Key Takeaways

- Reliance on financially weaker tenants and exposure to regional downturns raise risks of inconsistent rent collections, higher vacancies, and reduced earnings growth.

- Limited access to capital and regulatory pressures may restrict acquisition opportunities and leasing demand, constraining future income and dividend expansion.

- Tenant financial instability, capital recycling reliance, high leverage, vacancy risks, and persistent tenant credit concerns threaten revenue growth, earnings predictability, and cash flow stability.

Catalysts

About Community Healthcare Trust- A real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States.

- While CHCT stands to benefit over time from the expanding healthcare needs of aging populations in rural and secondary markets, persistent credit issues with a significant geriatric behavioral hospital tenant highlight the vulnerability of operators serving these demographics, raising the risk of inconsistent rent collections and downward pressure on revenue growth.

- Although the sector continues to benefit from a nationwide shift toward outpatient care and value-based healthcare models that increase demand for specialized real estate, pressure from telehealth adoption and possible regulatory tightening could undermine long-term leasing demand for certain facility types, increasing the risk of higher average vacancies and lease roll-downs that limit earnings growth.

- Despite management's disciplined acquisition strategy and active capital recycling, the company's focus on secondary and tertiary markets leaves it exposed to regional economic downturns, which could trigger elevated tenant defaults and reduce occupancy rates, with a negative impact on net operating income and portfolio stability.

- While CHCT demonstrates prudent leverage and refuses to overextend its balance sheet, the secular rise in interest rates and the lack of access to equity capital in the current environment may restrict its ability to fully execute on its acquisition pipeline, limiting AFFO and future dividend growth opportunities.

- Although tenant diversification remains a strategic priority, continued reliance on financially weaker, non-investment grade tenants may result in structurally higher credit losses and drag on net margins, especially if reimbursement pressures or cost increases strain tenant operations over the next several years.

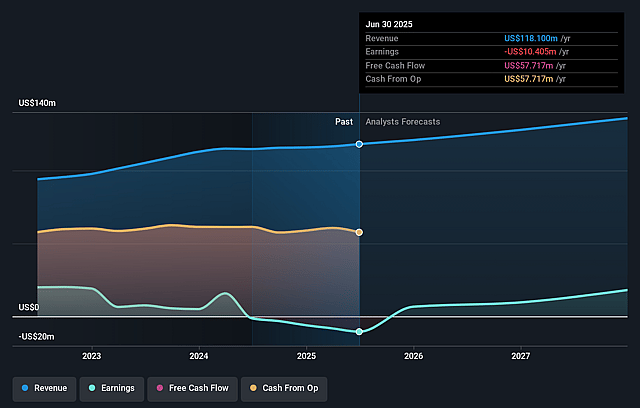

Community Healthcare Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Community Healthcare Trust compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Community Healthcare Trust's revenue will grow by 4.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -8.8% today to 17.9% in 3 years time.

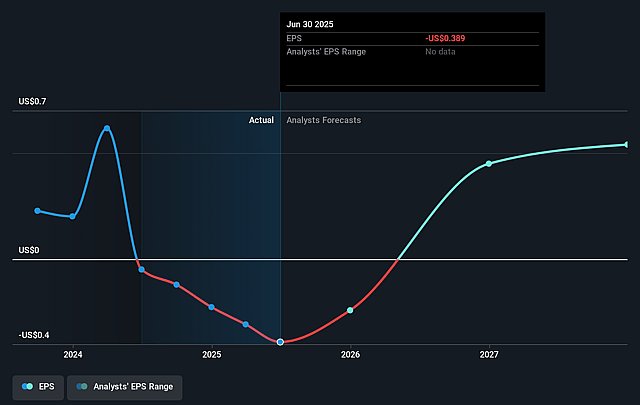

- The bearish analysts expect earnings to reach $24.0 million (and earnings per share of $0.84) by about September 2028, up from $-10.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from -39.2x today. This future PE is lower than the current PE for the US Health Care REITs industry at 34.8x.

- Analysts expect the number of shares outstanding to grow by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.0%, as per the Simply Wall St company report.

Community Healthcare Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant credit losses related to the geriatric behavioral hospital tenant, including an $8.7 million credit loss reserve and a full reversal of interest receivables, indicate ongoing tenant financial instability that could lead to further rent collection uncertainty and ultimately hurt total revenue and funds from operations over the long term.

- Reliance on capital recycling to fund acquisitions, rather than issuing equity due to a subdued share price, may limit the company's ability to grow its portfolio if suitable assets cannot be sold at attractive prices, constraining long-term earnings and making net income growth more volatile.

- Persistently high leverage from using the revolving credit facility for acquisitions, in a rising or prolonged higher interest rate environment, could increase interest expense and restrict financial flexibility, putting sustained pressure on net margins.

- Vacancies and upcoming lease expirations (including 5% of the portfolio in the second half of the year and 12% in 2026) present a risk if core occupancy does not improve as expected, especially if company efforts to enhance leasing and portfolio performance do not deliver results, which would negatively impact rental revenue and cash flow stability.

- The company's track record of tenant exposure, as evidenced by 15 to 20 names consistently on the tenant watch list and previous willingness to advance significant leverage to tenants, raises concerns about tenant credit risk and future probability of bad debt, which could result in further write-downs, depressed funds from operations, and decreased predictability of long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Community Healthcare Trust is $17.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Community Healthcare Trust's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $134.0 million, earnings will come to $24.0 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 9.0%.

- Given the current share price of $15.17, the bearish analyst price target of $17.0 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.