Last Update 21 Nov 25

Fair value Increased 0.64%JNJ: Upcoming Business Reorganization and Legal Risks Will Influence Future Performance

Johnson & Johnson's analyst price target has increased slightly from $199.56 to $200.82, as analysts cite stronger-than-expected sector performance and a constructive long-term industry outlook, which support the adjustment.

Analyst Commentary

Recent analyst commentary on Johnson & Johnson highlights a variety of perspectives related to the company's valuation, strategic direction, and future growth potential. Many analysts have revised their targets upwards, and the tone remains largely constructive even as some concerns persist.

Bullish Takeaways- Bullish analysts have cited strong quarterly results and robust execution, with growth in key areas such as Innovative Medicine and MedTech.

- Plans to spin out the orthopedics business are seen as a move that could transform Johnson & Johnson into a faster-growing, higher-margin enterprise. This could also generate incremental revenue growth.

- Recent price target increases are supported by confidence in the pipeline's potential along with optimism about new product launches and expanded indications for existing therapies.

- Valuation is viewed as attractive relative to historical averages and broader indices. This is especially true as risks surrounding major products appear better managed and long-term prospects improve.

- Bearish analysts have noted ongoing headwinds such as negative publicity and litigation risk related to legacy products, which could weigh on consumer and investor sentiment.

- Concerns remain about sales headwinds arising from the loss of exclusivity for key drugs, notably Stelara, and the need for Johnson & Johnson to demonstrate it can offset these pressures effectively.

- Despite recent gains, some analysts believe consensus estimates for outer-year growth may be too optimistic if new product ramps or divestiture benefits fall short of expectations.

- A few have expressed caution around incremental guidance upgrades, emphasizing that revenue and margin expansion must be sustained to justify higher valuation multiples.

What's in the News

- Johnson & Johnson received U.S. FDA approval for DARZALEX Faspro as a single-agent treatment for adults with high-risk smoldering multiple myeloma, making it the first approved therapy for this condition (Product-Related Announcements).

- The company announced new long-term clinical data showing TREMFYA and icotrokinra continue to demonstrate efficacy in treating psoriatic arthritis, plaque psoriasis, and ulcerative colitis, with significant improvements in patient outcomes (Product-Related Announcements).

- J&J faces the first UK lawsuits over allegations that its talc-based products cause cancer, with over 3,000 claimants involved. Kenvue, which spun out from J&J, faces potential liability for litigation outside the U.S. and Canada (Reuters).

- Johnson & Johnson is reportedly in acquisition talks with Protagonist Therapeutics, aiming to deepen its portfolio in oral treatments for immune diseases including plaque psoriasis and ulcerative colitis (WSJ).

- The company announced plans to separate its Orthopaedics business, DePuy Synthes, to sharpen strategic focus and potentially accelerate growth and margins (Business Reorganizations).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from $199.56 to $200.82.

- Discount Rate is up modestly, moving from 6.78% to 6.96%.

- Revenue Growth projections have improved marginally, increasing from 5.10% to 5.22%.

- Net Profit Margin shows a slight decrease, declining from 23.49% to 23.41%.

- Future P/E ratio has increased moderately, from 23.33x to 23.60x.

Key Takeaways

- Johnson & Johnson is poised for growth in immunology and oncology despite facing challenges from loss of drug exclusivity, leveraging next-gen therapies for strengthened revenue.

- Strategic investments in U.S. operations, acquisitions, and MedTech expansion aim to boost future earnings and efficiency, with potential restructuring in surgery to aid profitability.

- Loss of exclusivity for key products and tariffs could significantly threaten revenue and margins, while ongoing litigation poses financial risks.

Catalysts

About Johnson & Johnson- Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

- Johnson & Johnson anticipates accelerated growth in their portfolio and pipeline, particularly in the Innovative Medicine sector, despite the headwind from STELARA's loss of exclusivity. This is expected to bolster revenues through next-generation therapies and significant market share gains in oncology and immunology.

- The company's substantial investment of over $55 billion into manufacturing, R&D, and technology in the U.S. over the next four years is projected to expand capacity for advanced medicines and devices, potentially increasing operational efficiency and future earnings.

- Recent acquisitions, such as Intra-Cellular Therapies, are expected to contribute substantial revenue streams, with products like CAPLYTA potentially reaching over $5 billion in peak sales, positively affecting the company’s revenue and EPS in the future.

- Ongoing expansion within MedTech, highlighted by strong performance from acquired cardiovascular units Abiomed and Shockwave, as well as developments in robotic surgery, are expected to drive revenue growth and enhance adjusted income margins over time.

- The company plans significant restructuring in their surgery business within MedTech to streamline operations and improve efficiency, anticipated to have short-term revenue disruptions but expected to enhance long-term profitability and margin expansion.

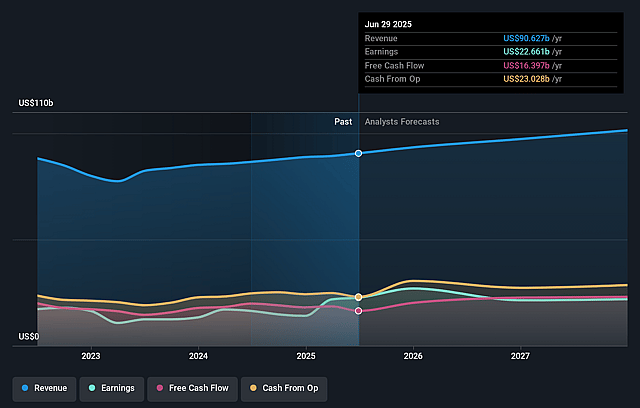

Johnson & Johnson Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Johnson & Johnson's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.0% today to 22.0% in 3 years time.

- Analysts expect earnings to reach $22.9 billion (and earnings per share of $10.07) by about September 2028, up from $22.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $19.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, up from 18.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Johnson & Johnson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Loss of exclusivity for STELARA and the impact of biosimilar competition could significantly erode revenue from one of Johnson & Johnson's major products. This could affect overall revenue and net margins, especially in the innovative medicine segment.

- Tariffs, particularly those related to exports to China, could increase costs and impact the net margins negatively, due to increased cost of goods sold from tariffs being relieved through the P&L in future periods.

- The ongoing litigation related to talc, though controlled for now, poses a continual risk to financial stability and could impact net earnings and cash flow, particularly if adverse judgments or settlements occur.

- The orthopedics segment faced headwinds, including competitive pressures and challenges in the spine and sports areas. Ongoing issues could impact revenue and earnings unless the planned innovations drive a turnaround.

- Potential dilution from acquisitions such as Intra-Cellular Therapies and the impact of tariffs could affect operating margin improvement efforts, challenging overall earnings and net margins despite robust sales growth in some areas.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $177.468 for Johnson & Johnson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $155.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $104.1 billion, earnings will come to $22.9 billion, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $176.96, the analyst price target of $177.47 is 0.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.