Last Update08 May 25Fair value Increased 0.49%

Key Takeaways

- Johnson & Johnson is poised for growth in immunology and oncology despite facing challenges from loss of drug exclusivity, leveraging next-gen therapies for strengthened revenue.

- Strategic investments in U.S. operations, acquisitions, and MedTech expansion aim to boost future earnings and efficiency, with potential restructuring in surgery to aid profitability.

- Loss of exclusivity for key products and tariffs could significantly threaten revenue and margins, while ongoing litigation poses financial risks.

Catalysts

About Johnson & Johnson- Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

- Johnson & Johnson anticipates accelerated growth in their portfolio and pipeline, particularly in the Innovative Medicine sector, despite the headwind from STELARA's loss of exclusivity. This is expected to bolster revenues through next-generation therapies and significant market share gains in oncology and immunology.

- The company's substantial investment of over $55 billion into manufacturing, R&D, and technology in the U.S. over the next four years is projected to expand capacity for advanced medicines and devices, potentially increasing operational efficiency and future earnings.

- Recent acquisitions, such as Intra-Cellular Therapies, are expected to contribute substantial revenue streams, with products like CAPLYTA potentially reaching over $5 billion in peak sales, positively affecting the company’s revenue and EPS in the future.

- Ongoing expansion within MedTech, highlighted by strong performance from acquired cardiovascular units Abiomed and Shockwave, as well as developments in robotic surgery, are expected to drive revenue growth and enhance adjusted income margins over time.

- The company plans significant restructuring in their surgery business within MedTech to streamline operations and improve efficiency, anticipated to have short-term revenue disruptions but expected to enhance long-term profitability and margin expansion.

Johnson & Johnson Future Earnings and Revenue Growth

Assumptions

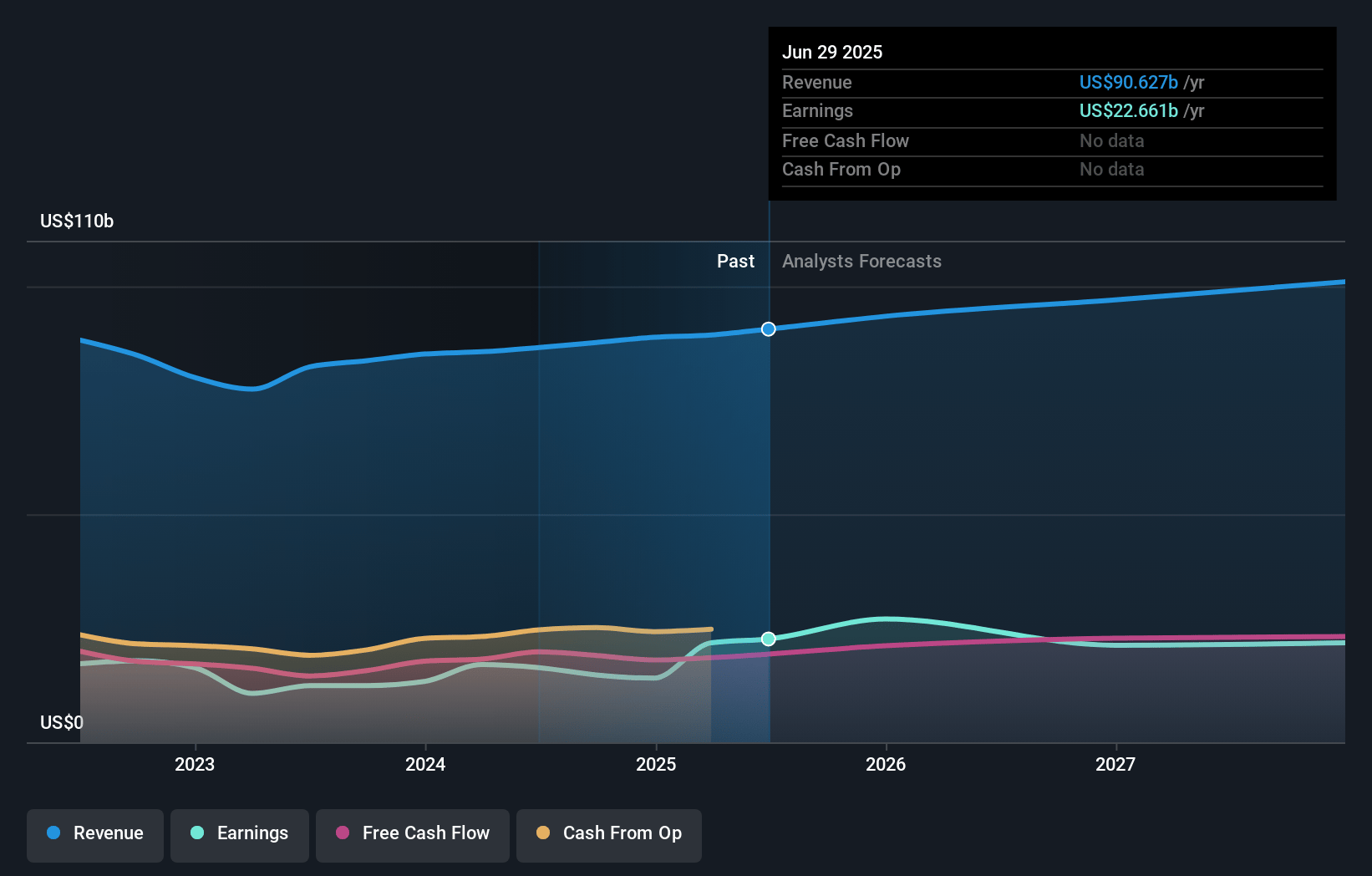

How have these above catalysts been quantified?- Analysts are assuming Johnson & Johnson's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.4% today to 23.0% in 3 years time.

