Key Takeaways

- Ongoing pricing pressures, patent cliffs, and government cost containment threaten revenue growth and long-term earnings, especially in mature and Asian markets.

- Dependence on key products, high leverage from restructuring, and aggressive biosimilar competition may constrain innovation, margin expansion, and strategic investment.

- Heavy dependence on aging products, financial constraints, and regulatory pressures threaten future revenue growth, profitability, and Organon's ability to innovate or respond strategically.

Catalysts

About Organon- Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

- While global demand for women's health solutions and biosimilars continues to increase, Organon is heavily exposed to ongoing pricing pressure and cost-containment measures by governments, particularly across Europe and Japan, which are already driving lower prices and constraining revenue growth in mature markets.

- Although Organon's women's health pipeline is showing signs of diversification with innovation-such as NEXPLANON's anticipated 5-year indication and the expansion of VTAMA-the company remains dependent on a handful of key products at risk of future patent expirations and generic competition, threatening long-term top-line stability and potentially compressing future earnings.

- While geographic expansion and launches in emerging markets have begun to support mid

- to high-single digit growth in select areas such as fertility and JADA, the company faces ongoing volume and pricing headwinds in China due to value-based procurement policies and in Japan from mandatory pricing revisions, which could dampen overall revenue expansion and pressure margins.

- Despite the growing worldwide acceptance and reimbursement of biosimilars, which should in theory improve Organon's market access and volumes over time, aggressive price competition and the accelerating adoption of alternative biosimilars may continue to erode net margins and limit the profitability of Organon's biosimilar franchise.

- While cost-saving initiatives and accelerated deleveraging are expected to boost free cash flow and enhance balance sheet strength, relatively high leverage and substantial ongoing restructuring and separation costs from the Merck spin-off may continue to restrict Organon's ability to invest in R&D or larger strategic acquisitions, potentially reducing operational flexibility and capping earnings growth in the medium term.

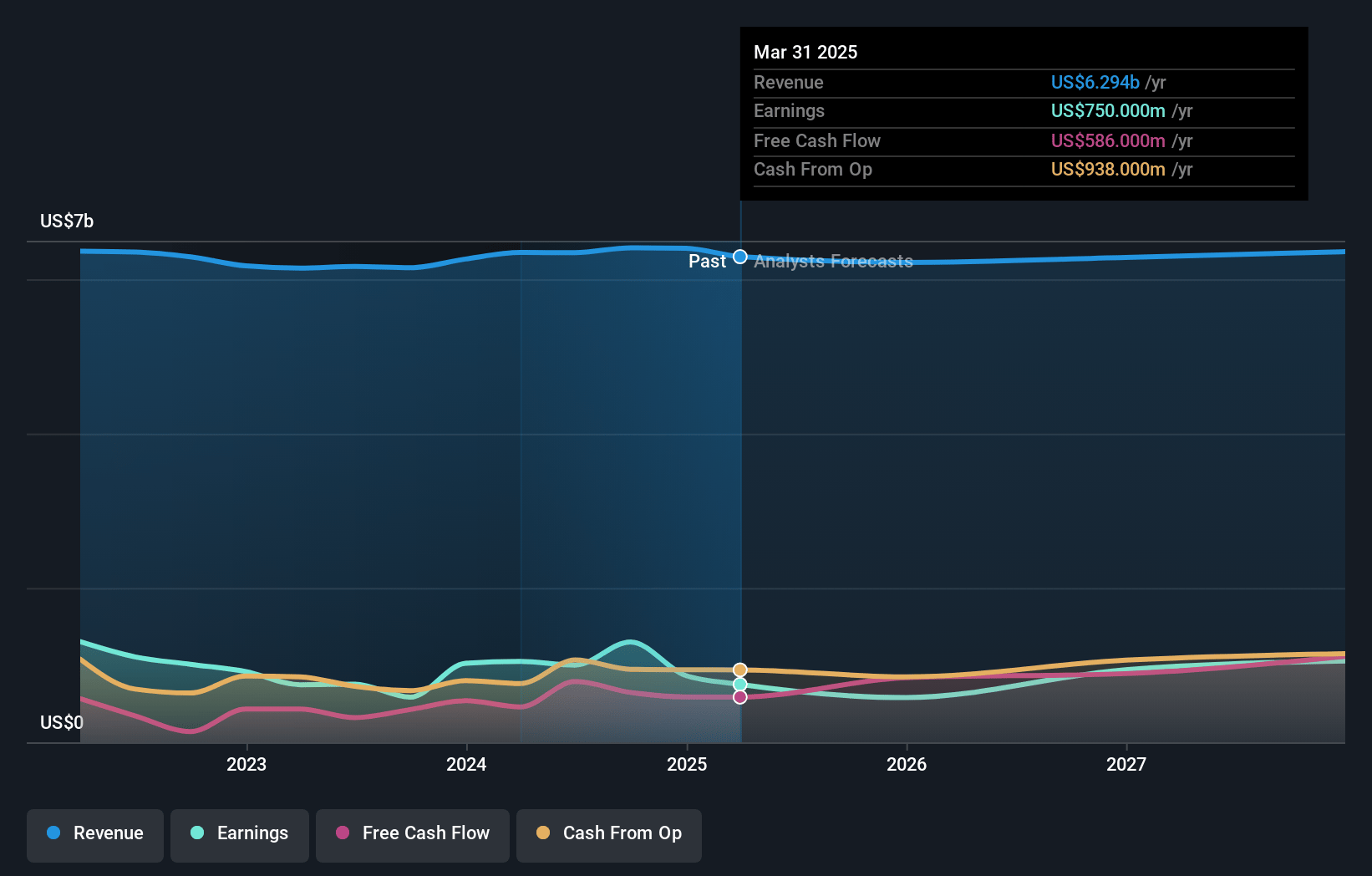

Organon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Organon compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Organon's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.9% today to 18.4% in 3 years time.

