Narratives are currently in beta

Key Takeaways

- Expanding patient access and new product launches drive revenue growth in cystic fibrosis and highlight significant revenue potential.

- Advancements in transformative therapies like VX-880 and global expansions offer substantial opportunities for revenue diversification and growth.

- Unfavorable regulatory outcomes, intense competition, and high expenses threaten Vertex's revenue, profitability, and reliance on cystic fibrosis treatments.

Catalysts

About Vertex Pharmaceuticals- A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

- Vertex's CF revenue growth is driven by expanding patient access and new product launches like the vanzacaftor triple combination therapy and VX-522, highlighting potential to significantly increase revenues.

- The launch of CASGEVY for sickle cell and beta thalassemia patients and further global expansion suggest a multibillion-dollar opportunity that will positively impact earnings and revenue.

- The suzetrigine launch for acute pain and efforts in securing access, including policy fronts, are expected to capture the unmet need in pain management, contributing to revenue growth and margin improvements.

- Pove's progression into Phase III with potential for same at-home delivery could expedite patient adoption, addressing unmet needs in auto-immune diseases, thereby enhancing revenue streams.

- Continued advancement and potential market introduction of VX-880 for type 1 diabetes highlight transformative therapies that can drive future revenue diversification and growth.

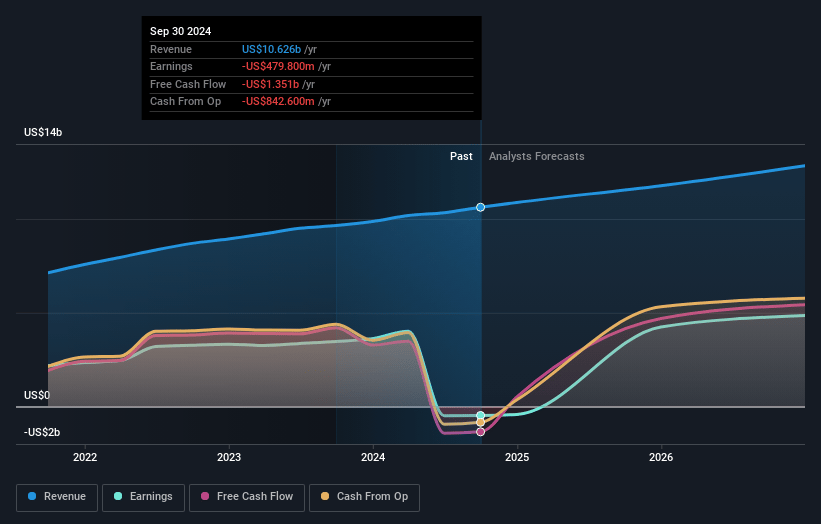

Vertex Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vertex Pharmaceuticals's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.5% today to 39.0% in 3 years time.

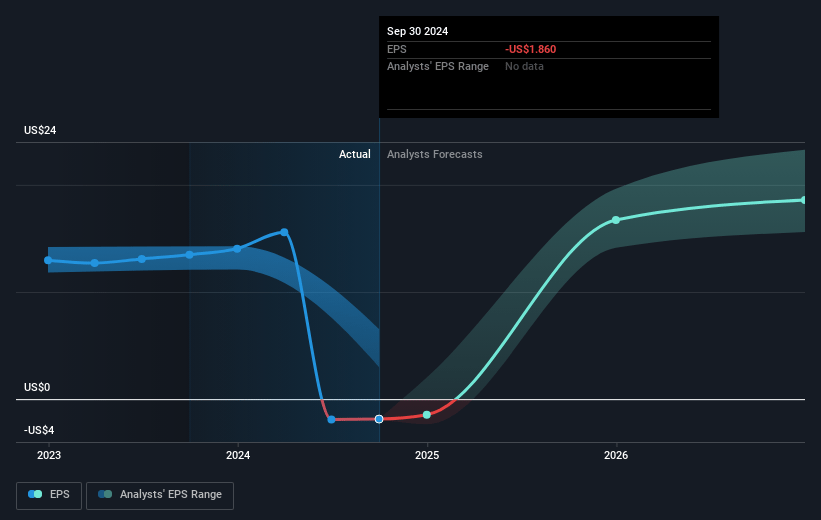

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $20.31) by about December 2027, up from $-479.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.2 billion in earnings, and the most bearish expecting $4.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.3x on those 2027 earnings, up from -251.9x today. This future PE is greater than the current PE for the US Biotechs industry at 16.6x.

- Analysts expect the number of shares outstanding to grow by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

Vertex Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential risk of unfavorable regulatory outcomes or delays in approvals for upcoming product launches, such as the vanzacaftor triple, suzetrigine, and other drugs in the clinical pipeline, could negatively impact revenue and earnings.

- High R&D and SG&A expenses, particularly related to launch activities for new products and clinical trials, could exert pressure on net margins and overall profitability.

- The high investment in manufacturing capacity for CASGEVY and the associated logistical challenges might impact the company’s cost structure and financial efficiency, affecting net margins.

- The introduction of new pain management treatments like suzetrigine in a highly competitive and scrutinized market could face payer resistance or require significant concessions, impacting revenue growth and earnings.

- Vertex's reliance on existing cystic fibrosis treatments for a significant portion of its revenue means any market changes, such as increased competition or regulatory hurdles, could substantially impact revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $515.27 for Vertex Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $602.0, and the most bearish reporting a price target of just $325.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $13.7 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 30.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $469.24, the analyst's price target of $515.27 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives