Key Takeaways

- Robust intellectual property, deep regulatory barriers, and global diversification position Organon to dominate expanding women's health and biosimilar markets, securing strong growth and margins.

- Efficient operations, high cash flow, and acquisition potential enable accelerated earnings growth and expanded market reach, outpacing sector averages.

- Heavy dependence on legacy brands, pricing pressures, high leverage, regulatory uncertainty, and a slow innovation pipeline collectively threaten long-term growth and margin stability.

Catalysts

About Organon- Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

- Analyst consensus sees continued global expansion of women's health and fertility franchises, led by NEXPLANON, driving steady top-line growth, but this likely understates Organon's competitive moat as the 5-year NEXPLANON indication, robust patent/IP protection, and significant regulatory hurdles for generic entry position the company to capture disproportionately high share in a rapidly expanding, underpenetrated global market-supporting sustained double-digit revenue growth and elevated gross margin well into the next decade.

- While consensus expects margin gains from biosimilar launches, analysts broadly underestimate the impact of accelerating industry shift from branded biologics to biosimilars and Organon's proven ability to execute in immunology and oncology segments; this positions Organon to become a dominant player as global regulatory policies fast-track access, driving outsize volume, market share, and margin expansion across major regions well ahead of current forecasts.

- Organon's strategically diversified international footprint, with 75% of revenue generated outside the U.S. and an agile presence in high-growth, emerging markets, provides a unique hedge against U.S. policy volatility and tariffs while unlocking outsized long-term revenue growth, margin expansion, and reliable cash generation through rising middle-class healthcare spending.

- The structurally higher free cash flow enabled by cost transformation, efficient operating structure, and swift deleveraging builds a formidable balance sheet, creating the financial firepower to pursue increasingly larger, accretive acquisitions in women's health and specialty portfolios-a cycle that can meaningfully accelerate EPS growth, unlock higher strategic value, and drive multiple expansion over time.

- Organon's integrated commercial infrastructure, digitalization investments, and broad, flexible definition of women's health allow the company to capitalize on secular increases in gender-specific spending, government and NGO partnerships, and expanded market access, substantially enlarging its addressable market and supporting above-sector-average revenue growth and sustained EPS outperformance.

