Key Takeaways

- Upgrading operators and management could drive faster revenue and occupancy gains, with operational improvements likely underestimated by the market.

- Attractive acquisitions and sector trends position CHCT for outsized growth, stable earnings, and stronger long-term dividend potential.

- Overreliance on a troubled major tenant, asset sales for funding, and exposure to industry shifts and rising costs heighten uncertainty, risk, and potential revenue pressures.

Catalysts

About Community Healthcare Trust- A real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States.

- Analyst consensus expects the transition of the troubled geriatric hospital portfolio to simply stabilize rent collections and reduce credit risk, but the introduction of an experienced and financially strong operator-already active in geriatric psych care-could unlock substantial incremental occupancy and rental rate gains, meaningfully accelerating revenue and net operating income beyond current expectations.

- While analysts broadly agree that capital recycling will allow CHCT to fund acquisitions without excessive leverage or equity dilution, management's stated intent to close the $146 million pipeline with asset sales and existing capacity-against very attractive acquisition yields above nine percent and disposition cap rates as low as seven and a half-creates an immediate and accretive arbitrage potential that could drive above-trend earnings growth and margin expansion.

- The combination of an aging US population and the accelerating shift toward outpatient care is likely to boost demand for modern facilities in CHCT's secondary and tertiary markets well beyond current forecasts, supporting sustained high occupancy, upward rental resets, and robust long-term same-store revenue growth.

- The recent hiring of a Senior Vice President of Asset Management with a strong track record at leading healthcare REITs positions CHCT for operational outperformance through more proactive leasing and redevelopment initiatives, which could meaningfully improve core portfolio occupancy and drive higher net operating income run rates than currently embedded by the market.

- CHCT's continued expansion into highly fragmented, non-urban healthcare real estate creates an opportunity for outsized external growth by consolidating assets at attractive cap rates, while the resilience of healthcare expenditures and low tenant concentration risk suggest greater stability and predictability of future earnings and dividend growth.

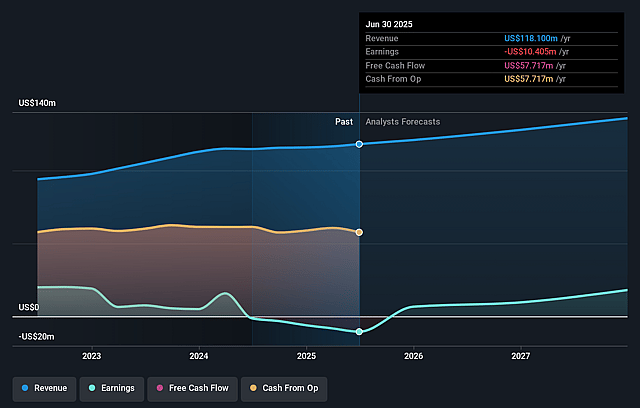

Community Healthcare Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Community Healthcare Trust compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Community Healthcare Trust's revenue will grow by 8.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -8.8% today to 15.9% in 3 years time.

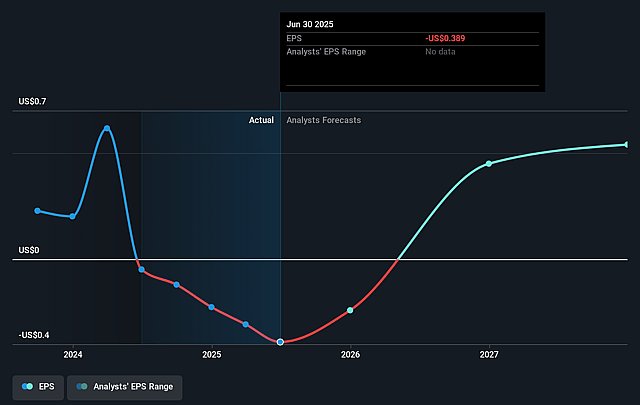

- The bullish analysts expect earnings to reach $24.3 million (and earnings per share of $0.86) by about September 2028, up from $-10.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, up from -40.7x today. This future PE is greater than the current PE for the US Health Care REITs industry at 33.2x.

- Analysts expect the number of shares outstanding to grow by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.0%, as per the Simply Wall St company report.

Community Healthcare Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent financial distress and nonpayment issues with a major geriatric behavioral hospital tenant, including a fully reserved note and reliance on a successful sale to a new operator, introduce uncertainty regarding rental income and highlight tenant concentration risk, which could suppress core revenue growth and contribute to earnings volatility.

- The company's increasing reliance on capital recycling and asset sales to fund its acquisition pipeline, combined with a reluctance to issue equity due to a depressed share price, exposes CHCT to execution risk in asset dispositions and potential constraints on its ability to grow accretively, which may negatively affect funds from operations and long-term earnings growth.

- Rising interest expenses due to elevated borrowings under the revolving credit facility, set against a likely continuation of a high interest rate environment for REITs, threaten to increase financing costs and pressure net margins, particularly if external funding is required for future acquisitions.

- The slight decrease in occupancy rates alongside a portfolio largely focused on smaller markets and single-tenant, outpatient medical properties raises exposure to tenant-specific failures and local economic stagnation, trends that could worsen if suburban and rural demand weakens, thereby putting downward pressure on occupancy, property values, and rental revenue stability.

- Industrywide risks such as accelerated adoption of telemedicine, increased competition for both tenants and properties, and ongoing healthcare provider consolidation could reduce demand for CHCT's physical assets, compress rental rates, and limit leasing opportunities, which over time may impact core revenues and constrain earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Community Healthcare Trust is $25.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Community Healthcare Trust's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $152.7 million, earnings will come to $24.3 million, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 9.0%.

- Given the current share price of $15.75, the bullish analyst price target of $25.0 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Community Healthcare Trust?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.