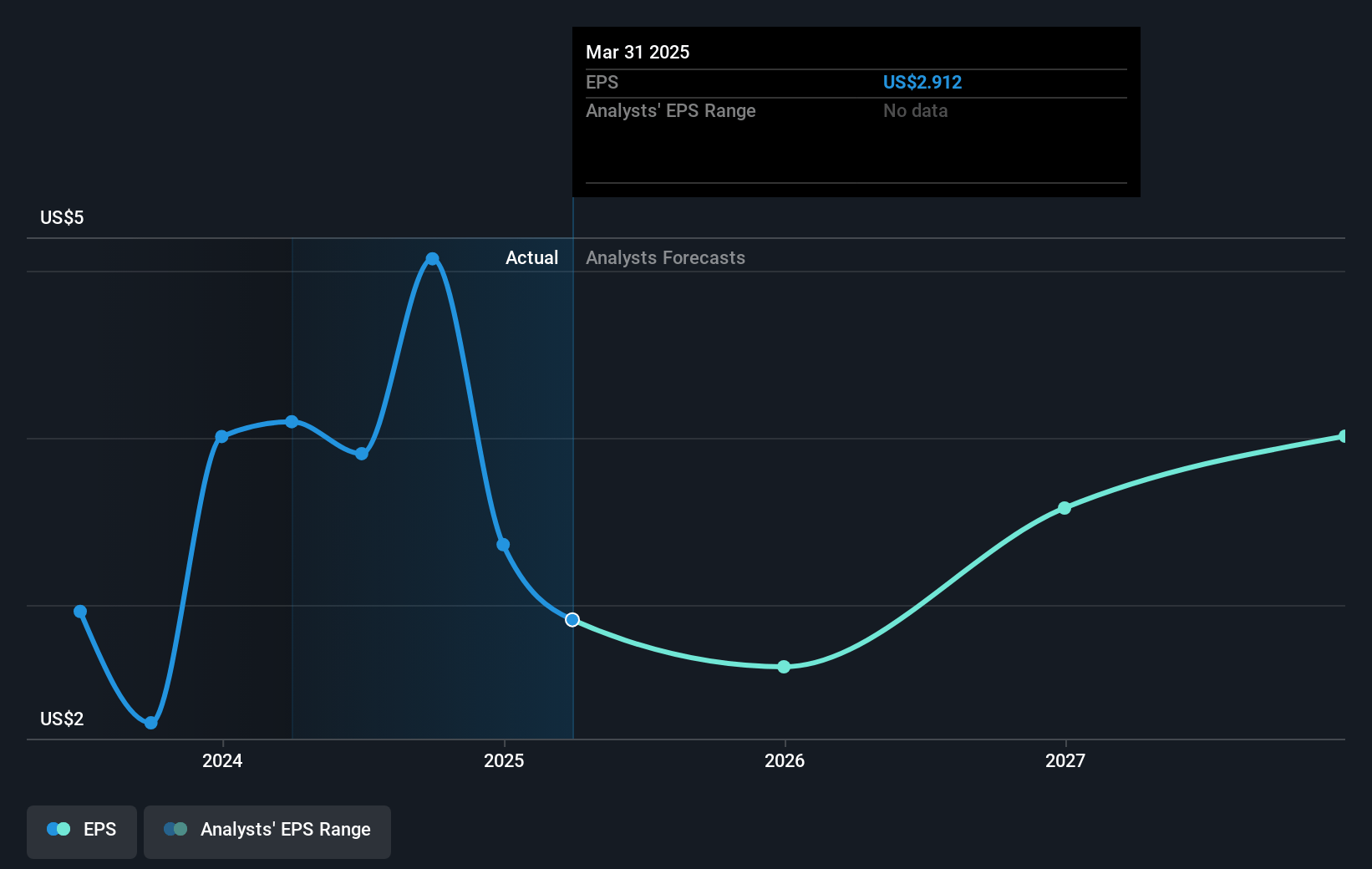

- The bearish analysts expect earnings to reach $1.1 billion (and earnings per share of $4.28) by about July 2028, up from $750.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.0x on those 2028 earnings, down from 3.5x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 18.1x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

Organon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising pricing pressure and continued healthcare cost-containment measures in key markets like Japan, China, and the US are eroding price realization and gross margins, as seen in the mandatory pricing revisions and biosimilar competition impacting both legacy and growth products.

- Heavy revenue dependence on NEXPLANON and other legacy women's health and biosimilar products-many of which are facing or will face patent expirations and generic threats such as Paragraph IV filings-poses a long-term risk to top-line revenue growth and earnings stability.

- Organon's high leverage following the spin-off from Merck, compounded by ongoing debt servicing requirements and the recent reduction in dividend payout to prioritize debt reduction, limits financial flexibility for R&D investment and future strategic acquisitions, placing net margins and future earnings at risk.

- The company's limited R&D pipeline relative to larger pharma peers and ongoing need for successful new launches (e.g., VTAMA, TOFIDENCE) creates a risk that a lack of blockbuster innovation will lead to stagnation or decline in revenue and operating profits in the medium to long term.

- Regulatory, macroeconomic, and tariff uncertainties-including evolving global standards for drug safety, pricing, and supply chain reliability and potential future tariff impacts on Organon's Europe

- and Asia-based manufacturing-present risks of increased costs and operational disruptions that could pressure both revenue and profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Organon is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Organon's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 3.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $10.1, the bearish analyst price target of $10.0 is 1.0% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.