Key Takeaways

- Focus on secondary and tertiary markets, coupled with strong leasing and property demand, supports stable occupancy and margin improvement.

- Prudent acquisitions, disciplined capital management, and operator transitions reduce risk and underpin reliable revenue and dividend growth.

- Heavy reliance on acquisitions, asset sales, and exposure to distressed tenants heighten risk of revenue volatility, margin compression, and portfolio growth challenges in a shifting healthcare environment.

Catalysts

About Community Healthcare Trust- A real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States.

- Demand for CHCT's property types is underpinned by the aging U.S. population and the shift from inpatient to outpatient care, which supports rising occupancy and rental rates; as leasing activity remains strong and new properties are coming online with long-term leases, this should drive steady revenue and net operating income growth.

- CHCT's strategic focus on secondary and tertiary markets-where competitive supply remains limited-provides insulation from oversupply and positions the company for above-average occupancy, helping to stabilize and potentially improve net margins over the next several years.

- Planned acquisitions totaling $146 million with expected yields above 9% and long-term lease expirations create a clear, forward-looking pipeline of revenue growth, while prudent capital recycling (instead of equity dilution or excessive leverage) should optimize capital deployment and protect earnings per share.

- The anticipated transition of the troubled geriatric behavioral hospital portfolio to an experienced, well-capitalized operator reflects sector-wide consolidation trends and is likely to reduce credit risk, stabilize occupancy, and normalize rent collections, materially improving near-term revenue reliability and lowering bad debt risk.

- Continued discipline in balance sheet management-targeting modest leverage, avoiding over-reliance on revolvers, and controlling G&A costs post-restructuring-positions CHCT to maintain EPS accretion and dividend growth even in periods of capital market volatility, supporting long-term investor returns.

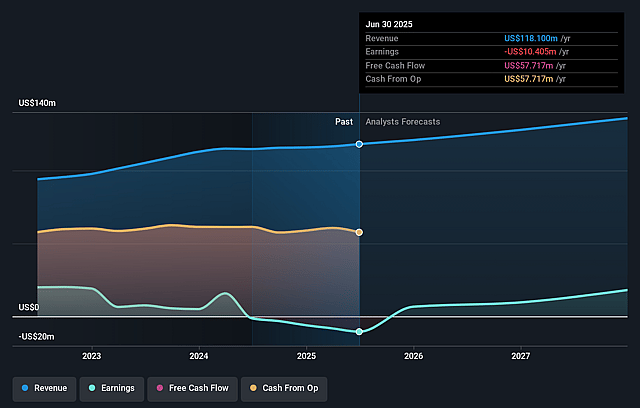

Community Healthcare Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Community Healthcare Trust's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.8% today to 13.3% in 3 years time.

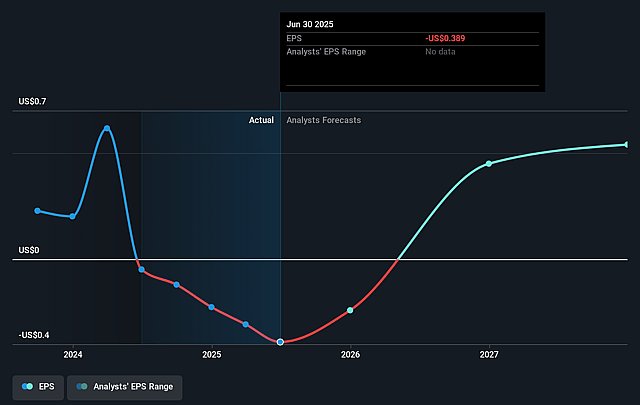

- Analysts expect earnings to reach $19.8 million (and earnings per share of $0.54) by about September 2028, up from $-10.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.7x on those 2028 earnings, up from -39.1x today. This future PE is lower than the current PE for the US Health Care REITs industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.03%, as per the Simply Wall St company report.

Community Healthcare Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has significant exposure to a distressed geriatric behavioral hospital tenant, leading to full reserves on notes and interest, reduced operating income, and ongoing uncertainty about lease terms and transaction completion, which may contribute to revenue volatility and credit losses.

- Persistent reliance on acquisitions to drive portfolio growth amid higher acquisition yields (9.1–9.75%) and property dispositions at lower cap rates (7.5–8%) in a competitive market could compress future net margins if yield spreads narrow or if financing costs rise.

- The company's dependence on capital recycling and asset sales-rather than equity issuance or new borrowing-to fund acquisitions in the current interest rate environment creates execution risk around completing planned investments, potentially limiting portfolio and AFFO growth if asset dispositions are delayed or priced below expectations.

- Slight declines in portfolio occupancy (from 90.9% to 90.7%) and notable lease expirations coming in 2026 (12% of portfolio) could signal increased leasing and vacancy challenges, especially if secular headwinds like telehealth adoption or changes in healthcare delivery reduce demand for physical outpatient facilities, impacting rental revenues and occupancy rates.

- One-time severance and transition costs, along with prior tenant-related credit losses, illustrate potential operational and transition execution risk, raising the prospect of elevated G&A or unexpected expenses that could pressure both net margins and bottom-line earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.1 for Community Healthcare Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $148.8 million, earnings will come to $19.8 million, and it would be trading on a PE ratio of 33.7x, assuming you use a discount rate of 9.0%.

- Given the current share price of $15.11, the analyst price target of $19.1 is 20.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.