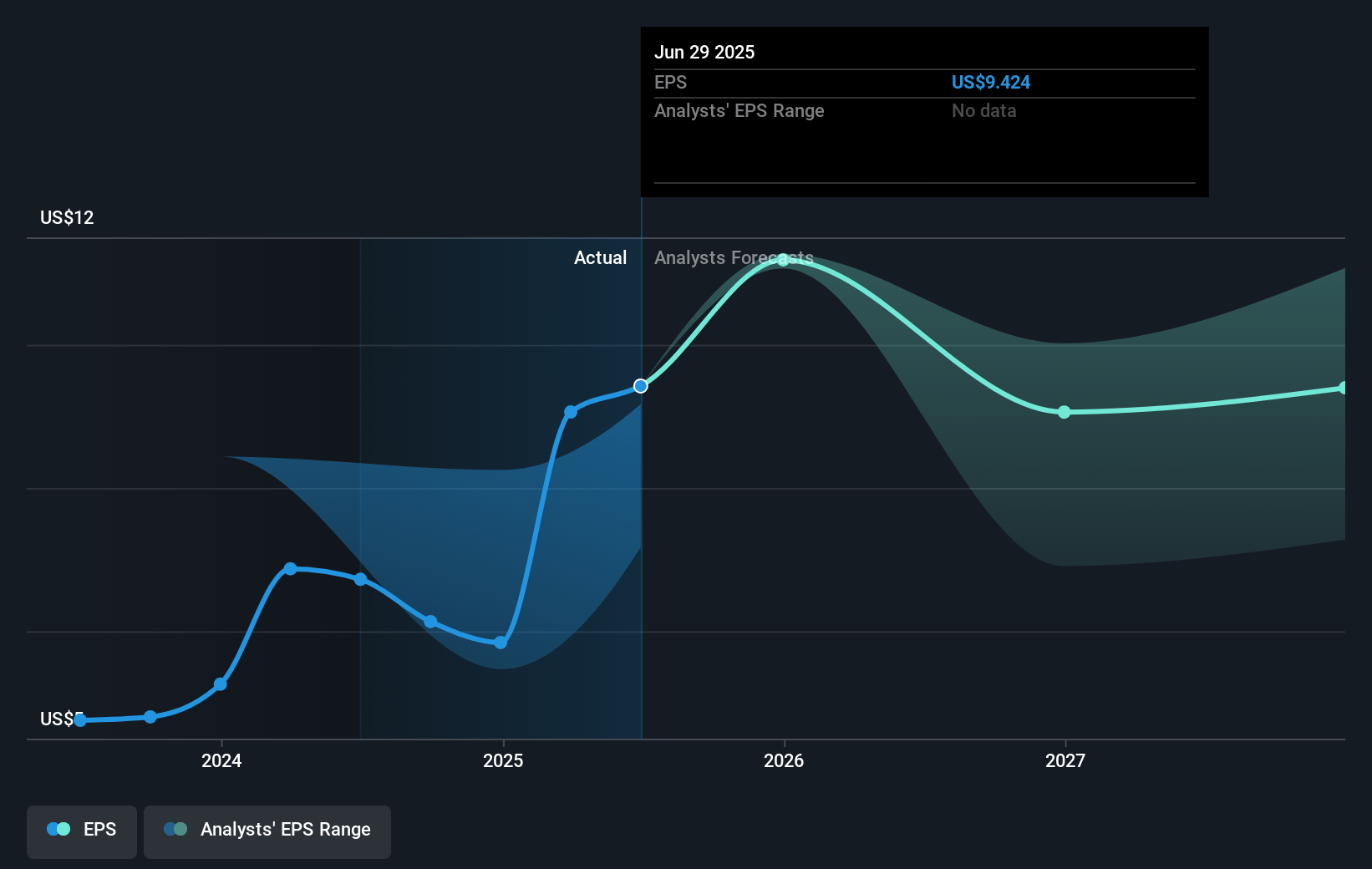

- Analysts expect earnings to reach $22.9 billion (and earnings per share of $9.7) by about May 2028, up from $21.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $32.9 billion in earnings, and the most bearish expecting $18.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, up from 17.0x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Johnson & Johnson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Loss of exclusivity for STELARA and the impact of biosimilar competition could significantly erode revenue from one of Johnson & Johnson's major products. This could affect overall revenue and net margins, especially in the innovative medicine segment.

- Tariffs, particularly those related to exports to China, could increase costs and impact the net margins negatively, due to increased cost of goods sold from tariffs being relieved through the P&L in future periods.

- The ongoing litigation related to talc, though controlled for now, poses a continual risk to financial stability and could impact net earnings and cash flow, particularly if adverse judgments or settlements occur.

- The orthopedics segment faced headwinds, including competitive pressures and challenges in the spine and sports areas. Ongoing issues could impact revenue and earnings unless the planned innovations drive a turnaround.

- Potential dilution from acquisitions such as Intra-Cellular Therapies and the impact of tariffs could affect operating margin improvement efforts, challenging overall earnings and net margins despite robust sales growth in some areas.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $169.981 for Johnson & Johnson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $99.6 billion, earnings will come to $22.9 billion, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $154.47, the analyst price target of $169.98 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.