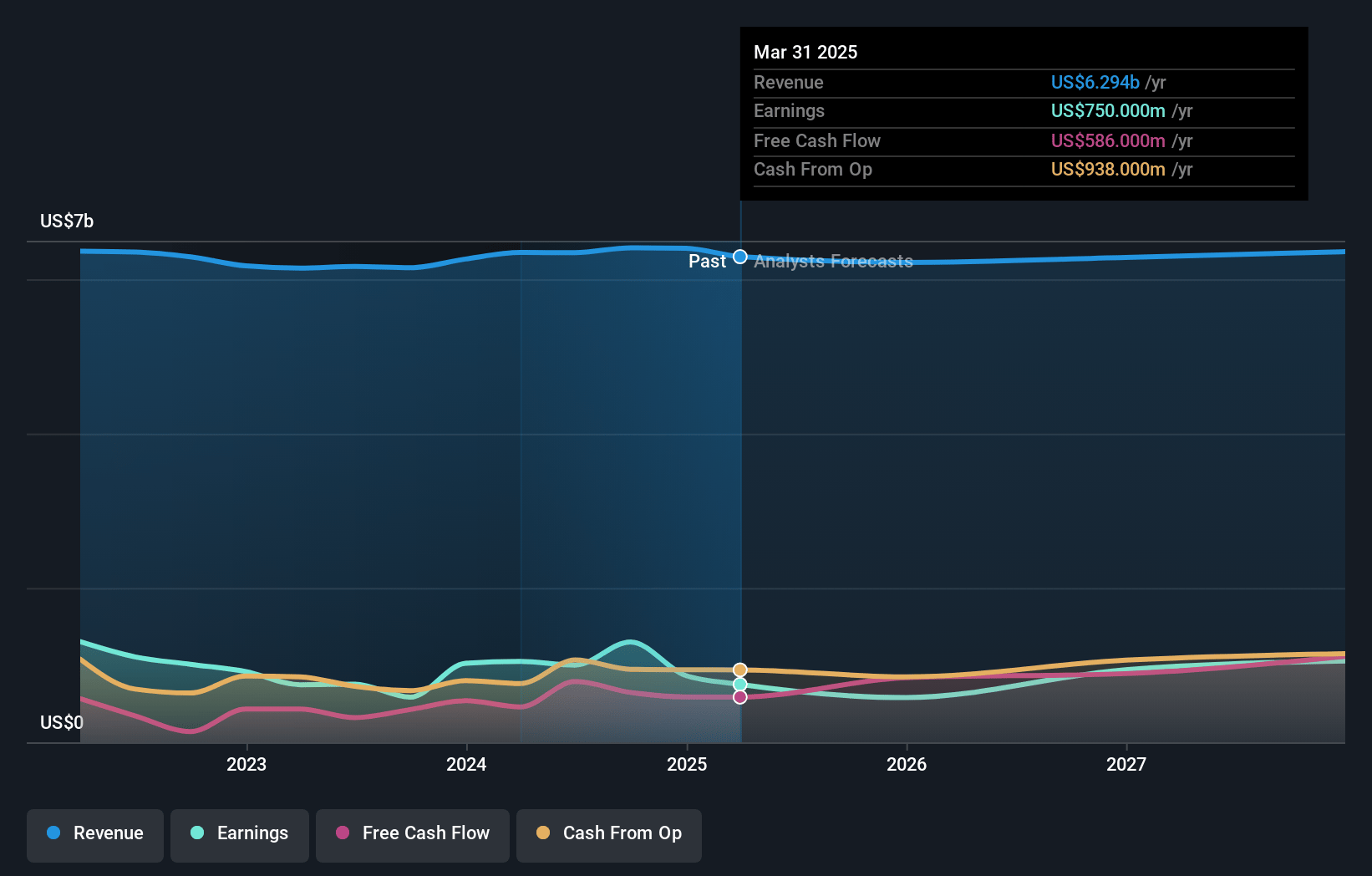

Organon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Organon compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Organon's revenue will grow by 1.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.9% today to 17.3% in 3 years time.

