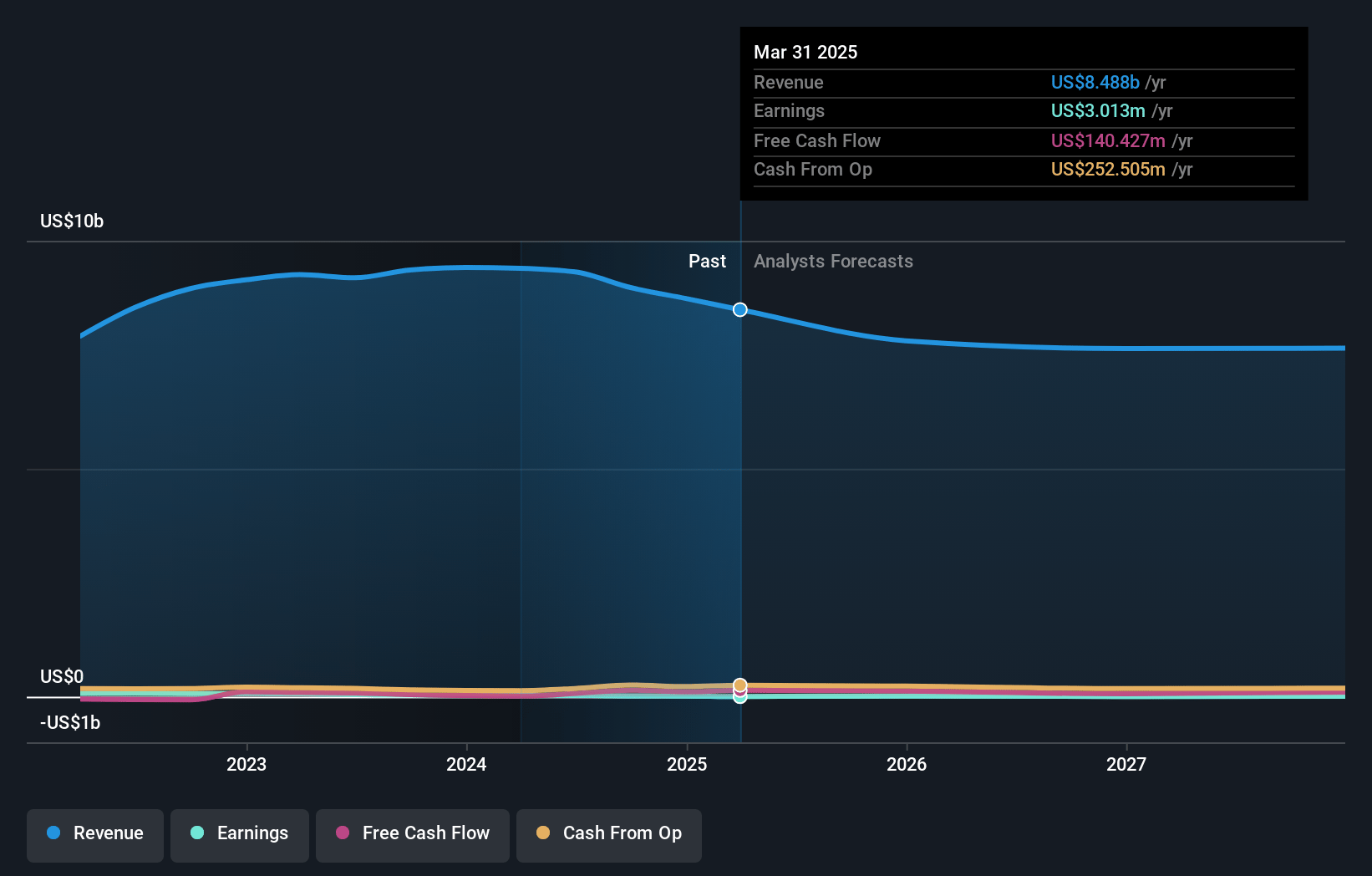

Arko Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Arko compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Arko's revenue will decrease by 3.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.0% today to 0.5% in 3 years time.

