Key Takeaways

- Revitalized urban markets, strategic redevelopments, and travel trends position Pebblebrook for sustained rate, occupancy, and margin outperformance compared to cautious analyst expectations.

- Strong barriers to new supply and technological advancements should drive pricing power, operational efficiency, and multi-year growth in revenue and profitability.

- Structural changes in travel demand, urban concentration risks, labor cost pressures, alternative lodging competition, and high leverage threaten profitability and long-term growth prospects.

Catalysts

About Pebblebrook Hotel Trust- Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real estate investment trust ("REIT") and the largest owner of urban and resort lifestyle hotels and resorts in the United States.

- Analyst consensus expects the recovery in key urban markets like San Francisco to drive revenue and RevPAR higher as demand builds, but this view likely underestimates further upside; with occupancy rates still trailing well below pre-pandemic peaks and visionary city leadership now focused on improving market fundamentals, there is potential for an extended, multi-year outperformance in both rate and occupancy, leading to far stronger top-line growth than currently anticipated.

- While analysts broadly see property reinvestment and redevelopment fueling above-average margin expansion, the market may be missing the magnitude and persistence of this effect: most major redevelopments (e.g., Newport Harbor Island Resort, Estancia, 1 Hotel San Francisco) are still ramping, indicating multiple years of strong EBITDA growth and margin expansion ahead as these assets achieve full stabilization and capitalize on rising group, leisure, and ancillary revenues.

- The accelerating shift toward experience-based consumer spending and the rise of digital nomadism bode particularly well for Pebblebrook's high-end urban and resort portfolio, supporting structurally higher year-round occupancy and rate growth, which will translate into enhanced revenue stability and improved net margins over the next economic cycle.

- Industry-wide barriers to new supply in premier urban and resort markets are at generational highs-Pebblebrook is uniquely positioned to extract pricing power and drive outsized RevPAR and earnings growth as demand inevitably outpaces new inventory, providing a sustainable tailwind for multi-year cash flow growth.

- Rapid adoption of advanced AI, automation, and sustainability technologies across hotel operations positions Pebblebrook as an industry leader in cost control and operational efficiency, creating the potential for structural declines in per-occupied-room expenses and meaningfully higher EBITDA margins, with benefits accelerating over the medium to long term.

Pebblebrook Hotel Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Pebblebrook Hotel Trust compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Pebblebrook Hotel Trust's revenue will grow by 3.0% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Pebblebrook Hotel Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Pebblebrook Hotel Trust's profit margin will increase from -4.4% to the average US Hotel and Resort REITs industry of 3.7% in 3 years.

- If Pebblebrook Hotel Trust's profit margin were to converge on the industry average, you could expect earnings to reach $58.7 million (and earnings per share of $0.51) by about September 2028, up from $-64.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.3x on those 2028 earnings, up from -21.1x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.69%, as per the Simply Wall St company report.

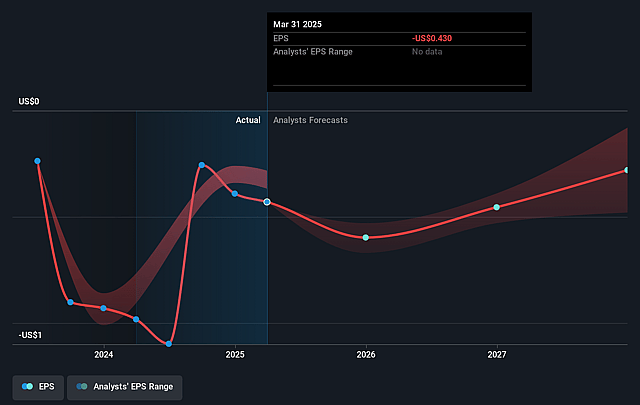

Pebblebrook Hotel Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent adoption of remote and hybrid work models has led to structurally lower business travel and group demand, particularly impacting Pebblebrook's urban hotels and risking long-term underperformance in revenue growth relative to historical norms.

- Heavy concentration in major urban markets such as San Francisco, Los Angeles, New York, and Washington, DC increases vulnerability to slow post-pandemic urban recovery, ongoing urban flight, and any renewed social or economic disruptions, all of which could suppress occupancy rates and limit revenue stability.

- Sector-wide labor cost inflation driven by union renegotiations, local minimum wage increases, and persistent staffing challenges, especially in cities like Los Angeles and San Diego, threaten to outpace efficiency gains and erode net margins over time despite current cost-control initiatives.

- Ongoing competitive pressure from home-sharing platforms and shifts in traveler preferences toward alternative accommodation continue to compress hotel ADRs and occupancy rates, challenging Pebblebrook's ability to sustain profitable revenue growth and maintain earnings power.

- Elevated leverage and substantial recurring capital needs for portfolio redevelopment, environmental upgrades, or refinancing-against a backdrop of rising interest rates or tightened credit conditions-pose risks to long-term free cash flow, increase debt servicing costs, and may constrain future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Pebblebrook Hotel Trust is $17.53, which represents two standard deviations above the consensus price target of $12.08. This valuation is based on what can be assumed as the expectations of Pebblebrook Hotel Trust's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $58.7 million, and it would be trading on a PE ratio of 48.3x, assuming you use a discount rate of 11.7%.

- Given the current share price of $11.44, the bullish analyst price target of $17.53 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.