Last Update 23 Sep 25

Fair value Increased 4.14%Despite a decline in revenue growth forecasts and a slight increase in forward P/E, Pebblebrook Hotel Trust's consensus analyst price target has edged up from $12.08 to $12.58.

What's in the News

- Pebblebrook Hotel Trust revised full-year 2025 net loss guidance to a narrower range of $26.5 million to $12.0 million, assuming stable travel conditions.

- No shares were repurchased between April 1 and June 30, 2025; the company has completed repurchasing 2,604,724 shares (2.17%) for $32.41 million under its buyback program.

- Q3 2025 earnings guidance issued, projecting net income of $4.0 million to $11.0 million.

Valuation Changes

Summary of Valuation Changes for Pebblebrook Hotel Trust

- The Consensus Analyst Price Target has risen slightly from $12.08 to $12.58.

- The Consensus Revenue Growth forecasts for Pebblebrook Hotel Trust has significantly fallen from 2.8% per annum to 2.4% per annum.

- The Future P/E for Pebblebrook Hotel Trust has risen slightly from 33.66x to 34.84x.

Key Takeaways

- Reinvestment in upgraded assets and adoption of automation technologies are driving higher margins, increased efficiencies, and stronger revenue streams across the portfolio.

- Major upcoming city events and prudent risk management position the company for substantial urban market growth and resilient long-term earnings.

- Heavy reliance on urban gateway markets, rising labor costs, and evolving travel trends expose the company to revenue unpredictability, margin compression, and long-term competitive threats.

Catalysts

About Pebblebrook Hotel Trust- Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real estate investment trust ("REIT") and the largest owner of urban and resort lifestyle hotels and resorts in the United States.

- The ongoing recovery and strengthening of urban hotel demand, particularly in major gateway cities like San Francisco (where occupancy climbed from ~64% to nearly 70% year-over-year and remains well below peak levels), signals robust upside for further RevPAR and revenue growth as global travel and urbanization trends persist and major events return to cities.

- Strategic reinvestment and repositioning of key assets-such as the multimillion-dollar redevelopment of Newport Harbor Island Resort and other properties-are driving outsized gains in both room and high-margin ancillary revenue streams (e.g., F&B and event spaces), pointing to above-average NOI and margin expansion as newly upgraded assets achieve stabilization.

- Accelerated adoption of AI-enabled and automation technology across hotel operations is beginning to yield material cost efficiencies and productivity gains, with management expecting further reductions in per-occupied-room expenses and operating margins to structurally improve as technology diffusion continues.

- The portfolio is set to benefit from a loaded pipeline of major citywide events, convention calendars, and sports/entertainment spectacles (World Cup, Super Bowl, Olympics) in 2026–2028, which are expected to significantly boost occupancy, push ADR higher, and drive revenue growth in core urban markets.

- Proactive risk management, strong balance sheet positioning (low fixed-rate debt and high cash/reserves), and continued focus on asset recycling and CapEx discipline enhance FFO visibility and enable the company to capitalize on sector consolidation trends, supporting resilient long-term earnings growth.

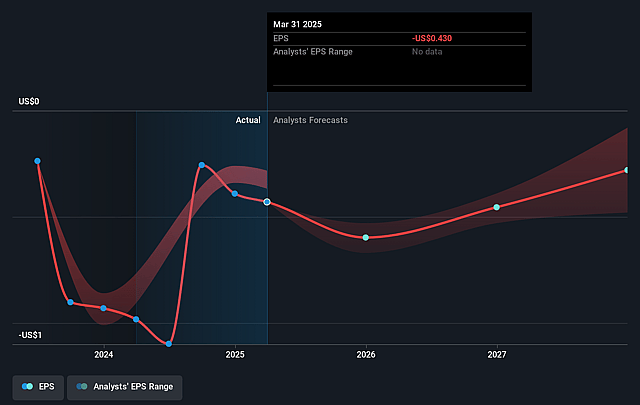

Pebblebrook Hotel Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pebblebrook Hotel Trust's revenue will grow by 2.8% annually over the next 3 years.

- Analysts are not forecasting that Pebblebrook Hotel Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Pebblebrook Hotel Trust's profit margin will increase from -4.4% to the average US Hotel and Resort REITs industry of 3.7% in 3 years.

- If Pebblebrook Hotel Trust's profit margin were to converge on the industry average, you could expect earnings to reach $58.3 million (and earnings per share of $0.5) by about September 2028, up from $-64.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.7x on those 2028 earnings, up from -21.3x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.85%, as per the Simply Wall St company report.

Pebblebrook Hotel Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pebblebrook's high geographic concentration in urban gateway markets like Los Angeles, San Francisco, Boston, and Seattle exposes it to underperformance risk versus faster-growing leisure and Sunbelt markets, which may result in stagnating or declining revenue growth if business and international travel to these areas fails to recover to historical highs.

- Increasing labor costs, unionization pressures, and potential wage legislation in major cities such as Los Angeles and San Diego could continue to put downward pressure on operating margins, especially as wage increases may outpace the benefits gained from AI-driven or efficiency initiatives in the medium to long term.

- The persistent trend toward shorter booking windows and higher leisure price sensitivity, coupled with rising competition from alternative accommodations (like Airbnb and Vrbo), could reduce Pebblebrook's pricing power and lead to unpredictable occupancy and average daily rate (ADR) levels, directly impacting revenue and earnings stability.

- Ongoing exposure to climate risks-including severe weather and hurricanes, especially in markets like Naples, Florida-not only threatens operational interruptions but also elevates capex and insurance costs in the long-term, potentially pressuring free cash flow and net margins even with improved recent insurance rates.

- Structural shifts such as the continuation of remote/hybrid work and the evolution toward virtual or hybrid meetings may lead to structurally lower group and business travel demand in urban hotels, cutting into critical group bookings and ancillary revenues, and creating a long-term headwind for revenue and profitability growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.083 for Pebblebrook Hotel Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $58.3 million, and it would be trading on a PE ratio of 33.7x, assuming you use a discount rate of 11.9%.

- Given the current share price of $11.54, the analyst price target of $12.08 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.