Key Takeaways

- Ongoing shifts to remote work and growth of alternative lodging constrain demand and pricing power, pressuring long-term revenue and occupancy rates for urban hotels.

- Concentration in costly urban markets, rising operational expenses, and climate-related risks threaten stability, compress margins, and undermine future earnings reliability.

- Strategic renovations, operational efficiencies, and favorable urban travel trends are driving sustainable revenue growth, margin expansion, and robust long-term demand for Pebblebrook's hotel portfolio.

Catalysts

About Pebblebrook Hotel Trust- Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real estate investment trust (“REIT”) and the largest owner of urban and resort lifestyle hotels and resorts in the United States.

- Sustained adoption of remote and hybrid work models is likely to result in structurally lower corporate and group travel demand, especially for high-cost urban hotels in Pebblebrook's portfolio, undermining future occupancy rates and compressing revenue growth for the long term.

- The persistent popularity of alternative lodging platforms such as Airbnb and VRBO among younger travelers is expected to erode traditional hotel demand and limit Pebblebrook's ability to exercise pricing power, negatively impacting RevPAR and revenue streams.

- Pebblebrook's heavy concentration in dense urban markets exposes the company to outsized risks from local economic downturns, stricter municipal regulations, and delayed recovery post-pandemic, compromising revenue stability and reducing long-term growth potential.

- Historic properties in premium locations are inherently subject to rising maintenance, labor, and property tax costs, particularly as new wage legislations in cities like Los Angeles and San Diego come into effect, leading to ongoing net margin compression despite attempted operational efficiencies.

- Long-term climate risks, including the increasing frequency of severe weather events and the associated rise in insurance premiums and potential asset impairments, are likely to escalate operating expenses and hamper earnings reliability well into the future.

Pebblebrook Hotel Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Pebblebrook Hotel Trust compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Pebblebrook Hotel Trust's revenue will grow by 1.8% annually over the next 3 years.

- The bearish analysts are not forecasting that Pebblebrook Hotel Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Pebblebrook Hotel Trust's profit margin will increase from -4.4% to the average US Hotel and Resort REITs industry of 3.7% in 3 years.

- If Pebblebrook Hotel Trust's profit margin were to converge on the industry average, you could expect earnings to reach $56.6 million (and earnings per share of $0.49) by about September 2028, up from $-64.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, up from -21.7x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 30.4x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

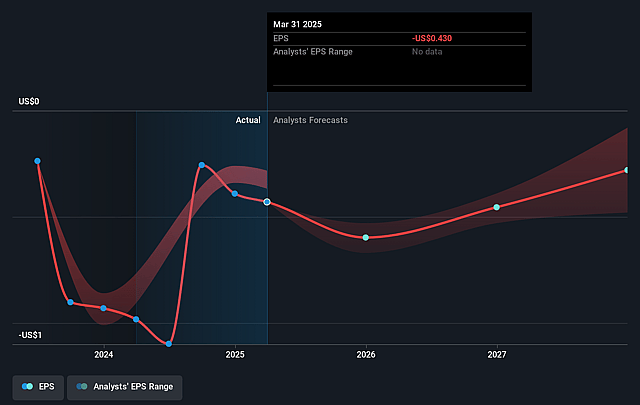

Pebblebrook Hotel Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pebblebrook's strategic investments in property upgrades and redevelopments are driving significant outperformance at renovated hotels, enabling multiple years of above-market RevPAR growth and higher cash flow, which supports the expansion of both revenues and earnings.

- The company's active cost management and adoption of AI-enabled operational efficiencies are resulting in declining same-property expenses per occupied room and improved margins, which could fuel sustained net operating income and profitability growth.

- Recovering business and group travel, especially in major urban markets like San Francisco and a robust calendar of large-scale events in 2026 and beyond, are driving strong group booking pace and ADR increases, indicating durable demand that can positively impact revenues.

- Pebblebrook maintains prudent balance sheet management, with low-cost, mostly fixed-rate debt and no major maturities until late 2026, supporting ample liquidity and reducing interest expense risk, which helps protect long-term earnings.

- Secular tailwinds in urban travel and the hospitality industry, including experience-focused consumer spending and restricted new hotel supply in gateway markets, position Pebblebrook's high-quality, centrally located portfolio for resilient demand and strengthening pricing power, ultimately supporting longer-term revenue and free cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Pebblebrook Hotel Trust is $9.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Pebblebrook Hotel Trust's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $56.6 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $11.79, the bearish analyst price target of $9.0 is 31.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.