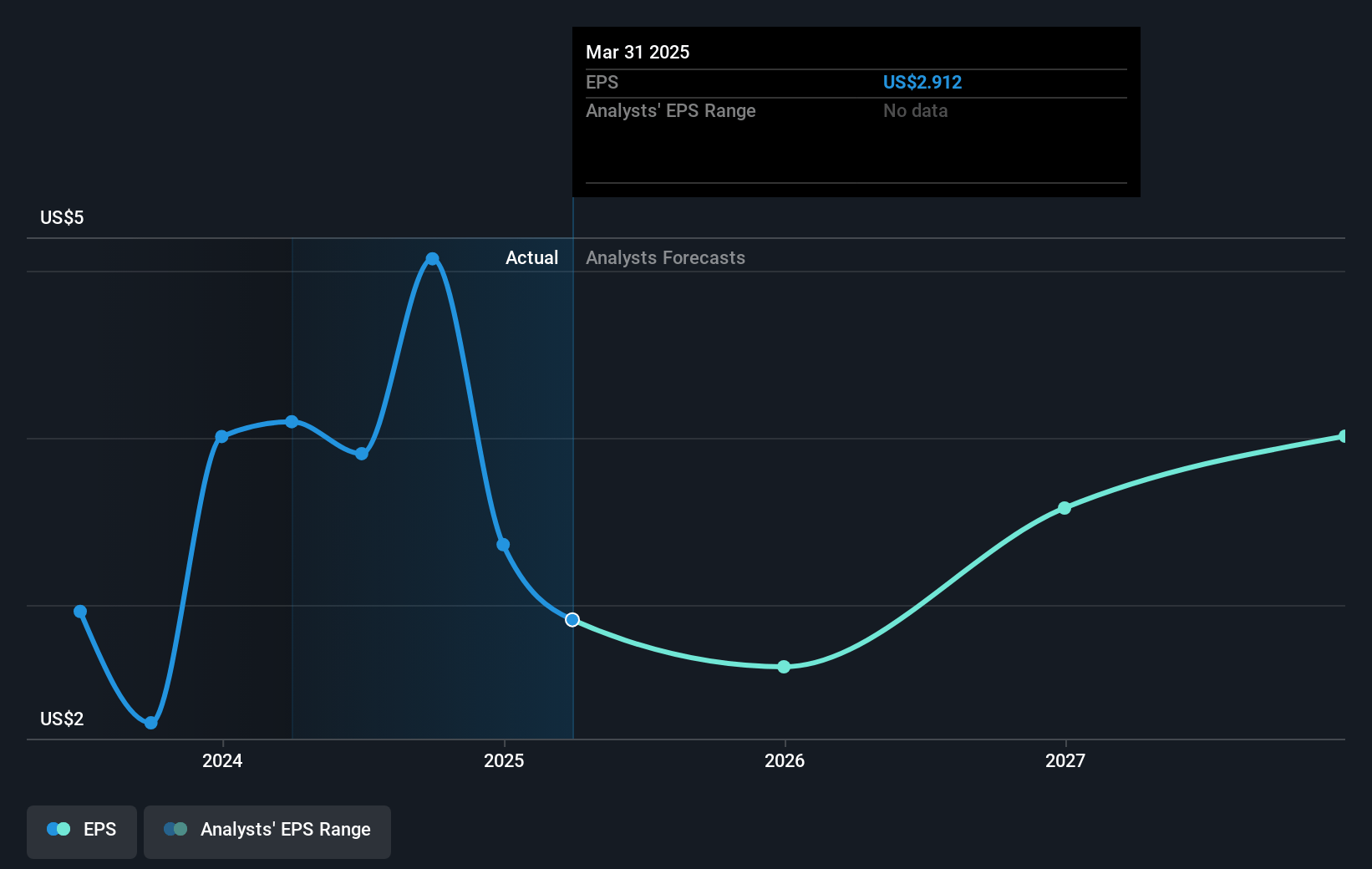

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $4.28) by about July 2028, up from $750.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, up from 3.4x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 18.1x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.94%, as per the Simply Wall St company report.

Organon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Organon's heavy reliance on legacy and mature women's health brands, such as NEXPLANON, exposes the company to significant risks from patent expirations, potential generic competition, and demographic trends like declining birth rates in developed markets, which may result in long-term revenue erosion and impact earnings.

- Sustained pricing pressure was highlighted throughout the call, with mandatory pricing revisions in Japan, headwinds from value-based procurement in China, and increasing competitive price pressures impacting product lines such as respiratory and biosimilars, all of which threaten revenue growth and compress net margins over time.

- The company's high leverage, with a reported net leverage ratio of 4.3x and a stated priority on deleveraging rather than share repurchases or large-scale M&A, could constrain future investment in R&D or business development, thereby limiting the company's ability to generate future growth and putting sustained pressure on net margins and free cash flow.

- Exposure to global regulatory changes and tariffs, as well as growing trends of payer, insurer, and government consolidation, introduces uncertainty that could increase compliance costs and supply chain complexity, while also increasing the likelihood of price controls or reimbursement cuts, leading to margin compression and unstable earnings.

- Limited innovation and a slow-moving R&D pipeline, as evidenced by management's guidance that growth depends largely on recently acquired or in-licensed products like VTAMA and TOFIDENCE, puts the company at risk of stagnation; long-term earnings growth is threatened should these assets underperform or if there are delays in regulatory approvals or market uptake.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Organon is $18.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Organon's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.6 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of $9.82, the bullish analyst price target of $18.0 is 45.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.