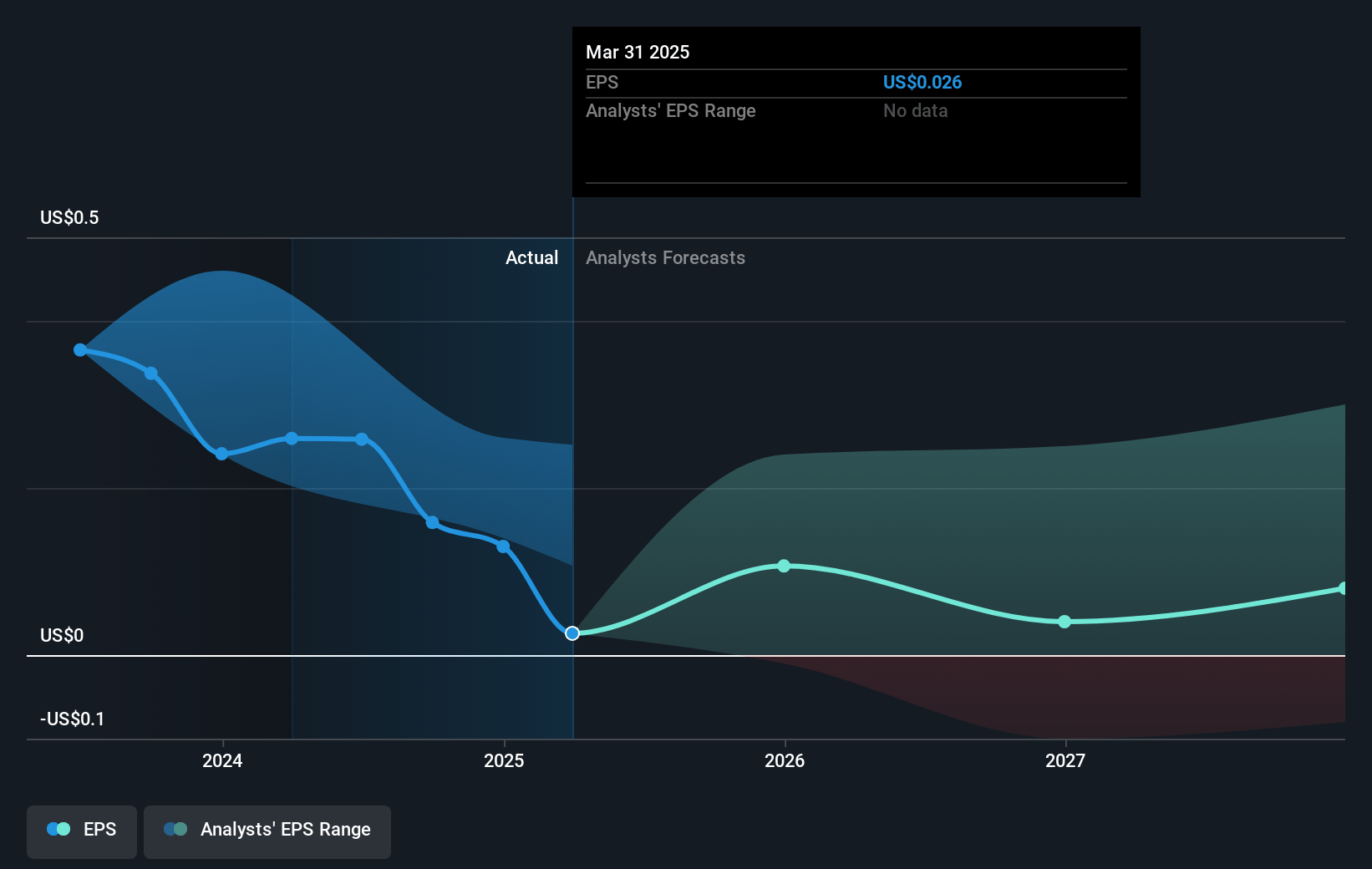

- The bullish analysts expect earnings to reach $35.2 million (and earnings per share of $0.31) by about July 2028, up from $3.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.6x on those 2028 earnings, down from 171.7x today. This future PE is greater than the current PE for the US Specialty Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to decline by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Arko Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift toward electric vehicles and stricter emissions standards will likely drive a long-term decline in gasoline demand, which is core to Arko's retail and wholesale segments, putting structural pressure on both revenues and fuel margins.

- Declining consumer interest in tobacco and nicotine, with cigarettes and other tobacco products currently accounting for around 39 percent of sales and a significant portion of in-store margin, presents a secular headwind to same-store merchandise revenues and profitability in key categories.

- Margins are at risk from intensifying industry competition and technological disruption, including the rise of cashierless store models and digital payment systems; failure to invest adequately or execute upgrades could result in lost market share and require significant ongoing capital expenditures, compressing future earnings.

- The current growth model relies heavily on store acquisition, dealerization, and organic remodels, but as integration risk mounts and the number of attractive targets falls, a slowdown in acquisition-driven expansion could weaken top-line revenue growth and materially lower future EBITDA and earning potential.

- Industry trends toward urbanization and delivery-based shopping may reduce foot traffic and customer dependence on traditional C-store formats, threatening Arko’s retail volumes and same-store sales while already thin net margins leave the business highly exposed to even modest revenue or volume declines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Arko is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arko's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.7 billion, earnings will come to $35.2 million, and it would be trading on a PE ratio of 42.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $4.54, the bullish analyst price target of $10.0 is 54.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.